filmov

tv

Session 4: Financial Statement Analysis

Показать описание

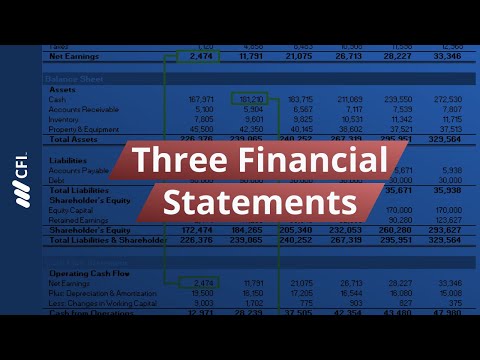

In investing, we are dependent upon accounting statements for raw data in assessing companies. In this session, we look at the three basic financial statements: the balance sheet, where we record what a company owns and owes at a point in time, the income statement, where we measure revenues, expenses and earnings during a period and the statement of cash flows, where we explain changes in cash balances by looking at operating, investing and financing cash flows. We look at how a financial perspective can vary from an accounting perspective in each of these statements.

Session 4: Financial Statement Analysis

SESSION 4 : FINANCIAL STATEMENTS ANALYSIS

Session 4: The Statement of Cash Flows

FINANCIAL ANALYSIS USING RATIOS-DECEMBER 2022 Q4 FINANCIAL REPORTING AND ANALYSIS

Accounting and Financial Statements Analysis, session 4 by AcademyCity.org

Session 4 Descriptive Analysis of Financial Statements | Unit 3 Ratio Analysis | Sub Unit 3.1

Financial Evaluation and Analysis: Session 4 'Financial Leverage'

INTERPRETATION OF FINANCIAL STATEMENTS (ACCOUNTING RATIOS) - PART 1

Intermediate Paper 5:A&E | Topic: Chapter 4: Audit Evidence | Session 2 | 30 Oct, 2024

Introduction to Financial Statement Analysis

Financial Statement Analysis (Working Capital)

The Regrets of An Accounting Major @zoeunlimited

16 -- Tools for Financial Statement Analysis

Session 3: The Balance Sheet

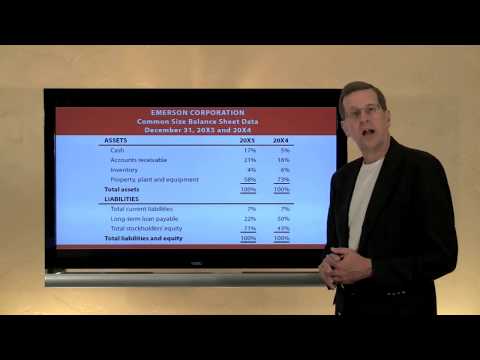

Vertical analysis of financial statements

Session 03: Objective 4 - Ratio Analysis (2023)

Introduction to Financial Statement Analysis (2024/2025 CFA® Level I Exam – FSA – Learning Module 1)...

INTERPRETATION OF FINANCIAL STATEMENTS (REPORT WRITING) - PART 4

Financial ratio analysis

3 Financial Statements: Balance Sheet, Income & Cash Flow

Level II Concept: Integration of Financial Statement Analysis Techniques

Financial Statement Analysis (Overview)

Turnover Ratio | Analysis of Financial Statement | Session-4 | Class-12 | CBSE 2025

Cash Flow Statement - Analysis of Financial Statement | Session-4 | Accountancy Class-12 | CBSE 2025

Комментарии

0:20:20

0:20:20

0:20:10

0:20:10

0:13:24

0:13:24

1:05:25

1:05:25

1:23:56

1:23:56

0:21:48

0:21:48

0:13:02

0:13:02

0:44:03

0:44:03

2:36:22

2:36:22

0:11:12

0:11:12

0:04:02

0:04:02

0:00:37

0:00:37

0:06:33

0:06:33

0:14:05

0:14:05

0:11:52

0:11:52

0:13:53

0:13:53

0:32:43

0:32:43

0:26:13

0:26:13

0:10:09

0:10:09

0:01:19

0:01:19

0:11:03

0:11:03

0:05:40

0:05:40

0:20:46

0:20:46

0:11:02

0:11:02