filmov

tv

What are Volatility Swaps? Financial Derivatives - Trading Volatility

Показать описание

In todays class we learn about what a volatility swap is.

What is a Volatility Swap?

A volatility swap is a forward contract with a payoff based on the realized volatility of the underlying asset. Volatility swaps settle in cash based on the difference between the realized volatility and the volatility strike.

They are not swaps in the traditional sense, with an exchange of cash flows between counterparties.

At settlement, the payoff is, Notional Amount X (Volatility – Volatility Strike)

What is a Volatility Swap?

A volatility swap is a forward contract with a payoff based on the realized volatility of the underlying asset. Volatility swaps settle in cash based on the difference between the realized volatility and the volatility strike.

They are not swaps in the traditional sense, with an exchange of cash flows between counterparties.

At settlement, the payoff is, Notional Amount X (Volatility – Volatility Strike)

What are Volatility Swaps? Financial Derivatives - Trading Volatility

What are Variance Swaps? Financial Derivatives - Trading Volatility

What is Volatility swap? Explain Volatility swap, Define Volatility swap, Meaning of Volatility swap

What's a Volatility Swap ? (VolSwap)

What are Volatility Derivatives

Volatility: Trading and Managing Risk - Dr. Simon Acomb

LFS Webcast series - Volatility Trading - Does a variance swap have a delta?

Realized Volatility Vs Implied Volatility (FRM Part 2, Book 1, Market Risk)

$DOG Coming to Rune Swaps (Major UX Upgrade) 😱💰

Volatility Explained in One Minute: From Definition/Meaning & Examples to the Volatility Index (...

What's a variance Swap ? (Varswap)

What are Swaps? Financial Derivatives Tutorial

What are Dividend Swaps, commodity swaps, equity swaps?

The Spot Curve and Forward Curve Explained In 5 Minutes

The Barclays Trading Strategy that Outperforms the Market

Volatility Swap #VolatilitySwap#Shorts

INTEREST RATE SWAPS - Part 1- FRM (2020 Syllabus)

The Volatility of the Gold Market, Explained | WSJ

Implied volatility | Finance & Capital Markets | Khan Academy

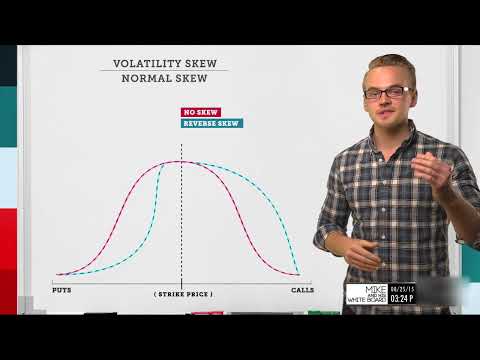

Volatility Skew Explained | Options Trading Concepts

Volatility (FRM Part 1 2023 – Book 2 – Chapter 14)

All Financial Risks Simplified in 8 Minutes – Relative, Volatility, Model, Sovereign, Credit Risks!...

What is Volatility ? 🤔 #shortsfeed

FRM: You will never be scared of SWAPS after watching this!

Комментарии

0:06:05

0:06:05

0:09:37

0:09:37

0:01:21

0:01:21

0:01:07

0:01:07

0:02:49

0:02:49

0:08:19

0:08:19

0:03:13

0:03:13

0:15:27

0:15:27

0:09:45

0:09:45

0:01:59

0:01:59

0:01:24

0:01:24

0:17:36

0:17:36

0:04:23

0:04:23

0:04:51

0:04:51

0:09:30

0:09:30

0:00:38

0:00:38

0:24:00

0:24:00

0:05:41

0:05:41

0:05:00

0:05:00

0:10:43

0:10:43

0:14:44

0:14:44

0:08:54

0:08:54

0:00:30

0:00:30

0:58:05

0:58:05