filmov

tv

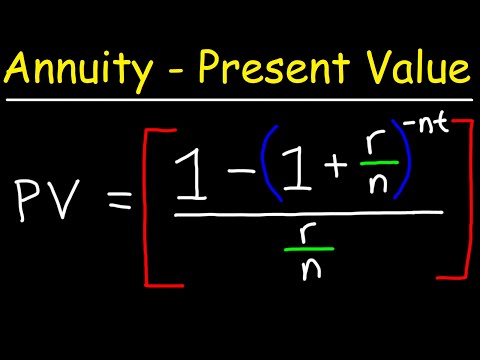

Retirement Annuity Questions and Comments Answered!

Показать описание

Regarding Retirement Planning, There have been a lot of questions and comments on the Annuity Series that we're doing and in this episode, Troy takes the time to answer of few of them.

Video from Oak Harvest Insurance Services, LLC

To take Oak Harvest Annuity Quiz or travel the annuity education path, please visit:

We investigate and filter retirement annuities to help increase your income and reduce risk. For more information about Annuities offered by Oak Harvest Financial Group, please call us at (877) 896-0400.

#Annuity #retirementplanning #TroySharpe

Working with a CFP® professional can be an important step toward reaching your financial goals. Not only do these advisors meet rigorous education and experience requirements, but they are also held to some of the highest ethical and professional standards in the industry.

00:00 Introduction

00:35 Question #1

07:30 Question #2

09:17 Question #3

10:40 Contact Us!

Education

CFP® professionals must master nearly 100 integrated financial planning topics, including:

- Investment planning

- Tax planning

- Retirement planning

- Estate planning

- Insurance planning

- Financial management

In addition to completing a comprehensive financial planning curriculum approved by the CFP Board, or equivalent academic coursework, CFP® professionals are required to complete continuing education coursework, including a CFP Board approved code of ethics course, to ensure their competence in financial planning.

Examination

CFP® candidates must pass a comprehensive 6-hour CFP® Certification Examination that tests their ability to apply financial planning knowledge in an integrated format. The exam is notoriously difficult and only 64% of people who took the exam in 2017 passed. Based on regular research of what planners do, the exam covers:

Establishing and defining the Client-Planner relationship

Gathering information necessary to fulfill the engagement

Analyzing and evaluating the client’s current financial status

Developing recommendations

Communicating recommendations

Implementing recommendations

Monitoring the recommendations

Practicing within professional and regulatory standards

Experience

CFP® professionals must have a minimum of three years experience in the personal financial planning process prior to earning the right to use the CFP® certification marks. As a result, CFP® practitioners possess financial counseling skills in addition to financial planning knowledge.

Ethics

As a final step to certification, CFP® practitioners agree to abide by a strict code of professional conduct, known as CFP Board’s Code of Ethics and Professional Responsibility, that sets forth their ethical responsibilities to the public, clients and employers. CFP Board also performs a background check during this process, and each individual must disclose any investigations or legal proceedings related to their professional or business conduct.

Important Disclosures: Insurance services are provided through Oak Harvest Insurance Services, LLC, a licensed insurance agency. Some Oak Harvest investment adviser representatives are also independent insurance agents. The insurance agents and Oak Harvest Insurance Services, LLC earn combined commissions up to 7.5% for selling insurance products, in addition to other compensation.

Annuities are long-term contracts with limited liquidity that are designed for retirement. Returns may be limited by caps, spreads, surrender charges, early withdrawal penalties, and other fees stated in the annuity contract. Retirement accounts such as IRAs can be tax-deferred regardless of whether or not they are funded with an annuity. The purchase of an annuity within an IRA does not provide additional tax-deferred treatment of earnings. Withdrawals may be subject to federal and/or state income taxes. A 10% federal early withdrawal tax penalty may apply if taken before age 59 ½ in addition to ordinary income tax. Partial withdrawals may reduce benefits and contract value.

Annuities are not guaranteed by any bank or credit union and are not insured by the FDIC or any other governmental agency. Some annuities could go down in value. Annuity and life insurance guarantees are backed by the claims paying ability of the issuing insurance company. If the insurance company encounters financial difficulties, there is a possibility that they may be unable to meet their obligations.

All information stated above is general in nature and is for educational purposes only. It is not intended to provide specific financial, legal or tax advice. Consult a professional regarding your specific situation.

Video from Oak Harvest Insurance Services, LLC

To take Oak Harvest Annuity Quiz or travel the annuity education path, please visit:

We investigate and filter retirement annuities to help increase your income and reduce risk. For more information about Annuities offered by Oak Harvest Financial Group, please call us at (877) 896-0400.

#Annuity #retirementplanning #TroySharpe

Working with a CFP® professional can be an important step toward reaching your financial goals. Not only do these advisors meet rigorous education and experience requirements, but they are also held to some of the highest ethical and professional standards in the industry.

00:00 Introduction

00:35 Question #1

07:30 Question #2

09:17 Question #3

10:40 Contact Us!

Education

CFP® professionals must master nearly 100 integrated financial planning topics, including:

- Investment planning

- Tax planning

- Retirement planning

- Estate planning

- Insurance planning

- Financial management

In addition to completing a comprehensive financial planning curriculum approved by the CFP Board, or equivalent academic coursework, CFP® professionals are required to complete continuing education coursework, including a CFP Board approved code of ethics course, to ensure their competence in financial planning.

Examination

CFP® candidates must pass a comprehensive 6-hour CFP® Certification Examination that tests their ability to apply financial planning knowledge in an integrated format. The exam is notoriously difficult and only 64% of people who took the exam in 2017 passed. Based on regular research of what planners do, the exam covers:

Establishing and defining the Client-Planner relationship

Gathering information necessary to fulfill the engagement

Analyzing and evaluating the client’s current financial status

Developing recommendations

Communicating recommendations

Implementing recommendations

Monitoring the recommendations

Practicing within professional and regulatory standards

Experience

CFP® professionals must have a minimum of three years experience in the personal financial planning process prior to earning the right to use the CFP® certification marks. As a result, CFP® practitioners possess financial counseling skills in addition to financial planning knowledge.

Ethics

As a final step to certification, CFP® practitioners agree to abide by a strict code of professional conduct, known as CFP Board’s Code of Ethics and Professional Responsibility, that sets forth their ethical responsibilities to the public, clients and employers. CFP Board also performs a background check during this process, and each individual must disclose any investigations or legal proceedings related to their professional or business conduct.

Important Disclosures: Insurance services are provided through Oak Harvest Insurance Services, LLC, a licensed insurance agency. Some Oak Harvest investment adviser representatives are also independent insurance agents. The insurance agents and Oak Harvest Insurance Services, LLC earn combined commissions up to 7.5% for selling insurance products, in addition to other compensation.

Annuities are long-term contracts with limited liquidity that are designed for retirement. Returns may be limited by caps, spreads, surrender charges, early withdrawal penalties, and other fees stated in the annuity contract. Retirement accounts such as IRAs can be tax-deferred regardless of whether or not they are funded with an annuity. The purchase of an annuity within an IRA does not provide additional tax-deferred treatment of earnings. Withdrawals may be subject to federal and/or state income taxes. A 10% federal early withdrawal tax penalty may apply if taken before age 59 ½ in addition to ordinary income tax. Partial withdrawals may reduce benefits and contract value.

Annuities are not guaranteed by any bank or credit union and are not insured by the FDIC or any other governmental agency. Some annuities could go down in value. Annuity and life insurance guarantees are backed by the claims paying ability of the issuing insurance company. If the insurance company encounters financial difficulties, there is a possibility that they may be unable to meet their obligations.

All information stated above is general in nature and is for educational purposes only. It is not intended to provide specific financial, legal or tax advice. Consult a professional regarding your specific situation.

Комментарии