filmov

tv

Introduction to Annuities

Показать описание

Introduction to Annuities

Introduction To Annuities (2019)

What Is An Annuity And How Does It Work?

Introduction to Annuities

What is an annuity?

An Introduction to Annuities & Growing Your Retirement Income

Introduction To Annuities

The Basics Of Annuities: Introduction

Introduction to Annuities

RETIREMENT INCOME OPTIONS - INTRODUCTION TO ANNUITIES (#annuities )

Introduction to annuities

Introduction to Annuities

An Introduction to Annuities

Financial Mathematics Grade 12 ( Introduction to Annuities) Part 1 of 3

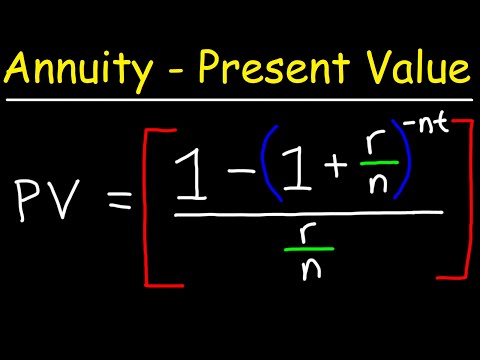

How To Calculate The Present Value of an Annuity

Introduction to Annuities (Chapter 11, sections 1 and 2)

Retirement Annuities Explained – Introduction to Annuities

Introduction to Annuities and Annuity Payout Options

Introduction to Annuities

Introduction to Annuities

An Introduction to Annuities

30 Introduction to Annuities

Lesson 1: Introduction to Annuities (Ordinary, Due, Simple, General Annuity)

Introduction to Annuities & the Annuity Recurrence Relation

Комментарии

0:13:37

0:13:37

0:18:06

0:18:06

0:05:54

0:05:54

0:02:32

0:02:32

0:02:02

0:02:02

0:04:06

0:04:06

0:04:07

0:04:07

0:29:30

0:29:30

0:02:49

0:02:49

0:10:41

0:10:41

0:13:00

0:13:00

0:25:22

0:25:22

0:01:32

0:01:32

0:47:17

0:47:17

0:16:15

0:16:15

0:17:18

0:17:18

0:20:58

0:20:58

0:04:48

0:04:48

1:02:43

1:02:43

0:08:40

0:08:40

0:02:02

0:02:02

0:06:44

0:06:44

0:15:34

0:15:34

0:15:45

0:15:45