filmov

tv

What is TDS in Income Tax | Complete guide of TDS | Basics of TDS

Показать описание

📍In this session we have discuss about the concept of TDS in India, what is TDS in income tax, complete guide of tds and basics of TDS. The concept of TDS was introduced with an aim to collect tax from the very source of income. As per this concept, a person (deductor) who is liable to make payment of specified nature to any other person (deductee) shall deduct tax at source and remit the same into the account of the Central Government. The deductee from whose income tax has been deducted at source would be entitled to get credit of the amount so deducted on the basis of Form 26AS or TDS certificate issued by the deductor.

👨🏻🎓Enroll to our practical course in TDS, ITR & GST Filing

👉Create your account

👉Proceed for payment

👉After payment you can access your complete course

👉Get Certificate after course completion

📍Payment of TDS

Payment of TDS to be done monthly and due date is 7th of the following month (30th April for march month)

📍Late payment of TDS

This point cover two aspects

1.If TDS not deducted - interest @1 % pm

2.If TDS Deducted but not deposited - interest @1.5% pm

📍Return of TDS

Form 24Q Statement for tax deducted at source from salaries

Form 26Q Statement for tax deducted at source on all payments other than salaries.

Form 27Q Statement for tax deduction on income received from interest, dividends, or any other sum payable to non residents.

Form 27EQ Statement of collection of tax at source.

📍Late filing of TDS Return

Penalty under section 234E & 271H are imposed on non filing of TDS Return within due date

Sec 234E - The deductor will be liable to pay by way of fees Rs.200 per day till the failure to pay TDS continues. However, the penalty should not exceed the amount of TDS for which the statement was required to be filed.

Sec 271H - The Assessing Officer may direct a person who fails to file the statement of TDS within the due date to pay a minimum penalty of Rs.10,000 which may be extended to Rs.1,00,000. The penalty under this section is in addition to the late filing fee u/s 234E. This section will also cover the cases of incorrect filing of TDS returns.

📍For tax consultancy please contact below

📞9718097735

📍For Digital Content and collaboration

📞8368741773

Regards,

-Team Fintaxpro

Disclaimer- Although all provisions, notifications, updates and live demo are analyzed in-depth by our team before presenting to public. We hereby provide our point of view only and tax matter are always subject to frequent changes hence advisory is only for the benefit of general public. Hence neither Fintaxpro Advisory LLP nor its designated partner are liable for any consequence arises on the basis of You Tube videos.

#TDS #Tax #deducted #source

⏰Time Stamp

0:00 Intro to TDS

0:26 What is TDS?

4:16 How to claim TDS refund/credit?

5:45 What are the objectives of deducting tax at source?

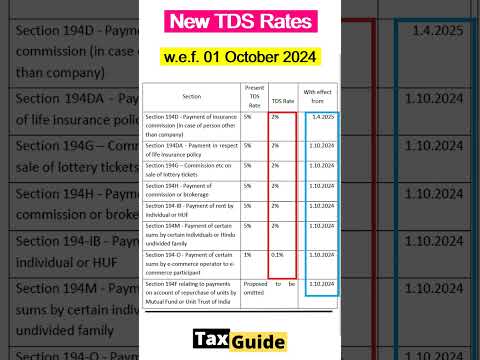

10:20 Rate of TDS?

10:59 How to pay TDS?

11:18 How to generate challan for TDS payment?

22:18 What is TCS?

26:26 Can we charge TDS on GST value?

29:16 Accounting Entry of TDS

38:07 Outro

👨🏻🎓Enroll to our practical course in TDS, ITR & GST Filing

👉Create your account

👉Proceed for payment

👉After payment you can access your complete course

👉Get Certificate after course completion

📍Payment of TDS

Payment of TDS to be done monthly and due date is 7th of the following month (30th April for march month)

📍Late payment of TDS

This point cover two aspects

1.If TDS not deducted - interest @1 % pm

2.If TDS Deducted but not deposited - interest @1.5% pm

📍Return of TDS

Form 24Q Statement for tax deducted at source from salaries

Form 26Q Statement for tax deducted at source on all payments other than salaries.

Form 27Q Statement for tax deduction on income received from interest, dividends, or any other sum payable to non residents.

Form 27EQ Statement of collection of tax at source.

📍Late filing of TDS Return

Penalty under section 234E & 271H are imposed on non filing of TDS Return within due date

Sec 234E - The deductor will be liable to pay by way of fees Rs.200 per day till the failure to pay TDS continues. However, the penalty should not exceed the amount of TDS for which the statement was required to be filed.

Sec 271H - The Assessing Officer may direct a person who fails to file the statement of TDS within the due date to pay a minimum penalty of Rs.10,000 which may be extended to Rs.1,00,000. The penalty under this section is in addition to the late filing fee u/s 234E. This section will also cover the cases of incorrect filing of TDS returns.

📍For tax consultancy please contact below

📞9718097735

📍For Digital Content and collaboration

📞8368741773

Regards,

-Team Fintaxpro

Disclaimer- Although all provisions, notifications, updates and live demo are analyzed in-depth by our team before presenting to public. We hereby provide our point of view only and tax matter are always subject to frequent changes hence advisory is only for the benefit of general public. Hence neither Fintaxpro Advisory LLP nor its designated partner are liable for any consequence arises on the basis of You Tube videos.

#TDS #Tax #deducted #source

⏰Time Stamp

0:00 Intro to TDS

0:26 What is TDS?

4:16 How to claim TDS refund/credit?

5:45 What are the objectives of deducting tax at source?

10:20 Rate of TDS?

10:59 How to pay TDS?

11:18 How to generate challan for TDS payment?

22:18 What is TCS?

26:26 Can we charge TDS on GST value?

29:16 Accounting Entry of TDS

38:07 Outro

Комментарии

0:05:10

0:05:10

0:07:26

0:07:26

0:13:24

0:13:24

0:17:07

0:17:07

0:03:02

0:03:02

0:23:32

0:23:32

0:09:41

0:09:41

0:00:36

0:00:36

0:09:14

0:09:14

0:03:59

0:03:59

0:09:56

0:09:56

0:05:20

0:05:20

0:09:59

0:09:59

0:22:22

0:22:22

0:39:16

0:39:16

0:07:56

0:07:56

0:16:04

0:16:04

0:23:58

0:23:58

0:01:27

0:01:27

0:40:22

0:40:22

0:13:33

0:13:33

0:24:21

0:24:21

0:03:24

0:03:24

0:20:23

0:20:23