filmov

tv

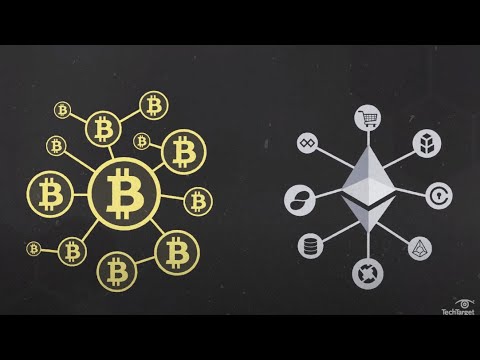

PREPARE: The Ethereum & Bitcoin ETFs Explained

Показать описание

Explaining The Ethereum & Bitcoin ETFs

My PO Box:

Andrei Jikh

4132 S. Rainbow Blvd # 270

Las Vegas, NV 89103

SOURCES:

*None of this is meant to be construed as investment advice, it's for entertainment purposes only. Links above include affiliate commission or referrals. I'm part of an affiliate network and I receive compensation from partnering websites. The video is accurate as of the posting date but may not be accurate in the future.

My PO Box:

Andrei Jikh

4132 S. Rainbow Blvd # 270

Las Vegas, NV 89103

SOURCES:

*None of this is meant to be construed as investment advice, it's for entertainment purposes only. Links above include affiliate commission or referrals. I'm part of an affiliate network and I receive compensation from partnering websites. The video is accurate as of the posting date but may not be accurate in the future.

PREPARE: The Ethereum & Bitcoin ETFs Explained

Billionaire Michael Saylor Explains The Difference Between Bitcoin And Ethereum

How to create YOUR own Cryptocurrency in 3 Minutes on Ethereum

Vitalik Buterin: What Will ETH Be Like in 10 Years?

What is ethereum, and how does it work?

'100% Certain! Prepare for $1.5 Million Bitcoin When This Happens' - Cathie Wood

How To Mine Ethereum & Make Money 2022 Tutorial! (Setup In 10 Minutes Guide)

How I Made $1,200/Day With an AI Ethereum Arbitrage Trading Bot

BITCOIN EMERGENCY: CRASHING NOW (I'm Out)!!! Bitcoin News Today & Ethereum Price Prediction...

I lost ALL of my BITCOIN & ETHEREUM in SECONDS! (Cold storage hacked)

Ethereum vs. Bitcoin: What's the Difference?

Ethereum Price Prediction

Ethereum Will Make Millionaires In 2024, BUT Not How You Think

ETH / BTC Outlook

Bitcoin OR Ethereum: What Makes Them DIFFERENT?

2024 Ethereum Price Prediction (Prepare for SHOCKING Market Moves!)

What is Ethereum? A Beginner's Explanation in Plain English

My half portfolio is in the hand of this man #ethereum #eth #crypto #bitcoin #btc

How Much Ethereum You Need To Retire! It’s Less Than You Think

How to Make $1,000/DAY With Passive Income Ethereum Trading Bot [2024]

Crypto Mining Results after 1 Month #crypto #mining #eth #investor

Ethereum 100% finished? 🤯

“Solana is repeating EXACTLY what Ethereum did”

How Many Ethereum To Be A Millionaire? (Crypto Price Prediction)

Комментарии

0:11:10

0:11:10

0:07:39

0:07:39

0:03:15

0:03:15

0:00:46

0:00:46

0:11:38

0:11:38

0:12:56

0:12:56

0:12:45

0:12:45

0:07:12

0:07:12

0:18:28

0:18:28

0:07:49

0:07:49

0:03:16

0:03:16

0:00:36

0:00:36

0:17:16

0:17:16

0:34:01

0:34:01

0:06:52

0:06:52

0:07:40

0:07:40

0:11:50

0:11:50

0:00:16

0:00:16

0:20:11

0:20:11

0:06:48

0:06:48

0:00:27

0:00:27

0:00:33

0:00:33

0:00:26

0:00:26

0:09:41

0:09:41