filmov

tv

Earnings Exchange: Disney, Super Micro, & Rivian

Показать описание

Gina Sanchez, Lido Advisors chief market strategist, joins CNBC's 'The Exchange' to discuss three stocks: Disney, Super Micro, and Rivian.

Earnings Exchange: Disney, Super Micro, & Rivian

Elon Musk fires employees in twitter meeting DUB

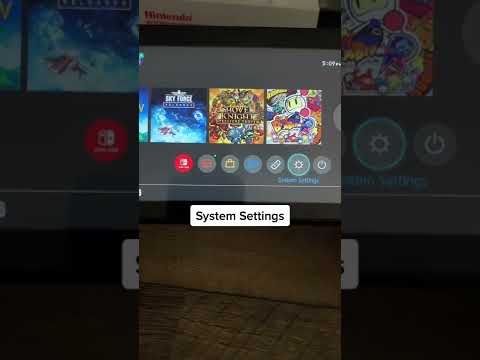

Nintendo Switch Secret Button 🤫. #nintendo #nintendoswitch #gaming #gamer #games

Nintendo Switch Tips I wish I knew sooner.

How many of you have done this? #starwars #disney #lightsaber #battlefront2

How Medical Staples Work 🤔

Apple always leaves their products so close to the edge #shorts #appleevent

CRAZY $7,190,000 GAIN OFF $50,000!!! | WallStreetBets trading Gamestop Stock

Märkte am Morgen: Bitcoin, Super Micro, Disney, CoBa, Siemens Energy, Airbus, Conti, Novo Nordisk

It sounds better coming from a Sith Lord #starwars #disney #cosplay #ahsokatano #darthvader

why does Nintendo do this?

Why You Should Invest Early

Mantlemount-MM340 standard pull down TV mount

I NEVER use this part of the console #gaming

'We hope you're dehydrated!' 💀💀💀

A Very Sad Nintendo eShop Fact...

Is the $7 Temu Nintendo Switch Legit?

SMCI Stock: The Next 100-Bagger? (+NVIDIA Comparison)

Should You Buy a USED Nintendo Switch?

Super Ultrawide Fortnite Gameplay on Nintendo Switch #shorts #gaming #nintendo

Walmart Employee EXPOSES What They Do, TikTok Goes Viral

Minimum salary in America, America ki Jankari #shorts #shortsvideo #shortvideo #amitaamerica #short

100 Heart Date Makeup Challenge 😍🤪

A feature you’ll probably want to turn off on your Switch

Комментарии

0:02:46

0:02:46

0:01:58

0:01:58

0:00:18

0:00:18

0:00:16

0:00:16

0:00:06

0:00:06

0:00:26

0:00:26

0:00:10

0:00:10

0:00:15

0:00:15

0:11:39

0:11:39

0:00:08

0:00:08

0:00:39

0:00:39

0:00:48

0:00:48

0:00:22

0:00:22

0:00:14

0:00:14

0:00:13

0:00:13

0:00:35

0:00:35

0:00:43

0:00:43

0:16:37

0:16:37

0:00:33

0:00:33

0:00:30

0:00:30

0:21:36

0:21:36

0:00:40

0:00:40

0:01:00

0:01:00

0:00:23

0:00:23