filmov

tv

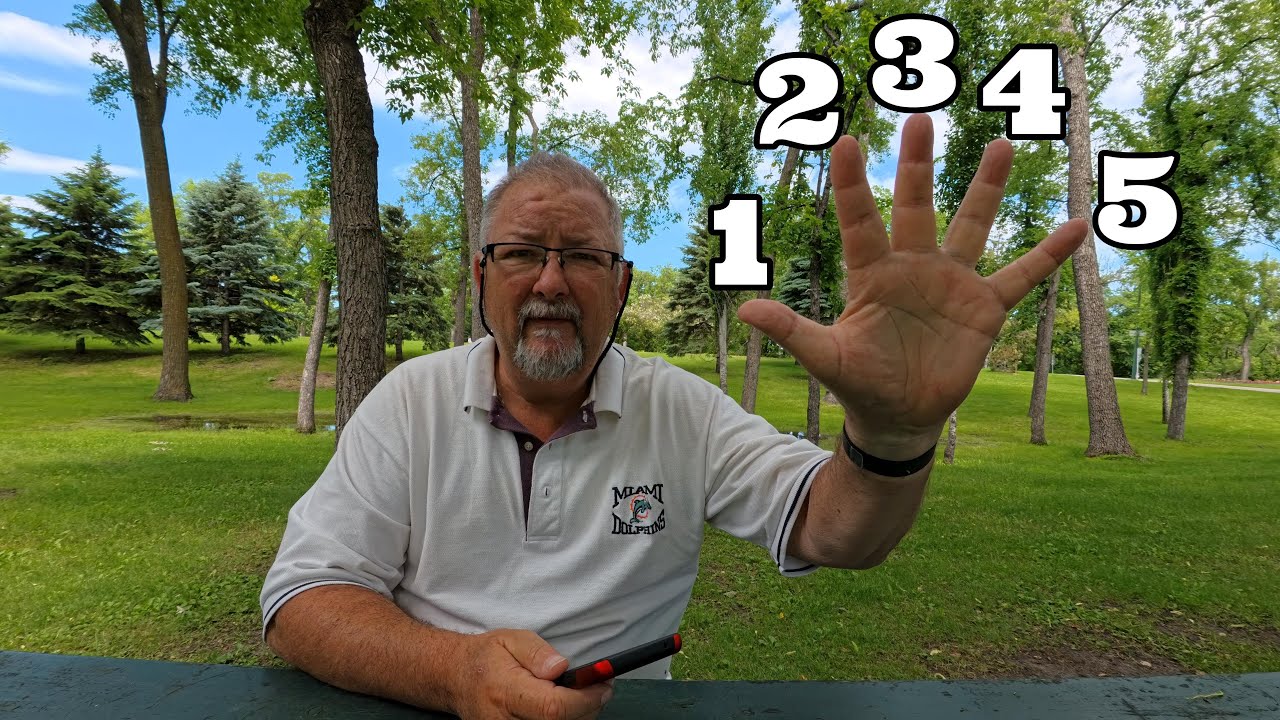

RETIREMENT REGRETS: Top 5 regrets from elderly (70-80 yrs old) retirees!

Показать описание

#RetirementRegrets #RetirementMistakes #RetirementPlanning

I had the chance to take with may senior (70-80 year olds) retirees and asked them what some of their biggest retirement regrets were. Here are the top 5 regrets from the senior retirees!

I hope you find this helpful and/or enlightening. If so, please leave a like and consider subscribing if you enjoy this content.

* DISCLAIMER *

All advice given is my opinion so please take it for what it's worth. Only you can determine what is best for you. Sharing my experiences and advice is just that, sharing. Hopefully it can help but it might not. Any financial advice I highly suggest talking to a registered financial consultant.

I had the chance to take with may senior (70-80 year olds) retirees and asked them what some of their biggest retirement regrets were. Here are the top 5 regrets from the senior retirees!

I hope you find this helpful and/or enlightening. If so, please leave a like and consider subscribing if you enjoy this content.

* DISCLAIMER *

All advice given is my opinion so please take it for what it's worth. Only you can determine what is best for you. Sharing my experiences and advice is just that, sharing. Hopefully it can help but it might not. Any financial advice I highly suggest talking to a registered financial consultant.

RETIREMENT REGRETS: Top 5 regrets from elderly (70-80 yrs old) retirees!

RETIREMENT REGRETS | Top 5 Regrets From 70-80 Year Old Retirees!

RETIREMENT REGRETS: Top 7 Regrets from (65-85 yrs old) Retirees!

Top 5 Retirement Regrets and How to Avoid Them

Retirement Regrets: 5 Things Retirees Wish They Did Differently

5 BIG Retirement Regrets

The 5 Regrets Of The Dying: Life Lessons Everybody Learns Too Late... | Bronnie Ware

5 Things I Wish I Knew Before Retirement – My Early Retirement Regrets

How to Avoid the Most Common Financial Regrets Around Retirement

End of Retirement Regrets, '10 Things I Wish I Did Differently'

24 Regrets of People Who Are Dying - Matthew Kelly

3 Controversial Retirement Regrets You‘ve NEVER Heard

The Top 5 Retirement Regrets

5 Top Retirement Regrets

Retirees Top 5 Regrets

Retirement Expert Shares: 5 Most Common Retirees Regrets | 'I Wish I Had Done THIS Differently&...

7 Most Common End of Retirement Regrets

Top 10 Retirement Regrets For Seniors

The Top 5 Regrets of the Dying with Lewis Howes

5 Major Retirement Regrets and How to Avoid Them

These Will be Your 5 Biggest Regrets at the End of Retirement

Regrets in Retirement: 6 Mistakes Retirees Wish They'd Fixed!

The Top Five Regrets Of The Dying // 10 Timeless Lessons

The 5 Biggest Retirement Regrets

Комментарии

0:05:33

0:05:33

0:03:07

0:03:07

0:08:55

0:08:55

0:06:30

0:06:30

0:06:47

0:06:47

0:11:28

0:11:28

1:36:58

1:36:58

0:16:28

0:16:28

0:47:27

0:47:27

0:10:43

0:10:43

0:02:00

0:02:00

0:04:41

0:04:41

0:07:10

0:07:10

0:02:41

0:02:41

0:07:56

0:07:56

0:08:45

0:08:45

0:11:18

0:11:18

0:01:15

0:01:15

0:03:13

0:03:13

0:12:36

0:12:36

0:11:33

0:11:33

0:08:02

0:08:02

0:14:08

0:14:08

0:08:50

0:08:50