filmov

tv

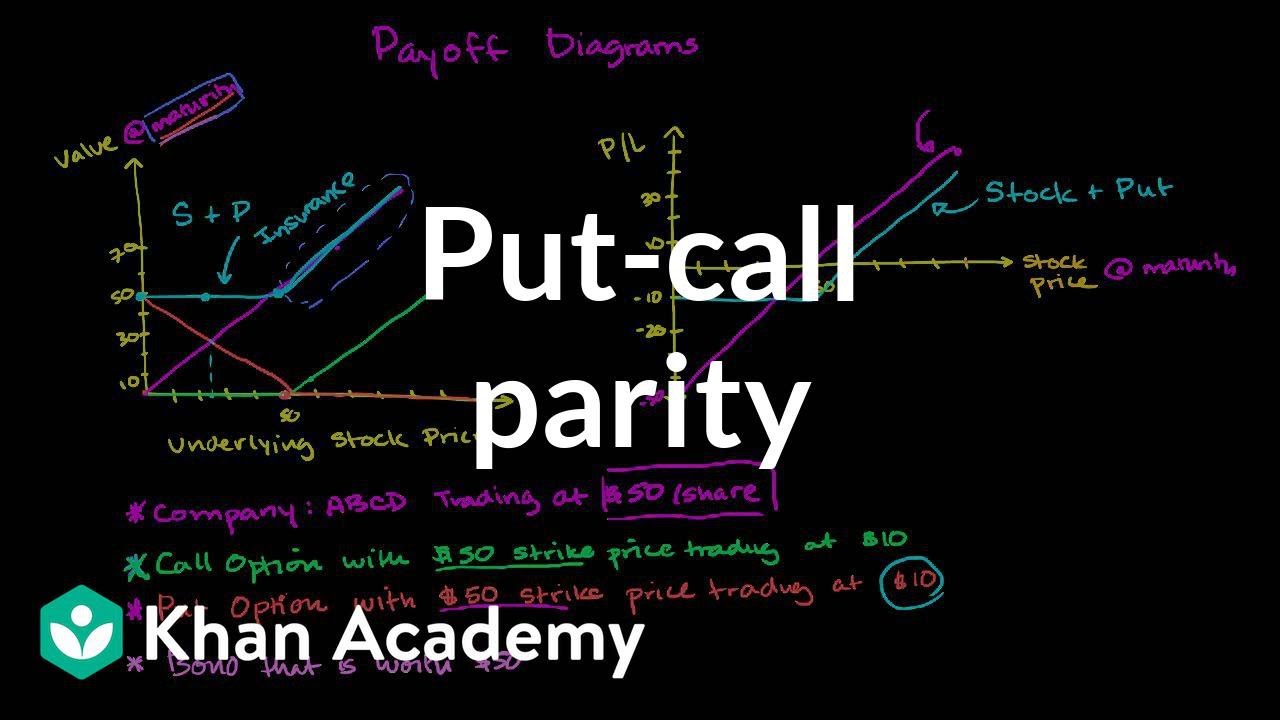

Put-call parity | Finance & Capital Markets | Khan Academy

Показать описание

Put-Call Parity. Created by Sal Khan.

Watch the next lesson:

Missed the previous lesson? Watch here:

Finance and capital markets on Khan Academy: Options allow investors and speculators to hedge downside (or upside). It allows them to trade on a belief that prices will change a lot--just not clear about direction. It allows them to benefit in any market (with leverage) if they speculate correctly. This tutorial walks through option basics and even goes into some fairly sophisticated option mechanics.

About Khan Academy: Khan Academy offers practice exercises, instructional videos, and a personalized learning dashboard that empower learners to study at their own pace in and outside of the classroom. We tackle math, science, computer programming, history, art history, economics, and more. Our math missions guide learners from kindergarten to calculus using state-of-the-art, adaptive technology that identifies strengths and learning gaps. We've also partnered with institutions like NASA, The Museum of Modern Art, The California Academy of Sciences, and MIT to offer specialized content.

For free. For everyone. Forever. #YouCanLearnAnything

Watch the next lesson:

Missed the previous lesson? Watch here:

Finance and capital markets on Khan Academy: Options allow investors and speculators to hedge downside (or upside). It allows them to trade on a belief that prices will change a lot--just not clear about direction. It allows them to benefit in any market (with leverage) if they speculate correctly. This tutorial walks through option basics and even goes into some fairly sophisticated option mechanics.

About Khan Academy: Khan Academy offers practice exercises, instructional videos, and a personalized learning dashboard that empower learners to study at their own pace in and outside of the classroom. We tackle math, science, computer programming, history, art history, economics, and more. Our math missions guide learners from kindergarten to calculus using state-of-the-art, adaptive technology that identifies strengths and learning gaps. We've also partnered with institutions like NASA, The Museum of Modern Art, The California Academy of Sciences, and MIT to offer specialized content.

For free. For everyone. Forever. #YouCanLearnAnything

Комментарии

0:08:14

0:08:14

0:03:29

0:03:29

0:09:23

0:09:23

0:03:56

0:03:56

0:06:07

0:06:07

0:02:04

0:02:04

0:38:47

0:38:47

0:03:54

0:03:54

0:05:01

0:05:01

0:09:06

0:09:06

0:05:53

0:05:53

0:04:37

0:04:37

0:07:48

0:07:48

0:04:37

0:04:37

0:29:02

0:29:02

0:09:11

0:09:11

0:04:33

0:04:33

0:07:14

0:07:14

0:05:05

0:05:05

0:01:47

0:01:47

0:25:49

0:25:49

0:03:18

0:03:18

0:03:50

0:03:50

0:06:01

0:06:01