filmov

tv

Call-Put Parity Explained (For Begineers!)

Показать описание

Welcome to Option Trader!

Please subscribe for weekly updates on option strategies, market discussions, Monte-Carlo simulations for market movement, and educational videos

This channel is for both first time investor or industry experts.

Lets invest the smarter way!!

Please subscribe for weekly updates on option strategies, market discussions, Monte-Carlo simulations for market movement, and educational videos

This channel is for both first time investor or industry experts.

Lets invest the smarter way!!

Call-Put Parity Explained (For Begineers!)

Call Put Parity Explained For Begineers!

Put-Call Parity in Options Trading Explained Using Excel

CFA Level I Derivatives - Put-Call Parity

Put-call parity | Finance & Capital Markets | Khan Academy

What Is Put-Call Parity And Its Applications | Put Call Parity Equation & Arbitrage Opportunity

Put/Call Parity Finally Explained [Episode 348]

What is Put Call Parity? How does it work?

The Hidden Logic of Options | Put-Call Parity Explained with Legos

European Options: Put-Call Parity

Put-call parity arbitrage I | Finance & Capital Markets | Khan Academy

Put-call parity clarification | Finance & Capital Markets | Khan Academy

What is Put Call Parity in Options Trading? 📊 | Understand Arbitrage Opportunities in Options 🚀...

Call Options Explained: Understanding Short and Long Calls

Directional Option Strategies - Put Call Parity

Put Options explained for dummies | Put options explained | Options Trading for beginners

Why Markets Are So EFFICIENT | Put Call Parity Explained | Option Sailor | Advance Trading concepts

A One Day Options Trade (66% return)

Covered Calls explained in under 1 minute ⏱

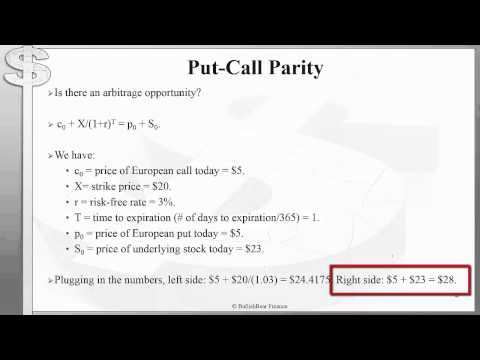

Put Call Parity

CFA Level 1 - Derivatives - Put-Call parity

What are Call Options? Explained.

Options Trading: Understanding Option Prices

Put call parity - CFA Level1 practice question

Комментарии

0:04:37

0:04:37

0:09:23

0:09:23

0:08:14

0:08:14

0:03:29

0:03:29

0:07:17

0:07:17

0:03:18

0:03:18

0:06:07

0:06:07

0:29:02

0:29:02

0:05:53

0:05:53

0:03:56

0:03:56

0:02:04

0:02:04

0:05:01

0:05:01

0:08:48

0:08:48

0:04:33

0:04:33

0:01:00

0:01:00

0:08:19

0:08:19

0:00:59

0:00:59

0:00:50

0:00:50

0:05:05

0:05:05

0:09:06

0:09:06

0:00:29

0:00:29

0:07:31

0:07:31

0:03:08

0:03:08