filmov

tv

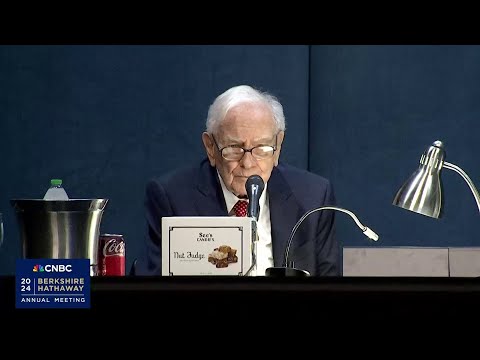

Warren Buffett on Private Equity (2004)

Показать описание

Often, Buffett acquires companies in full, takes them off the stock market, and has an operating team to fully service the business. Private Equity investment firms operate in a similar model of acquiring large ownership stakes in companies, and thus directly compete against Buffett in this realm of investing.

Private equity (PE) typically refers to investment funds, generally organized as limited partnerships, that buy and restructure companies that are not publicly traded. Private equity is a type of equity and one of the asset classes consisting of equity securities and debt in operating companies that are not publicly traded on a stock exchange.

A private-equity investment will generally be made by a private-equity firm, a venture capital firm or an angel investor. Each of these categories of investors has its own set of goals, preferences and investment strategies; however, all provide working capital to a target company to nurture expansion, new-product development, or restructuring of the company's operations, management, or ownership.

Common investment strategies in private equity include leveraged buyouts, venture capital, growth capital, distressed investments and mezzanine capital. In a typical leveraged-buyout transaction, a private-equity firm buys majority control of an existing or mature firm. This is distinct from a venture-capital or growth-capital investment, in which the investors (typically venture-capital firms or angel investors) invest in young, growing or emerging companies, and rarely obtain majority control.

Private equity is also often grouped into a broader category called private capital, generally used to describe capital supporting any long-term, illiquid investment strategy.

The key features of private-equity operations are generally as follows.

1) A private-equity manager uses the money of investors to fund its acquisitions – investors are e.g. hedge funds, pension funds, university endowments or wealthy individuals.

2) It restructures the acquired firm (or firms) and attempts to resell at a higher value, aiming for a high return on equity. The restructuring often involves cutting costs, which produces higher profits in the short term, but can probably do long-term damage to customer relationships and workforce morale.

3) Private equity makes extensive use of debt financing to purchase companies in use of leverage – hence the earlier name for private-equity operations: leveraged buy-outs. (A small increase in firm value – for example, a growth of asset price by 20% – can lead to 100% return on equity, if the amount the private-equity fund put down to buy the company in the first place was only 20% down and 80% debt. However, if the private-equity firm fails to make the target grow in value, losses will be large.) Additionally, debt financing reduces corporate taxation burdens, as interest payments are tax-deductible, and is one of the principal ways in which profits for investors are enhanced.

4) Because innovations tend to be produced by outsiders and founders in startups, rather than existing organizations, private equity targets startups to create value by overcoming agency costs and better aligning the incentives of corporate managers with those of their shareholders. This means a greater share of firm retained earnings is taken out of the firm to distribute to shareholders than is reinvested in the firm's workforce or equipment. When private equity purchases a very small startup it can behave like venture capital and help the small firm reach a wider market.

However, when private equity purchases a larger firm, the experience of being managed by private equity may lead to loss of product quality and low morale among the employees.

5) Private-equity investors often syndicate their transactions to other buyers to achieve benefits that include diversification of different types of target risk, the combination of complementary investor information and skillsets, and an increase in future deal flow.

Buffett Books:

#WarrenBuffett #Invest #Stockmarket

Private equity (PE) typically refers to investment funds, generally organized as limited partnerships, that buy and restructure companies that are not publicly traded. Private equity is a type of equity and one of the asset classes consisting of equity securities and debt in operating companies that are not publicly traded on a stock exchange.

A private-equity investment will generally be made by a private-equity firm, a venture capital firm or an angel investor. Each of these categories of investors has its own set of goals, preferences and investment strategies; however, all provide working capital to a target company to nurture expansion, new-product development, or restructuring of the company's operations, management, or ownership.

Common investment strategies in private equity include leveraged buyouts, venture capital, growth capital, distressed investments and mezzanine capital. In a typical leveraged-buyout transaction, a private-equity firm buys majority control of an existing or mature firm. This is distinct from a venture-capital or growth-capital investment, in which the investors (typically venture-capital firms or angel investors) invest in young, growing or emerging companies, and rarely obtain majority control.

Private equity is also often grouped into a broader category called private capital, generally used to describe capital supporting any long-term, illiquid investment strategy.

The key features of private-equity operations are generally as follows.

1) A private-equity manager uses the money of investors to fund its acquisitions – investors are e.g. hedge funds, pension funds, university endowments or wealthy individuals.

2) It restructures the acquired firm (or firms) and attempts to resell at a higher value, aiming for a high return on equity. The restructuring often involves cutting costs, which produces higher profits in the short term, but can probably do long-term damage to customer relationships and workforce morale.

3) Private equity makes extensive use of debt financing to purchase companies in use of leverage – hence the earlier name for private-equity operations: leveraged buy-outs. (A small increase in firm value – for example, a growth of asset price by 20% – can lead to 100% return on equity, if the amount the private-equity fund put down to buy the company in the first place was only 20% down and 80% debt. However, if the private-equity firm fails to make the target grow in value, losses will be large.) Additionally, debt financing reduces corporate taxation burdens, as interest payments are tax-deductible, and is one of the principal ways in which profits for investors are enhanced.

4) Because innovations tend to be produced by outsiders and founders in startups, rather than existing organizations, private equity targets startups to create value by overcoming agency costs and better aligning the incentives of corporate managers with those of their shareholders. This means a greater share of firm retained earnings is taken out of the firm to distribute to shareholders than is reinvested in the firm's workforce or equipment. When private equity purchases a very small startup it can behave like venture capital and help the small firm reach a wider market.

However, when private equity purchases a larger firm, the experience of being managed by private equity may lead to loss of product quality and low morale among the employees.

5) Private-equity investors often syndicate their transactions to other buyers to achieve benefits that include diversification of different types of target risk, the combination of complementary investor information and skillsets, and an increase in future deal flow.

Buffett Books:

#WarrenBuffett #Invest #Stockmarket

Комментарии

0:06:05

0:06:05

0:07:30

0:07:30

0:05:17

0:05:17

0:04:22

0:04:22

0:02:42

0:02:42

0:02:17

0:02:17

0:04:47

0:04:47

0:10:22

0:10:22

0:11:59

0:11:59

0:00:16

0:00:16

0:03:33

0:03:33

0:06:04

0:06:04

0:10:56

0:10:56

0:06:31

0:06:31

0:05:20

0:05:20

0:05:09

0:05:09

0:06:05

0:06:05

0:03:57

0:03:57

0:06:12

0:06:12

0:06:08

0:06:08

0:04:23

0:04:23

0:11:15

0:11:15

0:07:31

0:07:31

0:12:22

0:12:22