filmov

tv

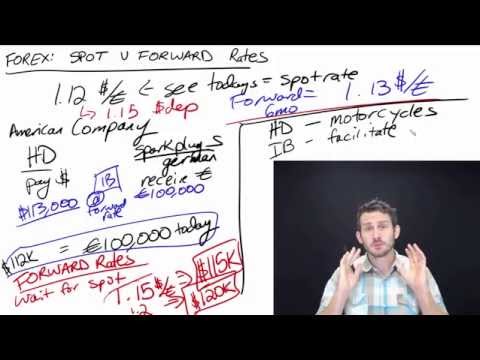

Spot and Forward Exchange Rates Explained in 5 Minutes

Показать описание

Spot and Forward Exchange Rates Explained in 5 Minutes by Ryan O'Connell, CFA, FRM

🎓 Tutor With Me: 1-On-1 Video Call Sessions Available

Chapters:

0:00 - Spot Exchange Rates

0:30 - Forward Exchange Rates and Forward Contracts

1:22 - Interest Rate Parity Formula

2:18 - Solving for the Forward Exchange Rate

4:01 - Interest Rate Parity Explained

*Disclosure: This is not financial advice and should not be taken as such. The information contained in this video is an opinion. Some of the information could be wrong. This channel is owned and operated by Portfolio Constructs LLC. Some of the links above are affiliate links, meaning, at no additional cost to you, I will earn a commission if you click through and make a purchase.

🎓 Tutor With Me: 1-On-1 Video Call Sessions Available

Chapters:

0:00 - Spot Exchange Rates

0:30 - Forward Exchange Rates and Forward Contracts

1:22 - Interest Rate Parity Formula

2:18 - Solving for the Forward Exchange Rate

4:01 - Interest Rate Parity Explained

*Disclosure: This is not financial advice and should not be taken as such. The information contained in this video is an opinion. Some of the information could be wrong. This channel is owned and operated by Portfolio Constructs LLC. Some of the links above are affiliate links, meaning, at no additional cost to you, I will earn a commission if you click through and make a purchase.

Spot and Forward Exchange Rates Explained in 5 Minutes

CFA® Level I Economics - Forward Exchange Rates

Forward Exchange Rates

Spot and Forward Exchange Rate

Spot and forward exchange rate...first two (miss) points of int. Trade topic-7

Interest Rate Parity (IRP) Explained | Foreign Exchange Rates

Spot rate & forward exchange rate

What is Spot Rate | Forex Management | CA Raja Classes

CAIIB BFM 2025 Free Online Classes | Forward Rates | CAIIB BFM Important Topics | CAIIB EduTap

The Spot Curve and Forward Curve Explained In 5 Minutes

Spot Exchange Rate and Forward Exchange Rate | Spot vs Forward Exchange Rate | ecoso

How to Calculate Spot Rates and Forward Rates in Bonds

Spot vs Forward Rates

FX Swaps | Outright Forward Transaction | Foreign Exchange Markets FRM Part 1

What are Spot and Forward contracts?

Forward Exchange Rate

Lesson 103 FX Forward

FX Forward Contracts (Derivatives Video 2)

Spot and Forward Contracts versus Forex Options

Forward FX Points

Spot, Forward, Option and Currency Futures

Forward and Spot Rate of Exchange - Foreign Exchange Market - (Part-11)- Macroeconomics By Tarun Sir

Spot Rate vs Forward Rate | Interest Rates

Spot Transaction, Forward Transaction, Spot and Forward Transaction, Foreign Exchange and risk, mba

Комментарии

0:05:09

0:05:09

0:05:49

0:05:49

0:05:04

0:05:04

0:10:33

0:10:33

0:04:33

0:04:33

0:08:06

0:08:06

0:00:59

0:00:59

0:02:13

0:02:13

0:08:18

0:08:18

0:04:51

0:04:51

0:23:39

0:23:39

0:06:18

0:06:18

0:08:04

0:08:04

0:04:16

0:04:16

0:00:35

0:00:35

0:01:37

0:01:37

0:05:49

0:05:49

0:12:55

0:12:55

0:08:01

0:08:01

0:03:51

0:03:51

0:17:53

0:17:53

0:06:31

0:06:31

0:03:23

0:03:23

0:09:29

0:09:29