filmov

tv

The difference between actual cash value (ACV) & replacement cost value (RCV) with home insurance.

Показать описание

Mike Schmisek, with Premier Mountain Insurance, explains the difference between actual cash value and replacement cost value when it comes to your home insurance in Colorado.

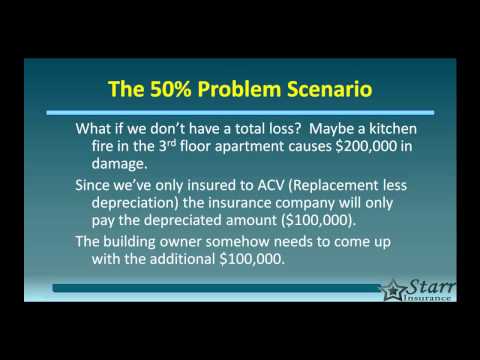

Most personal property is either covered at replacement cost or actual cash value. If your property is covered at actual cash value (ACV), you would get Goodwill store values for your items. If you have replacement cost, you could receive the amount to replace your items with new things.

More and more frequently, we're seeing roofs covered at actual cash value in Colorado. Imagine your roof is comprised of asphalt shingles that are five years old. A roof payment schedule or ACV loss settlement would pay less each year as the roof ages. With a realistic roof schedule, your insurance company would pay you 85% of the full replacement cost of your roof at five years of age. If it was 10 years old, 70%, and so on, down to about 25% for really old roofs. In your scenario, let’s say you have a $2,500 deductible, and your roof replacement will cost $20,000. 85% of 20k is $17,000, less your $2,500, which comes to $14,500 you will be paid for your $20,000 roof replacement. So you end up paying a total of $5,500 after all insurance proceeds are paid out. Make sense?

The thing is, in most cases, adding a roof payment schedule will only save you a few hundred dollars on your annual policy. Let’s say you save $300 per year to take on a roof payment schedule. It would take ten years to recoup the additional $3,000 you have to pay on your five-year-old roof. Does this sound like a good deal? Likely not.

Here’s the kicker, in 2023, in the great state of Colorado, many insurance companies are automatically switching their insureds to a Roof Payment Schedule or an ACV policy on the roof. Many without notice. And not just old roofs, but ALL ROOFS! Sound good to you? Not so much.

Most personal property is either covered at replacement cost or actual cash value. If your property is covered at actual cash value (ACV), you would get Goodwill store values for your items. If you have replacement cost, you could receive the amount to replace your items with new things.

More and more frequently, we're seeing roofs covered at actual cash value in Colorado. Imagine your roof is comprised of asphalt shingles that are five years old. A roof payment schedule or ACV loss settlement would pay less each year as the roof ages. With a realistic roof schedule, your insurance company would pay you 85% of the full replacement cost of your roof at five years of age. If it was 10 years old, 70%, and so on, down to about 25% for really old roofs. In your scenario, let’s say you have a $2,500 deductible, and your roof replacement will cost $20,000. 85% of 20k is $17,000, less your $2,500, which comes to $14,500 you will be paid for your $20,000 roof replacement. So you end up paying a total of $5,500 after all insurance proceeds are paid out. Make sense?

The thing is, in most cases, adding a roof payment schedule will only save you a few hundred dollars on your annual policy. Let’s say you save $300 per year to take on a roof payment schedule. It would take ten years to recoup the additional $3,000 you have to pay on your five-year-old roof. Does this sound like a good deal? Likely not.

Here’s the kicker, in 2023, in the great state of Colorado, many insurance companies are automatically switching their insureds to a Roof Payment Schedule or an ACV policy on the roof. Many without notice. And not just old roofs, but ALL ROOFS! Sound good to you? Not so much.

0:01:38

0:01:38

0:01:19

0:01:19

0:00:26

0:00:26

0:01:59

0:01:59

0:06:56

0:06:56

0:08:49

0:08:49

0:15:06

0:15:06

0:05:15

0:05:15

0:08:18

0:08:18

0:09:44

0:09:44

0:00:45

0:00:45

0:01:00

0:01:00

0:01:51

0:01:51

0:01:36

0:01:36

0:03:11

0:03:11

0:05:47

0:05:47

0:08:00

0:08:00

0:04:15

0:04:15

0:03:01

0:03:01

0:04:11

0:04:11

0:05:03

0:05:03

0:02:21

0:02:21

0:10:09

0:10:09

0:03:00

0:03:00