filmov

tv

Replacement Cost vs. Actual Cash Value - Insurance Basics by Starr Insurance

Показать описание

One of the basic decisions you need to make when purchasing an insurance policy is the type of valuation you would like it to be based on.

This will affect the amount of coverage you wish to purchase, policy premiums, coinsurance and much more.

Insurance policies need to have a fair means of valuing your property at the time of a loss. The two basic choices are:

Replacement Cost Valuation

Actual Cash Value

Replacement Cost Valuation

Replacement cost valuation is exactly like it sounds. We, the insurance company, will pay (up to the policy limit) to replace your property with like kind and quality for it's replacement cost at the time of loss. Even though the property only cost $100,000 to build ten years ago, since today's replacement cost is now $150,000, as long as you've kept the policy limit updated, we will now pay you that amount.

ACV (Actual Cash Value) Valuation

Actual Cash Value is defined as Replacement cost less depreciation. So at the time of loss the insurance company will pay (up to the policy limit) to replace your property with like kind and quality for it's replacement cost less depreciation. Depreciation is not an easy thing to define as different building materials depreciate at a different rate. Thus, it is much more difficult to determine at any point in time the exact amount you may be paid at the time of a loss.

Real World Example #1

Industrial Machine Inc. purchases a plot of land and builds a new shop for $1.2 Million.

Because they have just build the building they know exactly what it costs to rebuild should they have a loss and so decide to insure it to full value using Replacement cost valuation.

Each year they update their coverage to keep pace with rising steel costs, construction labor, etc. At any point in time they know that they have the full amount of coverage needed to rebuild should they suffer a loss.

Real World Example #2

Cool Computer Parts Inc. finds an incredible deal and purchases a 3600 square foot building on Main Street, Anytown, USA that 'needs a little work' for $160,000. It has a storefront for their business and apartments they can rent on the upper floors.

The mortgage is only $130,000 so that is all the insurance the bank requires. Cool Computer Parts decides the depreciated value of the building is probably $240,000 and decide to insure it for that value ACV and not bother to rebuild if they suffer a total loss.

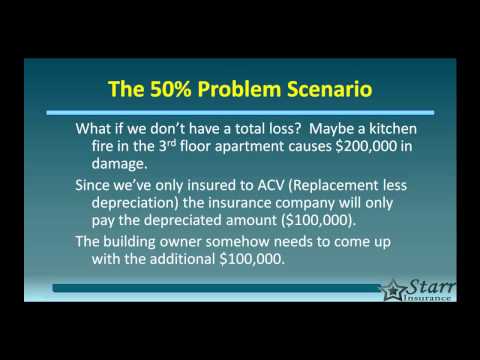

The problem is -- what happens during a partial loss?

Let's assume the actual replacement cost for this building is $480,000, a reasonable reconstruction amount for a 3600 square foot building.

If Replacement cost less depreciation is $240,000 the insurance company will pay our $240,000 limit if we have a total loss.

What if we don't have a total loss? Maybe a kitchen fire in the 3rd floor apartment causes $200,000 in damage. Since we've only insured to ACV (Replacement less depreciation) the insurance company will only pay the depreciated amount ($100,000).

The building owner somehow needs to come up with the additional $100,000. Where will they come up with that money? The bank has already lent 80% of the market value and to come up with that $100,000 someone will have to agree to lend far more than the market value of the property. Something that nobody wants to do.

Market Value Is Meaningless

In the world of insurance the market value of your property has no meaning.

All we care about is 'making you whole', in other words putting your building back into the same condition it was previously so that you can put it to use, generate rent receipts or revenue streams and income for your business.

What if we have Replacement Cost coverage and decide to not rebuild? This is a scenario that comes up from time to time. The answer is that there is a clause in most insurance contracts that still allow you to be paid the actual cash value of the property at the time of loss and not rebuild or replace the damaged property.

Комментарии

0:01:38

0:01:38

0:01:19

0:01:19

0:02:21

0:02:21

0:03:22

0:03:22

0:02:46

0:02:46

0:04:27

0:04:27

0:01:51

0:01:51

0:01:50

0:01:50

2:30:20

2:30:20

0:02:35

0:02:35

0:03:45

0:03:45

0:00:57

0:00:57

0:01:38

0:01:38

0:04:13

0:04:13

0:08:00

0:08:00

0:01:35

0:01:35

0:15:06

0:15:06

0:04:15

0:04:15

0:06:56

0:06:56

0:07:27

0:07:27

0:01:36

0:01:36

0:05:47

0:05:47

0:04:25

0:04:25

0:06:32

0:06:32