filmov

tv

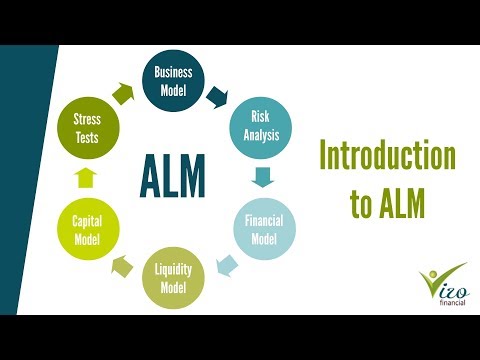

Introduction to Asset-Liability Management in Banks

Показать описание

Discover the fundamental principles of Asset-Liability Management (ALM) in banking. This video delves into the critical practice of managing and mitigating risks arising from discrepancies between a bank's assets and liabilities, ensuring financial stability, and adhering to regulatory requirements.

Covered in this introduction:

1. The Importance of ALM: A strategic manoeuvre to optimise profits while managing risks including liquidity, interest rate, and currency risks.

2. Components of ALM: A breakdown of key components such as interest rate risk, liquidity risk, and market risk.

3. The ALM Process: From setting up an ALM committee to deploying sophisticated information systems for risk assessment and decision-making.

This video is essential for banking professionals, finance students, and anyone interested in understanding how banks manage the balance between what they own and what they owe. Explore the concepts of interest rate risk management, liquidity provisions, and market risk considerations in the context of banking operations.

#AssetLiabilityManagement #Banking #Finance

Covered in this introduction:

1. The Importance of ALM: A strategic manoeuvre to optimise profits while managing risks including liquidity, interest rate, and currency risks.

2. Components of ALM: A breakdown of key components such as interest rate risk, liquidity risk, and market risk.

3. The ALM Process: From setting up an ALM committee to deploying sophisticated information systems for risk assessment and decision-making.

This video is essential for banking professionals, finance students, and anyone interested in understanding how banks manage the balance between what they own and what they owe. Explore the concepts of interest rate risk management, liquidity provisions, and market risk considerations in the context of banking operations.

#AssetLiabilityManagement #Banking #Finance

0:13:13

0:13:13

0:06:50

0:06:50

0:38:09

0:38:09

0:04:29

0:04:29

0:03:09

0:03:09

0:04:29

0:04:29

0:02:16

0:02:16

0:03:32

0:03:32

0:10:50

0:10:50

0:09:03

0:09:03

0:14:48

0:14:48

0:01:55

0:01:55

0:00:21

0:00:21

0:06:12

0:06:12

0:03:58

0:03:58

0:02:38

0:02:38

0:26:18

0:26:18

0:02:21

0:02:21

0:03:02

0:03:02

0:31:38

0:31:38

0:02:06

0:02:06

0:17:26

0:17:26

0:02:14

0:02:14

0:11:47

0:11:47