filmov

tv

What is Asset Liability Management in Banking?

Показать описание

A bank is a financial intermediary that collects funds from depositors and lends the funds to others at a higher rate than it pays to depositors (this is the net interest margin).

Historically, you could calculate a bank’s profit as follows:

interest earned from borrowers – interest paid to depositors = bank profit

To increase profit, banks focused on funding their activities at the lowest possible cost.

But the banking industry has changed significantly.

Loans used to account for nearly all of a bank’s revenue; today, banks generate additional income from investments in securities, speculation with derivatives, and other sources. While deposits used to be the primary source of funds, banks now obtain funds with short- and long-term borrowing, securitizations, and collateralized borrowings.

These changes brought new types of risk. Unfortunately, many banks failed to manage these risks, and some banks became insolvent or required a bailout during the 2008 financial crisis. The banking industry has evolved, however, and banks now manage these risks with asset-liability management (ALM).

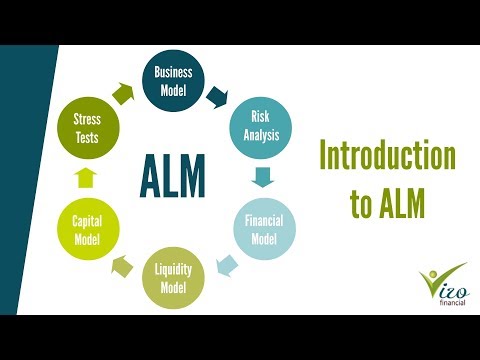

ALM is the process of matching assets and liabilities to manage risk; specifically, to protect against adverse changes to the bank’s profit, firm value, and liquidity.

Banks carry out ALM by optimizing the following gaps:

• The earning gap

• The duration gap

• The cash flow gap

• The liquidity gap

—

Edspira is the creation of Michael McLaughlin, an award-winning professor who went from teenage homelessness to a PhD. Edspira’s mission is to make a high-quality business education freely available to the world.

—

SUBSCRIBE FOR A FREE 53-PAGE GUIDE TO THE FINANCIAL STATEMENTS, PLUS:

• A 23-PAGE GUIDE TO MANAGERIAL ACCOUNTING

• A 44-PAGE GUIDE TO U.S. TAXATION

• A 75-PAGE GUIDE TO FINANCIAL STATEMENT ANALYSIS

• MANY MORE FREE PDF GUIDES AND SPREADSHEETS

—

SUPPORT EDSPIRA ON PATREON

—

GET CERTIFIED IN FINANCIAL STATEMENT ANALYSIS, IFRS 16, AND ASSET-LIABILITY MANAGEMENT

—

LISTEN TO THE SCHEME PODCAST

—

GET TAX TIPS ON TIKTOK

—

ACCESS INDEX OF VIDEOS

—

CONNECT WITH EDSPIRA

—

CONNECT WITH MICHAEL

—

ABOUT EDSPIRA AND ITS CREATOR

Historically, you could calculate a bank’s profit as follows:

interest earned from borrowers – interest paid to depositors = bank profit

To increase profit, banks focused on funding their activities at the lowest possible cost.

But the banking industry has changed significantly.

Loans used to account for nearly all of a bank’s revenue; today, banks generate additional income from investments in securities, speculation with derivatives, and other sources. While deposits used to be the primary source of funds, banks now obtain funds with short- and long-term borrowing, securitizations, and collateralized borrowings.

These changes brought new types of risk. Unfortunately, many banks failed to manage these risks, and some banks became insolvent or required a bailout during the 2008 financial crisis. The banking industry has evolved, however, and banks now manage these risks with asset-liability management (ALM).

ALM is the process of matching assets and liabilities to manage risk; specifically, to protect against adverse changes to the bank’s profit, firm value, and liquidity.

Banks carry out ALM by optimizing the following gaps:

• The earning gap

• The duration gap

• The cash flow gap

• The liquidity gap

—

Edspira is the creation of Michael McLaughlin, an award-winning professor who went from teenage homelessness to a PhD. Edspira’s mission is to make a high-quality business education freely available to the world.

—

SUBSCRIBE FOR A FREE 53-PAGE GUIDE TO THE FINANCIAL STATEMENTS, PLUS:

• A 23-PAGE GUIDE TO MANAGERIAL ACCOUNTING

• A 44-PAGE GUIDE TO U.S. TAXATION

• A 75-PAGE GUIDE TO FINANCIAL STATEMENT ANALYSIS

• MANY MORE FREE PDF GUIDES AND SPREADSHEETS

—

SUPPORT EDSPIRA ON PATREON

—

GET CERTIFIED IN FINANCIAL STATEMENT ANALYSIS, IFRS 16, AND ASSET-LIABILITY MANAGEMENT

—

LISTEN TO THE SCHEME PODCAST

—

GET TAX TIPS ON TIKTOK

—

ACCESS INDEX OF VIDEOS

—

CONNECT WITH EDSPIRA

—

CONNECT WITH MICHAEL

—

ABOUT EDSPIRA AND ITS CREATOR

Комментарии

0:06:50

0:06:50

0:13:13

0:13:13

0:04:29

0:04:29

0:03:32

0:03:32

0:03:02

0:03:02

0:00:21

0:00:21

0:17:26

0:17:26

0:09:21

0:09:21

0:05:39

0:05:39

0:41:05

0:41:05

0:02:38

0:02:38

0:38:09

0:38:09

0:11:47

0:11:47

0:17:20

0:17:20

0:01:42

0:01:42

0:21:02

0:21:02

0:15:05

0:15:05

0:04:26

0:04:26

0:31:38

0:31:38

0:02:40

0:02:40

0:01:55

0:01:55

0:09:21

0:09:21

0:07:08

0:07:08

0:06:42

0:06:42