filmov

tv

Personal Finance 101: Ten things to do when you turn 18

Показать описание

School teaches us a lot, but not about money. You learn about he intricacies of Mesopotamian irrigation and how to draw a turkey with your hand imprint. But you never learn personal finance 101!

In this video I break down some personal finance basics, how to save money, some teenage money management tips, and what to do with money in your 20s.

*Subscribe for more videos like this!*

**Best Credit Cards for Beginners

**Best Checking Accounts

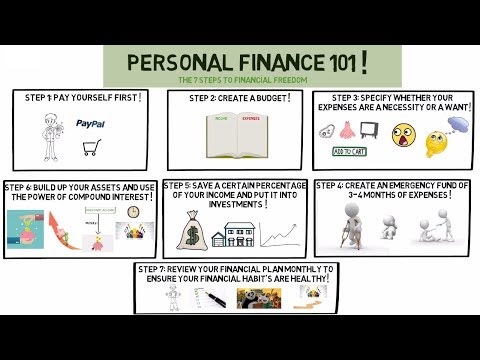

Personal Finance Tip #1: Make a budget

Making a budget allows you to see where all your money comes in and goes out.

Use Mint or a program similar to Mint to budget your money. Mint allows you to see all your transaction history across all linked accounts. Once you know where your money is going, it will get easier to budget.

Personal Finance Tip #2: Open a checking and savings account (or a hybrid checking/savings account)

You need a place to put your money that is not under your mattress. Having a bank where you can deposit checks, save your cash, and pay your bills is the most basic first step for personal finance success.

Do not go with Bank of America, Chase, or Wells Fargo. They charge you $12 every month unless you meet certain criteria.

I recommend going with SoFi Money. It is an online checking/savings hybrid account. SoFi Money is free to use and gives you great interest on all your money.

Personal Finance Tip #3: Open a credit card

Developing a credit history is very important. If you have a high credit score, you will pay less in interest on mortgages, auto loans, and almost any other debt you take out.

Having a credit card also allows you to save money on everyday things you buy. For example, using the right credit card can save you 2%-5%+ on gas, groceries, entertainment, and almost everything you can think of.

I recommend getting Discover. It is easier to qualify for. Discover has no annual fee and gives you great cash back on rotating categories. (Click here to get it:

Also, pay your credit card balance in FULL every month. Never, ever carry a balance.

Personal Finance Tip #4: Pay yourself first.

You need to pay yourself before you think about spending your money. Paying yourself first is a great automatic way to get in the habit of saving. You will never get ahead unless you save!

Specifically, I would take 5% or 10% of every dollar you get and automatically transfer it to your savings account.

#5: Invest in your 401(k), IRA, or after tax account

If you never find a way to make money when you sleep, you will work forever. That is why investing is so crucial. If you have a 401(k) at work, understand what your employer matches and match to that amount. This is free money!

If you do not have a 401(k) at work, open an IRA. I recommend Vanguard. Keep your expenses low and invest in a broad based index fund like VOO. Buy and hold forever.

Personal Finance Tip #6: Avoid student loans

Student loans are non-dischargeable in bankruptcy. This means that they will follow you around forever no matter what happens, with a few limited exceptions.

Personal Finance Tip #7: Do not buy a new car

Buying a new car is a waste of money. You will lose tons of money just driving the car off the lot. Buy a used car to save lots of money.

Personal Finance Tip #8: Learn about taxation

You pay taxes on everything. Take some time to understand it. For most people, taking the standard deduction ($12,200 for individuals and $24,400 for married folks in 2019) is the best option.

Personal Finance Tip #9: Never stop learning about personal finance

You spend 40-50+hrs a week in your job or at school, but how many hours do you spend learning about personal finance? Take a few hours a month to learn about investing, taxes, real estate, mortgages, credit cards, and other personal finance basics.

Personal Finance Tip #10: Look at cheap ways to have fun

National parks, hostels, camping, cooking at home. These are all things you can do to save money.

What do you think? Let me know in the comments below.

Don’t forget to like the video!

AFFILIATE DISCLOSURE: Some of the links on this webpage are affiliate links, meaning, at no additional cost to you, we may earn a commission if you click through and sign up. However, this does not impact our opinions and comparisons.

In this video I break down some personal finance basics, how to save money, some teenage money management tips, and what to do with money in your 20s.

*Subscribe for more videos like this!*

**Best Credit Cards for Beginners

**Best Checking Accounts

Personal Finance Tip #1: Make a budget

Making a budget allows you to see where all your money comes in and goes out.

Use Mint or a program similar to Mint to budget your money. Mint allows you to see all your transaction history across all linked accounts. Once you know where your money is going, it will get easier to budget.

Personal Finance Tip #2: Open a checking and savings account (or a hybrid checking/savings account)

You need a place to put your money that is not under your mattress. Having a bank where you can deposit checks, save your cash, and pay your bills is the most basic first step for personal finance success.

Do not go with Bank of America, Chase, or Wells Fargo. They charge you $12 every month unless you meet certain criteria.

I recommend going with SoFi Money. It is an online checking/savings hybrid account. SoFi Money is free to use and gives you great interest on all your money.

Personal Finance Tip #3: Open a credit card

Developing a credit history is very important. If you have a high credit score, you will pay less in interest on mortgages, auto loans, and almost any other debt you take out.

Having a credit card also allows you to save money on everyday things you buy. For example, using the right credit card can save you 2%-5%+ on gas, groceries, entertainment, and almost everything you can think of.

I recommend getting Discover. It is easier to qualify for. Discover has no annual fee and gives you great cash back on rotating categories. (Click here to get it:

Also, pay your credit card balance in FULL every month. Never, ever carry a balance.

Personal Finance Tip #4: Pay yourself first.

You need to pay yourself before you think about spending your money. Paying yourself first is a great automatic way to get in the habit of saving. You will never get ahead unless you save!

Specifically, I would take 5% or 10% of every dollar you get and automatically transfer it to your savings account.

#5: Invest in your 401(k), IRA, or after tax account

If you never find a way to make money when you sleep, you will work forever. That is why investing is so crucial. If you have a 401(k) at work, understand what your employer matches and match to that amount. This is free money!

If you do not have a 401(k) at work, open an IRA. I recommend Vanguard. Keep your expenses low and invest in a broad based index fund like VOO. Buy and hold forever.

Personal Finance Tip #6: Avoid student loans

Student loans are non-dischargeable in bankruptcy. This means that they will follow you around forever no matter what happens, with a few limited exceptions.

Personal Finance Tip #7: Do not buy a new car

Buying a new car is a waste of money. You will lose tons of money just driving the car off the lot. Buy a used car to save lots of money.

Personal Finance Tip #8: Learn about taxation

You pay taxes on everything. Take some time to understand it. For most people, taking the standard deduction ($12,200 for individuals and $24,400 for married folks in 2019) is the best option.

Personal Finance Tip #9: Never stop learning about personal finance

You spend 40-50+hrs a week in your job or at school, but how many hours do you spend learning about personal finance? Take a few hours a month to learn about investing, taxes, real estate, mortgages, credit cards, and other personal finance basics.

Personal Finance Tip #10: Look at cheap ways to have fun

National parks, hostels, camping, cooking at home. These are all things you can do to save money.

What do you think? Let me know in the comments below.

Don’t forget to like the video!

AFFILIATE DISCLOSURE: Some of the links on this webpage are affiliate links, meaning, at no additional cost to you, we may earn a commission if you click through and sign up. However, this does not impact our opinions and comparisons.

Комментарии

0:20:14

0:20:14

0:15:27

0:15:27

0:10:03

0:10:03

0:07:47

0:07:47

0:21:14

0:21:14

0:14:05

0:14:05

0:14:51

0:14:51

0:08:56

0:08:56

0:44:43

0:44:43

0:05:06

0:05:06

0:14:41

0:14:41

0:03:18

0:03:18

0:10:17

0:10:17

0:00:57

0:00:57

0:00:15

0:00:15

1:00:16

1:00:16

0:11:21

0:11:21

0:14:13

0:14:13

0:07:51

0:07:51

0:06:51

0:06:51

0:01:01

0:01:01

0:20:15

0:20:15

0:15:45

0:15:45

0:02:51

0:02:51