filmov

tv

Personal Finance 101: Your Complete Guide to Building Wealth

Показать описание

Feel like personal finance terms are an inside joke you don’t understand?

It’s easy to be confused by the language used in the financial world. But you don’t need to understand EVERYTHING in order to manage your money well. In this video, we’re covering the key phrases and concepts you need to understand for successful money management.

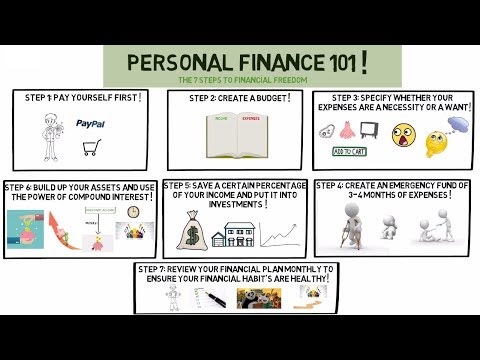

Welcome to personal finance 101, your guide to financial literacy! In this video, we’re covering what you need to know about…

👉 budgeting

👉 debt

👉 credit score

👉 emergency funds

👉 retirement accounts

👉 investing

Learn all the personal finance tips you need to to build wealth, get rich, and develop financial independence.

-----

----

✨FREE✨ RESOURCE:

RELATED VIDEOS:

COME SAY HI!

-----

The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained on our Site constitutes a solicitation, recommendation, endorsement, or offer by Dow Janes or any third party service provider to buy or sell any securities or other financial instruments.

#DowJanes #PersonalFinance #FinancialLiteracy

It’s easy to be confused by the language used in the financial world. But you don’t need to understand EVERYTHING in order to manage your money well. In this video, we’re covering the key phrases and concepts you need to understand for successful money management.

Welcome to personal finance 101, your guide to financial literacy! In this video, we’re covering what you need to know about…

👉 budgeting

👉 debt

👉 credit score

👉 emergency funds

👉 retirement accounts

👉 investing

Learn all the personal finance tips you need to to build wealth, get rich, and develop financial independence.

-----

----

✨FREE✨ RESOURCE:

RELATED VIDEOS:

COME SAY HI!

-----

The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained on our Site constitutes a solicitation, recommendation, endorsement, or offer by Dow Janes or any third party service provider to buy or sell any securities or other financial instruments.

#DowJanes #PersonalFinance #FinancialLiteracy

Комментарии

0:11:21

0:11:21

0:08:56

0:08:56

1:13:00

1:13:00

0:07:47

0:07:47

3:15:52

3:15:52

0:21:14

0:21:14

0:47:34

0:47:34

0:16:17

0:16:17

0:00:43

0:00:43

0:09:33

0:09:33

0:14:33

0:14:33

0:00:15

0:00:15

0:03:18

0:03:18

2:00:10

2:00:10

0:10:47

0:10:47

0:43:57

0:43:57

0:17:51

0:17:51

0:00:38

0:00:38

0:14:28

0:14:28

0:05:06

0:05:06

1:38:08

1:38:08

0:10:03

0:10:03

0:02:46

0:02:46

0:04:41

0:04:41