filmov

tv

Using GANs to Estimate Value-at-Risk for Market Risk Management - Hamaad Shah, Deutsche Bank

Показать описание

Talk Description:

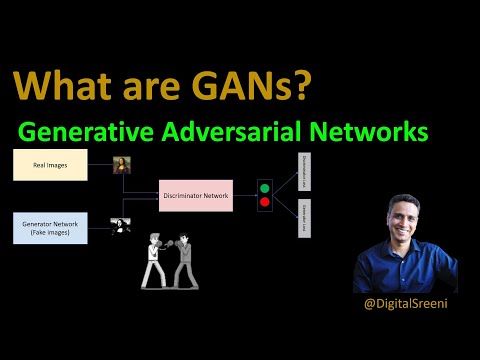

We will explore the use of Generative Adversarial Networks (GANs) for market risk management: Estimation of portfolio risk measures such as Value-at-Risk (VaR). Generative Adversarial Networks (GAN) allow us to implicitly maximize the likelihood of complex distributions thereby allowing us to generate samples from such distributions — the key point here is the implicit maximum likelihood estimation principle whereby we do not specify what this complex distribution is parameterized as. Dealing with high dimensional data potentially coming from a complex distribution is a key aspect to market risk management among many other financial services use cases. GANs will allow us to deal with potentially complex financial services data such that we do not have to explicitly specify a distribution such as a multidimensional Gaussian distribution.

0:11:35

0:11:35

0:21:14

0:21:14

0:04:35

0:04:35

0:22:19

0:22:19

0:04:19

0:04:19

1:59:54

1:59:54

0:41:58

0:41:58

1:30:00

1:30:00

0:14:42

0:14:42

0:53:07

0:53:07

0:24:38

0:24:38

0:04:06

0:04:06

0:31:25

0:31:25

0:19:32

0:19:32

0:00:19

0:00:19

0:12:01

0:12:01

0:25:36

0:25:36

0:06:10

0:06:10

0:00:46

0:00:46

0:20:19

0:20:19

0:00:36

0:00:36

0:00:28

0:00:28

0:00:17

0:00:17

0:00:15

0:00:15