filmov

tv

Calculating Bank Discounts and Proceeds

Показать описание

Another way of lending money is to deduct the interest from the principal at the beginning of the loan and give the borrower the difference. These are known as simple discount notes. When this method is used, the amount of interest charged is known as the bank discount and the amount that the borrower receives is known as the proceeds.

When the term of the note is over, the borrower will repay the entire principal, or face value, of the note as the maturity value.

When the term of the note is over, the borrower will repay the entire principal, or face value, of the note as the maturity value.

Calculating Bank Discounts and Proceeds

Bank Discounts and Proceeds

How to compute a simple discount/Bank discount/Proceeds

PROCEEDS - (BANK DISCOUNT)

How to Calculate Discount Factors? (Normal and Scientific)

How to discount a promissory note. Bank discount and proceed.

How to Calculate a Discount and Sale Price | Math with Mr. J

How to value a company using discounted cash flow (DCF) - MoneyWeek Investment Tutorials

AU Small Finance Bank Ltd Q2 FY2024-25 Earnings Conference Call

Nominal interest, real interest, and inflation calculations | AP Macroeconomics | Khan Academy

GCSE Maths - How to Calculate Simple Interest #95

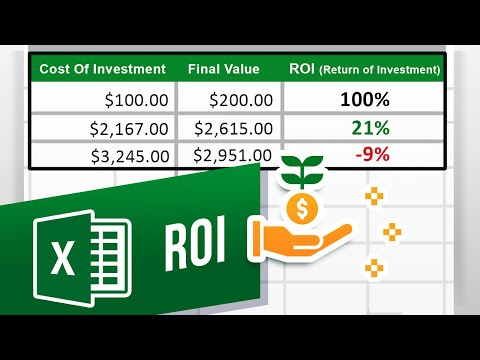

How to Calculate ROI (Return on Investment)

Repurchase Agreements (Repo) & Reverse Repurchase Agreements (Reverse Repo) Explained in One Min...

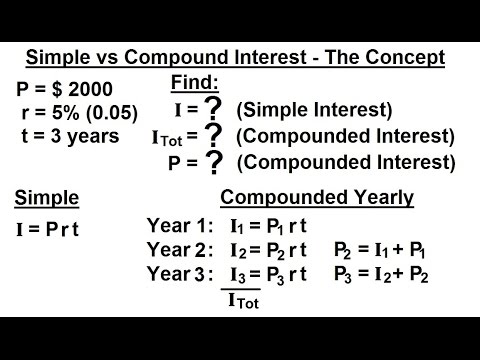

Business Math - Finance Math (2 of 30) Compound Interest - The Concept

Compound Interest

How To Do A Bank Reconciliation (EASY WAY)

Commercial Bank Revenue Model: Loan Projections

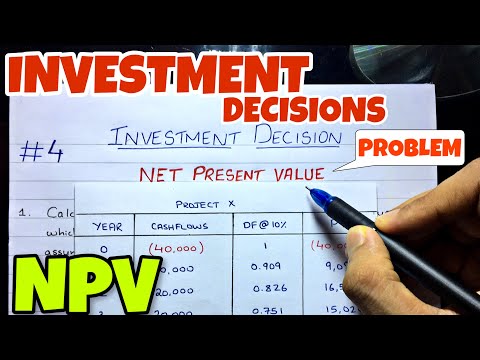

#4 Net Present Value (NPV) - Investment Decision - Financial Management ~ B.COM / BBA / CMA

Arbitrage basics | Finance & Capital Markets | Khan Academy

Session 9: Terminal Value

🔴 3 Minutes! Weighted Average Cost of Capital or WACC Explained (Quickest Overview)

Stock Multiples: How to Tell When a Stock is Cheap/Expensive

Increase Revenue with Bank Products

Banking Explained – Money and Credit

Комментарии

0:02:29

0:02:29

0:14:01

0:14:01

0:07:49

0:07:49

0:09:32

0:09:32

0:01:42

0:01:42

0:13:38

0:13:38

0:07:04

0:07:04

0:10:50

0:10:50

1:07:54

1:07:54

0:03:34

0:03:34

0:04:05

0:04:05

0:01:53

0:01:53

0:01:31

0:01:31

0:05:51

0:05:51

0:10:52

0:10:52

0:17:02

0:17:02

0:21:30

0:21:30

0:18:50

0:18:50

0:02:51

0:02:51

0:10:07

0:10:07

0:02:16

0:02:16

0:09:47

0:09:47

0:04:55

0:04:55

0:06:10

0:06:10