filmov

tv

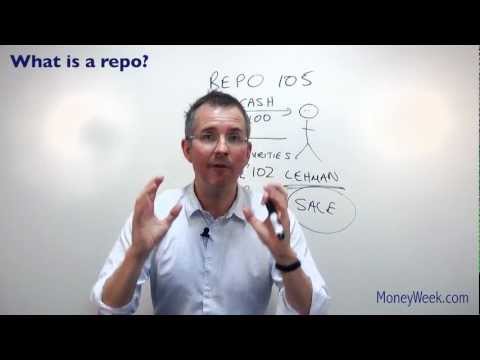

Repurchase Agreements (Repo) & Reverse Repurchase Agreements (Reverse Repo) Explained in One Minute

Показать описание

You have most likely come across stories about liquidity concerns when it comes to repurchase agreements (or, if you prefer, repo) quite a lot if you follow financial media outlets in general and US outlets in particular. Most people "kind of, sort of" understand why these concerns popped up but when it comes to explaining the repo (as well as reverse repo) concept... crickets.

What are these repurchase agreements anyway, and why should you care?

The same way, what are reverse repurchase agreements all about?

In one minute, this video explained the repo as well as reverse repo concepts in a way that doesn't go over your head. You will find out why the two are important when it comes to assessing the liquidity-related health of the banking system in particular or financial system in general.

Furthermore, as explained in this video, repurchase agreements are remarkably easy to understand if you follow a few simple/logical steps. And once you understand repurchase agreements, figuring out what the term "reverse repo" stands for is a piece of cake... it's ultimately all a matter of perspective, as you'll be finding out :)

What are these repurchase agreements anyway, and why should you care?

The same way, what are reverse repurchase agreements all about?

In one minute, this video explained the repo as well as reverse repo concepts in a way that doesn't go over your head. You will find out why the two are important when it comes to assessing the liquidity-related health of the banking system in particular or financial system in general.

Furthermore, as explained in this video, repurchase agreements are remarkably easy to understand if you follow a few simple/logical steps. And once you understand repurchase agreements, figuring out what the term "reverse repo" stands for is a piece of cake... it's ultimately all a matter of perspective, as you'll be finding out :)

Комментарии

0:01:31

0:01:31

0:10:02

0:10:02

0:08:31

0:08:31

0:05:28

0:05:28

0:05:02

0:05:02

0:04:29

0:04:29

0:01:43

0:01:43

0:00:22

0:00:22

0:01:50

0:01:50

0:01:23

0:01:23

0:00:23

0:00:23

0:06:57

0:06:57

0:10:45

0:10:45

0:01:08

0:01:08

0:13:02

0:13:02

0:01:14

0:01:14

0:05:36

0:05:36

0:11:13

0:11:13

0:39:06

0:39:06

0:13:33

0:13:33

0:00:20

0:00:20

0:06:02

0:06:02

0:01:00

0:01:00

0:00:55

0:00:55