filmov

tv

Laughing at the Laffer Curve: The Trump Tax Reform Con

Показать описание

Robert Wenzel

Editor & Publisher

Editor & Publisher

Laughing at the Laffer Curve: The Trump Tax Reform Con

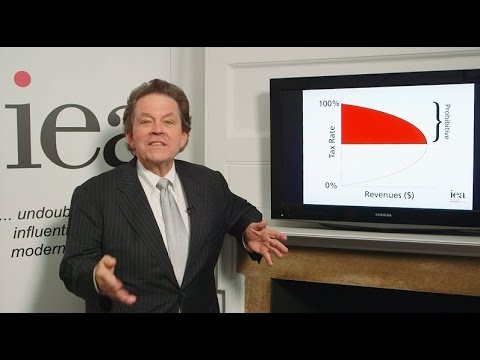

Art Laffer explains the Laffer Curve

Laughing at the Laffer Curve | the Root of Reaganomics and the Ideology of Cutting Taxes

Macro Minute -- The Laffer Curve

The Laffer Curve! What are you laughing at!?!?!

Does the Laffer Curve Make Any Sense?

Sam Seder Breaks Down the Laffer Curve on PBD Podcast: The Sam Brownback Story Uncovered #shorts

Dr. Arthur Laffer on the Fallacies of High Taxation

Idiotic Economist Pushes HORRIBLE Tax Plan That Left Kansas Crippled

Laffer: People don't work to pay taxes

Art Laffer on the best way to tax the ultra rich

Supply-Side Economics and American Prosperity | Official Trailer

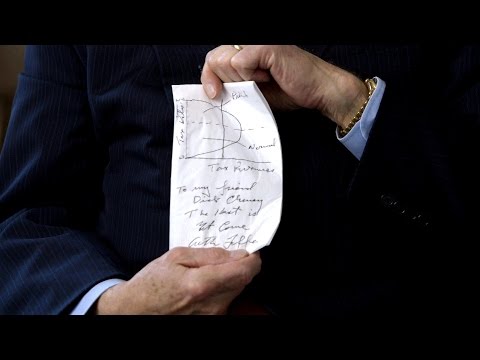

Dick Cheney, Donald Rumsfeld and Arthur Laffer on the Dinner Napkin that Changed the Economy

Laffer: How could a Dem vote against a big tax cut?

Do Higher Taxes Mean Less Revenue?

The Strange, Animal-Killing Side Effects of Tax Policy Changes

What is Laffer Curve?

Laffer Curve

‘I’m Very Concerned’: Art Laffer On Debt Crisis, Hyperinflation, War

'The Economic Debate Leading into 2016' - Art Laffer

The Laffer Curve, Part II: Reviewing the Evidence

Laffer Curve Explained | Public Economics | Ecoholics

Arthur Laffer defends GOP tax bill

The Kansas Brownback Experiment | Laffer's Failed Experiment

Комментарии

0:14:31

0:14:31

0:03:35

0:03:35

0:09:49

0:09:49

0:02:13

0:02:13

0:09:16

0:09:16

0:05:36

0:05:36

0:00:46

0:00:46

0:47:06

0:47:06

0:08:25

0:08:25

0:03:30

0:03:30

0:07:01

0:07:01

0:02:37

0:02:37

0:07:19

0:07:19

0:05:59

0:05:59

0:07:12

0:07:12

0:02:59

0:02:59

0:01:14

0:01:14

0:05:36

0:05:36

0:50:04

0:50:04

0:52:23

0:52:23

0:07:28

0:07:28

0:05:37

0:05:37

0:07:14

0:07:14

0:04:35

0:04:35