filmov

tv

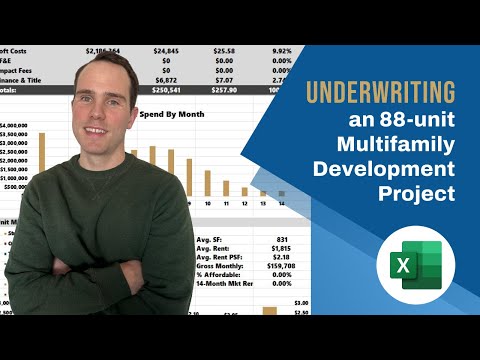

FULL Underwrite on a Multifamily Development | How to Develop 200 Units in 2 Years (PART 3)

Показать описание

I am reverse engineering all the numbers on one of my big apartment complex developments in Arizona. This is the nuts and bolts of how you can develop and a 200+ unit complex and how much profit you will make. Long term wealth is all about passive income from complexes like these, ladies and gentlemen. And it is MUCH easier than it seems, as long as you can break down the numbers like I'll show you in this video.

Meet me LIVE in Las Vegas on Nov. 3 to 5 at Build Wealth Summit! Past speakers include Cody Sperber, Cole Hatter, Eric Thomas, Dan Bilyeu, Jen Gottlieb, and more. Tickets on sale now:

Want to learn how to use LAND to make $10k-$50k in 60 days? Watch our free webinar on how to turn DIRT into DOLLARS by entitling & subdividing land at the link below:

💻 NEW Free Training: Turn Dirt to Dollars (Land Investor)

💻 FREE - How To Buy Land and Build a House:

Jerome Maldonado is a 25+ year veteran in the real estate investing industry. He specializes in real estate development, and teaches his students how to developing single family homes, multifamily complexes, and entitle land to sell to developers (or develop themselves!). Jerome also owns multiple 7-figure businesses including a construction company and a realty company, founded in 1998 and 2000.

👍 SUBSCRIBE for more videos on real estate investing. Compound your success!

💻 GET COACHING AND LEARN MORE:

🔵 NETWORK WITH OUR FACEBOOK MENTORSHIP GROUP:

CONNECT ON SOCIAL MEDIA:

---DISCLAIMER--- The suggestions, advice, and/or opinions that are given by Jerome Maldonado are simply opinions. There are no guarantees of set outcomes. Listeners, guests, and attendees are advised to always consult with attorneys, accountants, and other licensed professionals when doing a real estate investment transaction. Listeners, guests, and attendees are to hold Jerome Maldonado and Jerome Maldonado brands harmless from any liabilities and claims. Not all deals will guarantee any profit or benefits. Listeners, guests, and attendees are to view and listen to all materials and contents furnished by Jerome Maldonado as a perspective based upon experience.

Meet me LIVE in Las Vegas on Nov. 3 to 5 at Build Wealth Summit! Past speakers include Cody Sperber, Cole Hatter, Eric Thomas, Dan Bilyeu, Jen Gottlieb, and more. Tickets on sale now:

Want to learn how to use LAND to make $10k-$50k in 60 days? Watch our free webinar on how to turn DIRT into DOLLARS by entitling & subdividing land at the link below:

💻 NEW Free Training: Turn Dirt to Dollars (Land Investor)

💻 FREE - How To Buy Land and Build a House:

Jerome Maldonado is a 25+ year veteran in the real estate investing industry. He specializes in real estate development, and teaches his students how to developing single family homes, multifamily complexes, and entitle land to sell to developers (or develop themselves!). Jerome also owns multiple 7-figure businesses including a construction company and a realty company, founded in 1998 and 2000.

👍 SUBSCRIBE for more videos on real estate investing. Compound your success!

💻 GET COACHING AND LEARN MORE:

🔵 NETWORK WITH OUR FACEBOOK MENTORSHIP GROUP:

CONNECT ON SOCIAL MEDIA:

---DISCLAIMER--- The suggestions, advice, and/or opinions that are given by Jerome Maldonado are simply opinions. There are no guarantees of set outcomes. Listeners, guests, and attendees are advised to always consult with attorneys, accountants, and other licensed professionals when doing a real estate investment transaction. Listeners, guests, and attendees are to hold Jerome Maldonado and Jerome Maldonado brands harmless from any liabilities and claims. Not all deals will guarantee any profit or benefits. Listeners, guests, and attendees are to view and listen to all materials and contents furnished by Jerome Maldonado as a perspective based upon experience.

Комментарии

0:36:07

0:36:07

0:18:42

0:18:42

0:08:05

0:08:05

0:09:27

0:09:27

0:28:46

0:28:46

1:19:44

1:19:44

1:19:45

1:19:45

1:09:52

1:09:52

0:16:36

0:16:36

0:05:03

0:05:03

1:22:36

1:22:36

0:11:12

0:11:12

0:56:25

0:56:25

0:12:52

0:12:52

0:07:20

0:07:20

1:15:25

1:15:25

1:08:45

1:08:45

1:12:27

1:12:27

0:15:21

0:15:21

0:28:21

0:28:21

0:07:27

0:07:27

1:25:43

1:25:43

0:23:23

0:23:23

0:00:34

0:00:34