filmov

tv

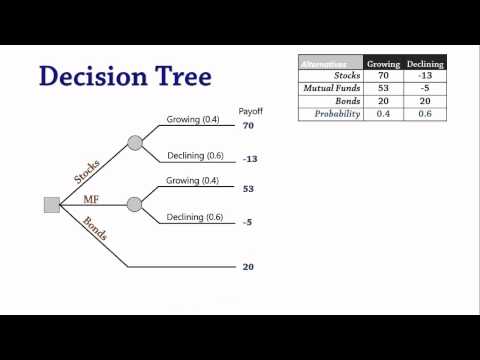

Using Decision Trees In Finance !

Показать описание

Decision trees are used frequently for investment analysis and decision-making in business.

A decision tree provides a comprehensive framework to review the alternative scenarios and consequences a decision may lead to. For example, a decision tree can explore the various issues associated with hiring new staff. By expanding, the tree can also show management the implications of hiring an employee who performs poorly and must be dismissed.

Decision trees are also useful for exploring the impact of a decision. For example, a company considering whether to air a TV advertisement could set up the tree to explore what happens if it airs the ad, what happens if the economy is strong or weak, and so on.

One of the most basic applications of a decision tree is in pricing options. In its simplest form, the model assumes the value of the option’s underlying stock will increase or decrease by set amounts, and the value can be easily determined in a simple tree.

Another application for decision trees is valuing real options, which are major operational decisions a company has to make, like whether to contract customer service or expand to new markets. An effective decision tree helps management consider all the factors involved in the decision, and choose the most profitable option.

Follow us: Investopedia on Facebook

A decision tree provides a comprehensive framework to review the alternative scenarios and consequences a decision may lead to. For example, a decision tree can explore the various issues associated with hiring new staff. By expanding, the tree can also show management the implications of hiring an employee who performs poorly and must be dismissed.

Decision trees are also useful for exploring the impact of a decision. For example, a company considering whether to air a TV advertisement could set up the tree to explore what happens if it airs the ad, what happens if the economy is strong or weak, and so on.

One of the most basic applications of a decision tree is in pricing options. In its simplest form, the model assumes the value of the option’s underlying stock will increase or decrease by set amounts, and the value can be easily determined in a simple tree.

Another application for decision trees is valuing real options, which are major operational decisions a company has to make, like whether to contract customer service or expand to new markets. An effective decision tree helps management consider all the factors involved in the decision, and choose the most profitable option.

Follow us: Investopedia on Facebook

0:01:37

0:01:37

0:03:06

0:03:06

0:06:47

0:06:47

0:01:37

0:01:37

0:10:23

0:10:23

0:10:33

0:10:33

0:13:10

0:13:10

0:07:30

0:07:30

0:16:58

0:16:58

0:04:49

0:04:49

0:22:25

0:22:25

0:22:22

0:22:22

0:07:33

0:07:33

0:00:52

0:00:52

1:09:52

1:09:52

0:21:39

0:21:39

0:28:12

0:28:12

0:21:53

0:21:53

0:41:28

0:41:28

0:09:20

0:09:20

0:01:48

0:01:48

0:01:39

0:01:39

0:16:07

0:16:07

0:06:07

0:06:07