filmov

tv

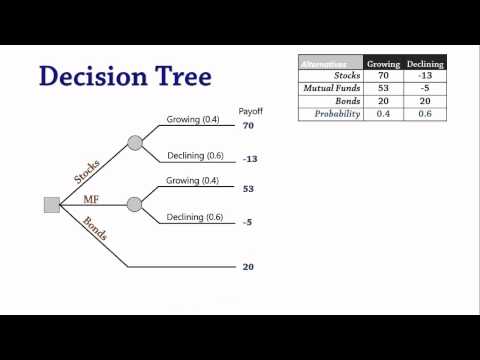

Decision Tree Analysis - Intro and Example with Expected Monetary Value

Показать описание

I discuss Decision Tree Analysis and walkthrough an example problem in which we use a Decision Tree to calculate the Expected Monetary Value (or Expected Value) of two fictitious products that we can invest in. I also describe how to interpret our findings in order to make a decision.

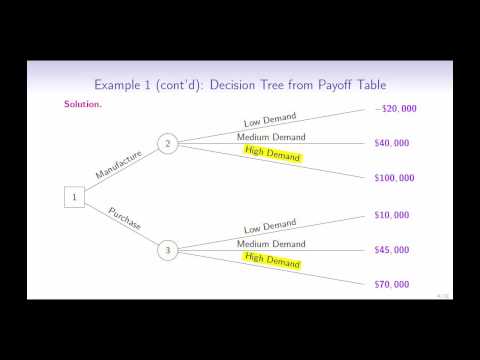

Decision Analysis 3: Decision Trees

Introduction to Decision Trees

Decision Tree: Important things to know

Decision Tree Analysis - Intro and Example with Expected Monetary Value

Decision Tree Analysis

Decision and Classification Trees, Clearly Explained!!!

Decision Tree Classification Clearly Explained!

How to Create a Decision Tree | Decision Making Process Analysis

How to MAKE (and USE) Decision Tree Analysis in Excel

Constructing A Decision Tree/Third Split - Intro to Machine Learning

Decision Tree in 60 seconds

What is Decision Tree Analysis in Project Management?

Coding A Decision Tree - Intro to Machine Learning

Coding A Decision Tree - Intro to Machine Learning

Decision Analysis 4 (Tree): EVSI - Expected Value of Sample Information

Decision Tree Accuracy - Intro to Machine Learning

Introduction to R: Decision Trees

Decision Tree Examples | Edureka

Solve Decision Tree for a bidding problem | Bid High or Low

Intro to Decision Tree - Decision Analysis - Part 1 of 5

CPA ADVANCED MANAGEMENT ACCOUNTING SEC 5 - DECISION TREE INTRO (lesson 1)

Lec-9: Introduction to Decision Tree 🌲 with Real life examples

Decision trees - A friendly introduction

Introduction to decision tree

Комментарии

0:03:06

0:03:06

0:04:41

0:04:41

0:04:24

0:04:24

0:06:47

0:06:47

0:03:17

0:03:17

0:18:08

0:18:08

0:10:33

0:10:33

0:05:32

0:05:32

0:10:54

0:10:54

0:00:51

0:00:51

0:01:00

0:01:00

0:03:15

0:03:15

0:01:28

0:01:28

0:01:53

0:01:53

0:05:56

0:05:56

0:00:10

0:00:10

0:12:14

0:12:14

0:13:24

0:13:24

0:04:18

0:04:18

0:05:00

0:05:00

0:08:28

0:08:28

0:06:07

0:06:07

0:22:23

0:22:23

0:11:48

0:11:48