filmov

tv

Can Extra Mortgage Payments Match HELOC's Payoff Speed?

Показать описание

Free Video Training: How You Can Pay Your Mortgage Off In 5 Years or Less On Your Current Income: 👇🏼

Free E-Book: Secret To Paying Off Your Home In 5 Years

In this video, Michael Lush addresses whether making extra mortgage payments can match the payoff speed of a HELOC (Home Equity Line of Credit). He explains that while extra payments on a mortgage can reduce debt, mortgages are closed-end products that lack liquidity. In contrast, HELOCs offer a two-way street for money, providing continuous access to funds, which is crucial for financial flexibility. Lush emphasizes that liquidity allows for better financial management and seizing opportunities, making HELOCs a more efficient tool for managing debt. He highlights the importance of understanding the value of liquidity and how it can impact long-term financial health, encouraging viewers to consider HELOCs as a superior option for debt repayment.

Free E-Book: Secret To Paying Off Your Home In 5 Years

In this video, Michael Lush addresses whether making extra mortgage payments can match the payoff speed of a HELOC (Home Equity Line of Credit). He explains that while extra payments on a mortgage can reduce debt, mortgages are closed-end products that lack liquidity. In contrast, HELOCs offer a two-way street for money, providing continuous access to funds, which is crucial for financial flexibility. Lush emphasizes that liquidity allows for better financial management and seizing opportunities, making HELOCs a more efficient tool for managing debt. He highlights the importance of understanding the value of liquidity and how it can impact long-term financial health, encouraging viewers to consider HELOCs as a superior option for debt repayment.

Can Extra Mortgage Payments Match HELOC's Payoff Speed?

Should You Make Extra Mortgage Principal Payments?

Paying extra on your loan: The RIGHT way to do it! (Monthly vs Annually)

The Power Of Additional Mortgage Payments

Double repayments to pay out mortgage twice as fast?

Should You Speed Up Mortgage Payments with a 7% Interest Rate?

I Stopped Investing and Overpaid My Mortgage… This Is What Happened.

The Ultimate Guide to Paying Off Your Mortgage Faster in Australia

Why Paying Off Your Mortgage Beats Investing | The Financial Mirror

Should I Pay Down My Mortgage Or Save For Retirement?

Mortgage Calculator With Extra Payment

Paying Down Your Mortgage: A Wise Use of Excess Cash?

Is Paying Off Your House Early A Huge Mistake? - Ramsey Show Reacts

Pay Off Mortgage Early Or Invest?

Pay Off Your Mortgage Early w/ These 6 Smart Strategies

Should I Cash Out My 401(k) To Pay Down My Mortgage?

Top up your Super or Pay off your mortgage?

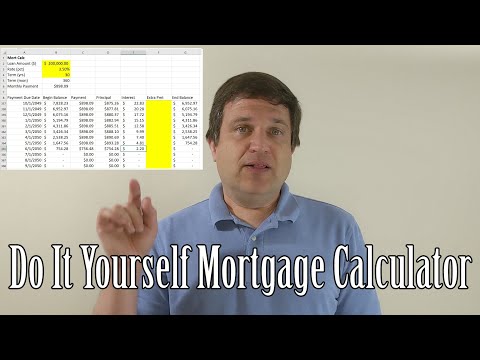

How to make a Loan Amortization Table with Extra Payments in Excel

Should you overpay on your mortgage?

Pay off the Mortgage or Invest? The Answer is Clear.

Extra Payment Car or Mortgage Loan Calculator - How Much Can I Really Save?

Should You Pay Extra on Your Mortgage?

Selecting the Right Mortgage Payment Frequency

Should I Pay Down My Mortgage or Save More for Retirement?

Комментарии

0:04:35

0:04:35

0:07:19

0:07:19

0:05:26

0:05:26

0:05:02

0:05:02

0:03:18

0:03:18

0:04:43

0:04:43

0:11:02

0:11:02

0:07:08

0:07:08

0:27:30

0:27:30

0:07:01

0:07:01

0:15:10

0:15:10

0:07:28

0:07:28

0:05:22

0:05:22

0:05:33

0:05:33

0:11:28

0:11:28

0:03:09

0:03:09

0:03:56

0:03:56

0:09:29

0:09:29

0:13:37

0:13:37

0:09:28

0:09:28

0:15:11

0:15:11

0:12:51

0:12:51

0:02:46

0:02:46

0:02:44

0:02:44