filmov

tv

I Stopped Investing and Overpaid My Mortgage… This Is What Happened.

Показать описание

InvestEngine - Get an investment bonus of between £10 & £50 when you sign up and deposit £100 (T&Cs apply):

Captial at risk. InvestEngine (UK) Limited is Authorised and Regulated by the Financial Conduct Authority (FRN: 801128)

Get a free share worth up to £100 from T212 when you sign up and deposit £1:

Overpaying your mortgage is as good as it has ever been, but should you do it?

With inflation at a high, the Bank of England have been raising the bank rate throughout the year. This has resulted in mortgage rates rocketing, up to an average value of 6% per year, meaning that overpaying your mortgage is as attractive as it has ever been.

In this video, I explore the benefits of overpaying your mortgage, and compare it to investing in the stock market. Choosing between investing and mortgage overpayments is an extremely difficult decision, but I found a solution.

Captial at risk. InvestEngine (UK) Limited is Authorised and Regulated by the Financial Conduct Authority (FRN: 801128)

Get a free share worth up to £100 from T212 when you sign up and deposit £1:

Overpaying your mortgage is as good as it has ever been, but should you do it?

With inflation at a high, the Bank of England have been raising the bank rate throughout the year. This has resulted in mortgage rates rocketing, up to an average value of 6% per year, meaning that overpaying your mortgage is as attractive as it has ever been.

In this video, I explore the benefits of overpaying your mortgage, and compare it to investing in the stock market. Choosing between investing and mortgage overpayments is an extremely difficult decision, but I found a solution.

I Stopped Investing and Overpaid My Mortgage… This Is What Happened.

Stop Investing To Overpay Your Mortgage? (This Surprised Me)

I Stopped Investing and Overpaid My Mortgage This Is What Happened iQinvesting

Stop Investing and Overpay Your Mortgage...

Pay Off Mortgage Early Or Invest?

Why You Should Focus On Paying Down The Mortgage Over Investing

I Solved the Investing vs Overpay Mortgage Dilemma

Should You Pay Off Your Mortgage Or Invest?

Boss Overpaid Us By $30,000 And Wants It Back!

Pay Off Your Mortgage Or Invest, Part Two

Should I Pay Down My Mortgage Or Save For Retirement?

Warren Buffett: Why Real Estate Is a LOUSY Investment?

Why Pay Off Debt If I Can Invest at a Higher Interest Rate?

Why You Should Never Pay Off Your House

Revealing my £100,000 Investment Portfolio

Use Your Pension to Pay Off Your Mortgage

Overpaying Mortgage vs. Investing | Should I pay off my mortgage or invest?

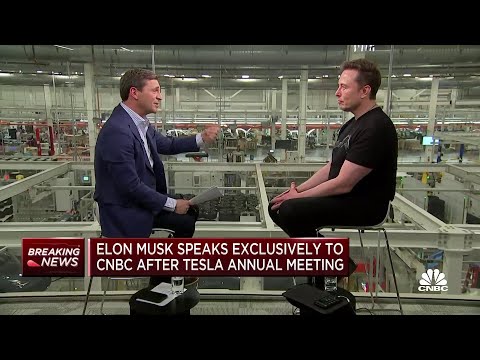

Tesla CEO Elon Musk: I'll say what I want to say, and if we lose money, so be it

The 3 Big Mortgage Mistakes EVERYONE Makes (Real world examples)

Here's Why You Want A Really Boring Job - How Money Works

Congresswoman Katie Porter grills billionaire CEO over pay disparity at JP Morgan

The Influencer Bubble - How Money Works

Save Money on Your Retirement Investments- Stop Overpaying!

How to Get Over Paid

Комментарии

0:11:02

0:11:02

0:02:51

0:02:51

0:00:50

0:00:50

0:07:09

0:07:09

0:05:33

0:05:33

0:07:21

0:07:21

0:11:15

0:11:15

0:08:20

0:08:20

0:05:53

0:05:53

0:10:48

0:10:48

0:07:01

0:07:01

0:04:51

0:04:51

0:07:58

0:07:58

0:15:13

0:15:13

0:21:14

0:21:14

0:13:43

0:13:43

0:11:14

0:11:14

0:05:11

0:05:11

0:12:04

0:12:04

0:10:28

0:10:28

0:02:36

0:02:36

0:10:08

0:10:08

0:00:56

0:00:56

0:03:57

0:03:57