filmov

tv

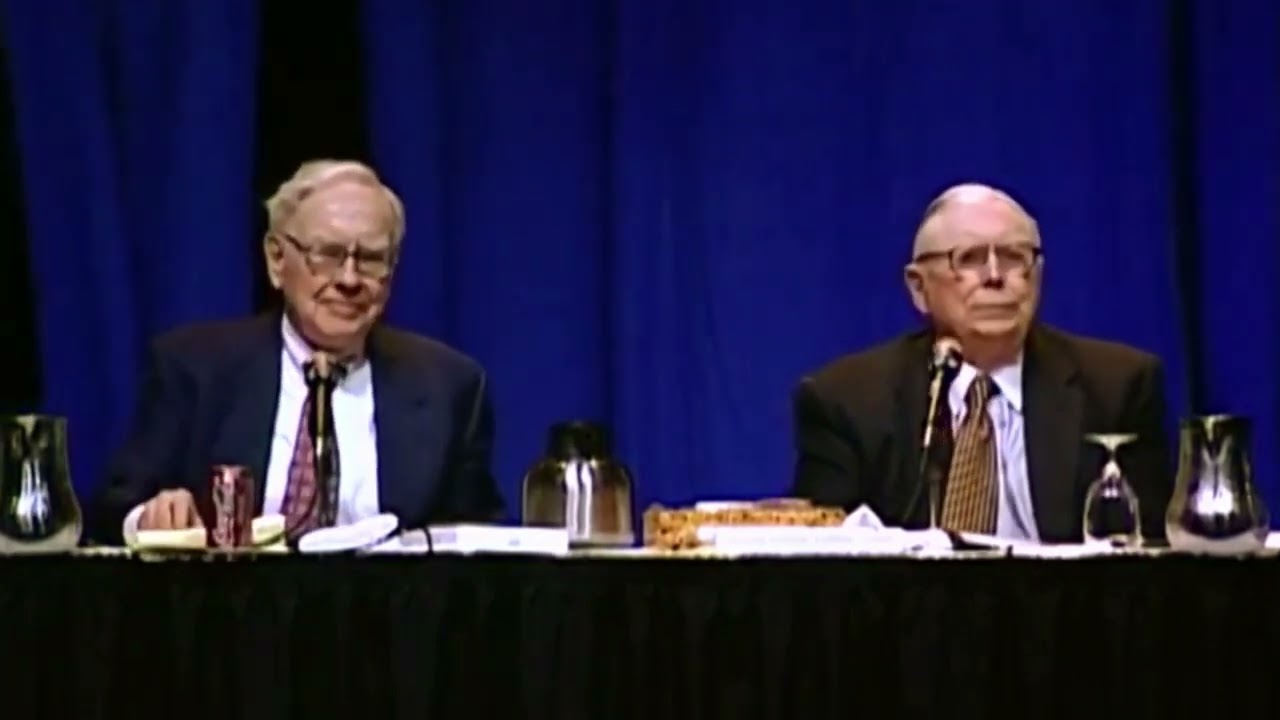

Warren Buffett & Charlie Munger: 100 Years of Financial Wisdom in 4 Hour - Investing/Market Analysis

Показать описание

Like the video? Every thumbs up helps! Also be sure to subscribe to get updates whenever I upload! It's free for you, and it helps me as a content creator grow! :)

#warrenbuffet #charliemunger #investing #marketanalysis #riskanalysis

Buffett has made his fortune by relying on the time-tested rules of value investing, meaning finding high-quality companies at fair market valuations. He then holds these investments for the long term, some indefinitely, always allowing the power of compounding work its magic. Warren Buffett is an American business magnate, investor, and philanthropist. He is currently the chairman and CEO of Berkshire Hathaway. He is one of the best-known fundamental investors in the world as a result of his immense investment success possessing a net worth of $104 billion, making him the fifth-richest person in the world as of posting. Charlie Munger is an American businessman, investor, and philanthropist. He is vice chairman of Berkshire Hathaway, the conglomerate controlled by Warren Buffett; Buffett has described Munger as his closest partner and right-hand man.

If you can, share with others so my channel can reach others and help me get sponsors so I can continue to make content for your guys! Thank you all.

#warrenbuffet #charliemunger #investing #marketanalysis #riskanalysis

Buffett has made his fortune by relying on the time-tested rules of value investing, meaning finding high-quality companies at fair market valuations. He then holds these investments for the long term, some indefinitely, always allowing the power of compounding work its magic. Warren Buffett is an American business magnate, investor, and philanthropist. He is currently the chairman and CEO of Berkshire Hathaway. He is one of the best-known fundamental investors in the world as a result of his immense investment success possessing a net worth of $104 billion, making him the fifth-richest person in the world as of posting. Charlie Munger is an American businessman, investor, and philanthropist. He is vice chairman of Berkshire Hathaway, the conglomerate controlled by Warren Buffett; Buffett has described Munger as his closest partner and right-hand man.

If you can, share with others so my channel can reach others and help me get sponsors so I can continue to make content for your guys! Thank you all.

Комментарии

3:59:35

3:59:35

0:07:28

0:07:28

0:07:16

0:07:16

2:06:07

2:06:07

3:12:45

3:12:45

0:01:29

0:01:29

0:35:16

0:35:16

0:04:50

0:04:50

0:08:15

0:08:15

5:16:37

5:16:37

0:01:10

0:01:10

0:09:27

0:09:27

0:00:38

0:00:38

0:01:03

0:01:03

0:09:26

0:09:26

0:02:32

0:02:32

0:05:17

0:05:17

0:04:48

0:04:48

0:04:42

0:04:42

2:30:04

2:30:04

0:07:54

0:07:54

0:07:01

0:07:01

0:00:43

0:00:43

0:04:44

0:04:44