filmov

tv

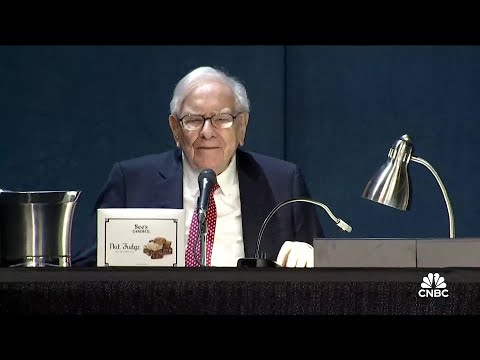

Warren Buffett and Charlie Munger on picking winning stocks, businesses and more: Yahoo Finance

Показать описание

0:00:00 April 30, 2020 In this episode of Influencers, Berkshire Hathaway Chairman and CEO, Warren Buffett, joins Yahoo Finance Editor-in-Chief Andy Serwer to share his philosophy on investing and discuss the COVID-19 impact on the U.S. economy.

0:49:00 May 22, 2019 Legendary investor Warren Buffett, Chairman and CEO of Berkshire Hathaway, sat down with Yahoo Finance's Editor-in-Chief Andy Serwer, as part of an exclusive one-hour one-on-one interview from Omaha, NE.

02:20:00 May 9, 2019 Berkshire Hathaway Vice Chairman Charlie Munger sits down with Yahoo Finance Editor-in-Chief Andy Serwer, as part of an exclusive one-on-one interview from Omaha, NE, following the Berkshire Hathaway Annual Shareholders Meeting.

Don't Miss: Valley of Hype: The Culture That Built Elizabeth Holmes

WATCH HERE:

Watch the 2021 Berkshire Hathaway Annual Shareholders Meeting on YouTube:

About Yahoo Finance:

At Yahoo Finance, you get free stock quotes, up-to-date news, portfolio management resources, international market data, social interaction and mortgage rates that help you manage your financial life.

Yahoo Finance Plus: With a subscription to Yahoo Finance Plus get the tools you need to invest with confidence. Discover new opportunities with expert research and investment ideas backed by technical and fundamental analysis. Optimize your trades with advanced portfolio insights, fundamental analysis, enhanced charting, and more.

Connect with Yahoo Finance:

0:49:00 May 22, 2019 Legendary investor Warren Buffett, Chairman and CEO of Berkshire Hathaway, sat down with Yahoo Finance's Editor-in-Chief Andy Serwer, as part of an exclusive one-hour one-on-one interview from Omaha, NE.

02:20:00 May 9, 2019 Berkshire Hathaway Vice Chairman Charlie Munger sits down with Yahoo Finance Editor-in-Chief Andy Serwer, as part of an exclusive one-on-one interview from Omaha, NE, following the Berkshire Hathaway Annual Shareholders Meeting.

Don't Miss: Valley of Hype: The Culture That Built Elizabeth Holmes

WATCH HERE:

Watch the 2021 Berkshire Hathaway Annual Shareholders Meeting on YouTube:

About Yahoo Finance:

At Yahoo Finance, you get free stock quotes, up-to-date news, portfolio management resources, international market data, social interaction and mortgage rates that help you manage your financial life.

Yahoo Finance Plus: With a subscription to Yahoo Finance Plus get the tools you need to invest with confidence. Discover new opportunities with expert research and investment ideas backed by technical and fundamental analysis. Optimize your trades with advanced portfolio insights, fundamental analysis, enhanced charting, and more.

Connect with Yahoo Finance:

Комментарии

3:59:35

3:59:35

0:07:16

0:07:16

0:07:28

0:07:28

3:12:45

3:12:45

0:35:16

0:35:16

5:16:37

5:16:37

0:04:50

0:04:50

2:06:07

2:06:07

0:05:46

0:05:46

0:01:29

0:01:29

0:05:17

0:05:17

0:01:10

0:01:10

0:02:32

0:02:32

2:30:04

2:30:04

0:07:01

0:07:01

0:00:38

0:00:38

0:09:27

0:09:27

0:06:47

0:06:47

0:01:00

0:01:00

0:00:43

0:00:43

0:04:28

0:04:28

0:08:04

0:08:04

0:04:42

0:04:42

0:06:39

0:06:39