filmov

tv

How To Choose The Best Strike Price For Selling Options

Показать описание

Get Your Copy of The Options Income Blueprint For FREE:

Wondering which is the best strike price to choose when you're selling Options?

Some people say that the best strike price is the one with the juiciest premium, while some people say that the best strike price is the one with the highest win rate.

So which is the best strike price?

I reveal all in this video.

Timestamps:

00:00 - Start

04:18 - Two Key Elements To Choosing Best Strikes

09:32 - The Fastest Way To Identify The Best Strikes On The Chart

Other videos you might be interested in...

#optiontradingforbeginners #optiontradingstrategies #optionsellingstrategy

Please subscribe & hit the notification bells for more videos like this just for you:

Wondering which is the best strike price to choose when you're selling Options?

Some people say that the best strike price is the one with the juiciest premium, while some people say that the best strike price is the one with the highest win rate.

So which is the best strike price?

I reveal all in this video.

Timestamps:

00:00 - Start

04:18 - Two Key Elements To Choosing Best Strikes

09:32 - The Fastest Way To Identify The Best Strikes On The Chart

Other videos you might be interested in...

#optiontradingforbeginners #optiontradingstrategies #optionsellingstrategy

Please subscribe & hit the notification bells for more videos like this just for you:

How To Choose The Best Career For You | Karan Shah | TEDxNMIMS

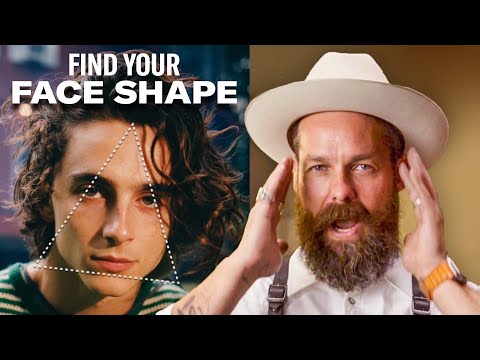

How to Choose the Best Haircut for Your Face Shape | GQ

how to choose the best college for you: research, match your personality type, avoid regrets, +more

How To Choose The Best Sunscreen In 4 Simple Steps

How to choose the BEST SHUTTER SPEED, APERTURE and ISO | Real life examples

How To Choose The BEST BADMINTON RACKET For You - The 4 Step Framework

How to Choose the Best Aperture

How To Choose The BEST Yoyo For You

How To Choose The Best Healthcare Plan (2022!)

How to choose the best bed for you

How to Choose the Best Country to Live in | Valer Pinderi | TEDxAlbanianCollegeTirana

How to choose the best bank account

How To Choose A Best Betta Fish

How to Choose a Right Career? | Best Career Opportunities

The Best Beginner Camera — How To Choose

How To Choose A Running Shoe | What Are The Best Shoes For You?

BEST Camera For Beginners? — how to choose right

How To Choose The BEST BADMINTON RACKET For You

HOW TO CHOOSE THE BEST LIGHTING FOR YOUR HOME (Ultimate Beginner's Guide!)

How to choose the BEST color for your VENEERS

How to choose the best Bluetooth speaker for you

How To Choose the Best Garlic To Plant

How To Choose The Best Glasses And Frames For Your Face Shape

HOW TO CHOOSE THE BEST JIGS FOR SLOW JIGGING

Комментарии

0:19:00

0:19:00

0:16:07

0:16:07

0:34:33

0:34:33

0:06:31

0:06:31

0:16:25

0:16:25

0:10:50

0:10:50

0:09:28

0:09:28

0:07:52

0:07:52

0:14:13

0:14:13

0:07:07

0:07:07

0:11:38

0:11:38

0:01:29

0:01:29

0:09:09

0:09:09

0:18:18

0:18:18

0:25:37

0:25:37

0:06:46

0:06:46

0:10:18

0:10:18

0:07:19

0:07:19

0:08:32

0:08:32

0:04:38

0:04:38

0:03:40

0:03:40

0:11:45

0:11:45

0:06:09

0:06:09

0:18:09

0:18:09