filmov

tv

Why you shouldn't buy Bitcoin in 2022 if you have Crypto FOMO

Показать описание

If you have a fear of missing out on crypto, that's one of the worst reasons to contemplate an investment in Bitcoin, Ether, NFTs, or anything else you don't understand. But the good news is that you might already have exposure to crypto-related investments or projects if you own index funds or any other diversified investment fund.

In this video, we'll examine the phenomenon known as Crypto FOMO - why so many people are worried that they might be missing out on Bitcoin or other crypto investments. There are huge marketing campaigns, and countless stories of people who've hit it big in the past. But are those reasons good enough for you to put your money at risk?

We'll look at whether the early returns can be repeated, and why you may already have exposure through the holdings in your index funds (or other diversified funds), since companies that mine cryptocurrencies or use blockchain technology are already listed on public stock exchanges and in major stock market indexes.

00:00 Intro

00:35 Crypto FOMO

02:02 Matt Damon marketing Crypto

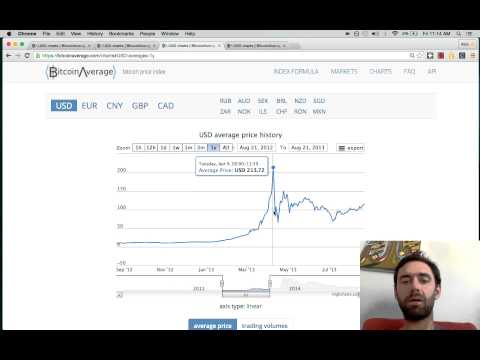

03:08 Spectacular early returns of Bitcoin

05:30 Bitcoin losses can be huge

07:08 Will Bitcoin become mainstream?

11:18 Should you buy Bitcoin?

WATCH MORE OF MY MOST POPULAR VIDEOS:

ABOUT ME: I've hosted a personal finance TV show on the Oprah Winfrey Network, used to be a stockbroker, went to school to become a racecar driver (failed), founded a fintech company that provides financial planning software to financial advisors who want to help more people who don't have lots of money, and I consult with wealth management companies on commercializing applications of behavioral finance. I'm also quite fond of donuts.

FOLLOW ME ON TWITTER

9MPNUGHR11MXF59L

#MoneySchool #PersonalFinance #LearnAboutMoney #LearnToInvest #money #stockmarket #finance #howtoinvest #budgeting #budget #savemoney #insurance #financialplanning

In this video, we'll examine the phenomenon known as Crypto FOMO - why so many people are worried that they might be missing out on Bitcoin or other crypto investments. There are huge marketing campaigns, and countless stories of people who've hit it big in the past. But are those reasons good enough for you to put your money at risk?

We'll look at whether the early returns can be repeated, and why you may already have exposure through the holdings in your index funds (or other diversified funds), since companies that mine cryptocurrencies or use blockchain technology are already listed on public stock exchanges and in major stock market indexes.

00:00 Intro

00:35 Crypto FOMO

02:02 Matt Damon marketing Crypto

03:08 Spectacular early returns of Bitcoin

05:30 Bitcoin losses can be huge

07:08 Will Bitcoin become mainstream?

11:18 Should you buy Bitcoin?

WATCH MORE OF MY MOST POPULAR VIDEOS:

ABOUT ME: I've hosted a personal finance TV show on the Oprah Winfrey Network, used to be a stockbroker, went to school to become a racecar driver (failed), founded a fintech company that provides financial planning software to financial advisors who want to help more people who don't have lots of money, and I consult with wealth management companies on commercializing applications of behavioral finance. I'm also quite fond of donuts.

FOLLOW ME ON TWITTER

9MPNUGHR11MXF59L

#MoneySchool #PersonalFinance #LearnAboutMoney #LearnToInvest #money #stockmarket #finance #howtoinvest #budgeting #budget #savemoney #insurance #financialplanning

Комментарии

0:06:20

0:06:20

0:16:36

0:16:36

0:00:43

0:00:43

0:00:56

0:00:56

0:09:26

0:09:26

0:13:55

0:13:55

0:09:07

0:09:07

0:01:28

0:01:28

0:07:53

0:07:53

0:15:52

0:15:52

0:00:31

0:00:31

0:00:40

0:00:40

0:03:57

0:03:57

0:10:21

0:10:21

0:07:38

0:07:38

0:05:13

0:05:13

0:07:40

0:07:40

0:09:48

0:09:48

0:10:03

0:10:03

0:08:53

0:08:53

0:10:40

0:10:40

0:14:32

0:14:32

0:13:54

0:13:54

0:09:37

0:09:37