filmov

tv

Signature Bank's Demise: Who's Next? | Joseph Wang

Показать описание

Signature and Silicon Valley Bank have collapsed. In this breaking news episode, hosts Jason Yanowitz and Jack Farley interview Joseph Wang to discuss the banking system failures and what to expect next. Joseph dives deep into the risk both banks took by not hedging interest rate risk, how this could have been avoided and whether other banks are in a similar position?

We then discuss if the Fed's Bank Term Funding Program was the right move? To hear all this and more, you'll have to tune! Filmed on March 13, 2023, at 10:30am ET.

- -

- -

- -

Disclaimer: Nothing said on Empire is a recommendation to buy or sell securities or tokens. This podcast is for informational purposes only, and any views expressed by anyone on the show are solely our opinions, not financial advice. Santiago, Jason, and our guests may hold positions in the companies, funds, or projects discussed.

We then discuss if the Fed's Bank Term Funding Program was the right move? To hear all this and more, you'll have to tune! Filmed on March 13, 2023, at 10:30am ET.

- -

- -

- -

Disclaimer: Nothing said on Empire is a recommendation to buy or sell securities or tokens. This podcast is for informational purposes only, and any views expressed by anyone on the show are solely our opinions, not financial advice. Santiago, Jason, and our guests may hold positions in the companies, funds, or projects discussed.

Signature Bank's Demise: Who's Next? | Joseph Wang

SVB, Signature Bank Collapse, What Happens Next? | BQ Prime

Signature Bank becomes next casualty of banking turmoil after SVB

SVB, Signature Bank collapse: Is this a domino effect? | LiveNOW from FOX

Signature Bank collapse becomes third-largest bank failure in U.S. history

How Silicon Valley Bank & Signature Bank Weakened Regulations That Could Have Prevented Collapse

Silicon Valley Bank, Signature Bank collapse. Could more banks follow? | JUST THE FAQS

Silicon Valley, Signature Bank collapse explained

New York’s Signature Bank Shut Days After Silicon Valley Bank Collapse

What Led to the Collapse of Signature Bank?

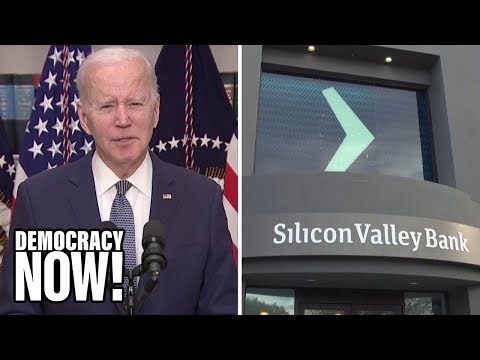

#Biden: 'Our #Banking System is Safe' After #Silicon Valley #Bank Collapse #svb #signature...

Barney Frank on Signature Bank's Demise: Was it Unfair? 💬💸

Bank collapse: US Senate questions SVB and Signature Bank bosses

Is my bank vulnerable after SVB collapse?

Biden Says U.S. Banking System Is Safe After SVB, Signature Collapse | U.S. Banks Collapse | News18

Getting Answers: Local banks impacted by Silicon Valley, Signature Bank collapse

New York Bancorp taking over failed Signature Bank

Biggest Lessons to Learn from SVB & Signature Bank Collapse

Joe Biden says US banking system is safe' after SVB collapse #shorts

FDIC attributes Signature Bank's failure to pursuit of 'rapid, unrestrained growth'

Biden Says U.S. Banking System Is Safe After SVB, Signature Collapse | U.S. Banks Collapse | News18

SVB and Signature Bank Just Closed Their Doors. What’s Next?

Business Matters | SVB collapse: Will US’s bank failures, bailouts affect India? | The Hindu

Following SVB collapse, former FDIC chair calls for better stress testing of big banks 💵 #shorts

Комментарии

0:56:57

0:56:57

0:01:34

0:01:34

0:00:51

0:00:51

0:20:48

0:20:48

0:02:15

0:02:15

0:25:42

0:25:42

0:02:16

0:02:16

0:05:27

0:05:27

0:01:19

0:01:19

0:04:04

0:04:04

0:00:53

0:00:53

0:01:00

0:01:00

0:02:46

0:02:46

0:01:00

0:01:00

2:36:51

2:36:51

0:02:52

0:02:52

0:00:36

0:00:36

0:11:03

0:11:03

0:00:50

0:00:50

0:02:41

0:02:41

11:23:45

11:23:45

0:01:00

0:01:00

0:10:43

0:10:43

0:01:00

0:01:00