filmov

tv

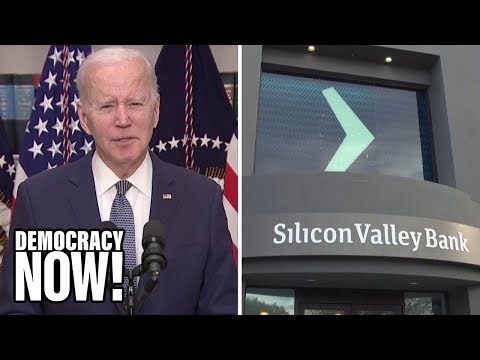

SVB and Signature Bank Just Closed Their Doors. What’s Next?

Показать описание

After a lucrative quarantine, the Silicon Valley Bank had a lot of resources that they could use to invest. They took the safe option and went with a long-term government bond investment to keep their portfolio growing. This seemed like a sound plan at first but the rising inflation rate proved otherwise. Inflation and government bonds have an inverse relationship. When one goes up the other one goes down. To fight inflation, the Federal Reserve increased interest rates which caused government bonds to lose value.

Silicon Valley needed money to plug the hole in its balance sheet and had to turn its bonds to cash at a considerable loss. This caused panic among the investors, who were mostly in the tech industry. After a hard year due to inflation, tech companies didn’t want to take risks and decided to withdraw their money, triggering a chain reaction also known as a run. SVB stocks immediately plummeted and they had to close their doors.

Signature Bank followed them on March 12th and also went bankrupt. Despite the Biden administration's attempt at keeping the situation under control, global banks are already losing stock value. Will this cause a ripple effect and cause a catastrophic financial crisis? Or is it just a one-off event and the economy will soon recover?

#shorts

Silicon Valley needed money to plug the hole in its balance sheet and had to turn its bonds to cash at a considerable loss. This caused panic among the investors, who were mostly in the tech industry. After a hard year due to inflation, tech companies didn’t want to take risks and decided to withdraw their money, triggering a chain reaction also known as a run. SVB stocks immediately plummeted and they had to close their doors.

Signature Bank followed them on March 12th and also went bankrupt. Despite the Biden administration's attempt at keeping the situation under control, global banks are already losing stock value. Will this cause a ripple effect and cause a catastrophic financial crisis? Or is it just a one-off event and the economy will soon recover?

#shorts

Комментарии

0:01:00

0:01:00

0:09:06

0:09:06

5:16:25

5:16:25

0:25:42

0:25:42

0:03:13

0:03:13

0:20:48

0:20:48

0:28:23

0:28:23

1:08:01

1:08:01

0:47:35

0:47:35

0:40:19

0:40:19

0:14:49

0:14:49

0:01:19

0:01:19

0:09:21

0:09:21

0:01:34

0:01:34

0:04:34

0:04:34

0:39:20

0:39:20

0:10:46

0:10:46

0:04:46

0:04:46

0:07:11

0:07:11

0:05:51

0:05:51

0:49:50

0:49:50

0:03:40

0:03:40

0:01:04

0:01:04

0:04:17

0:04:17