filmov

tv

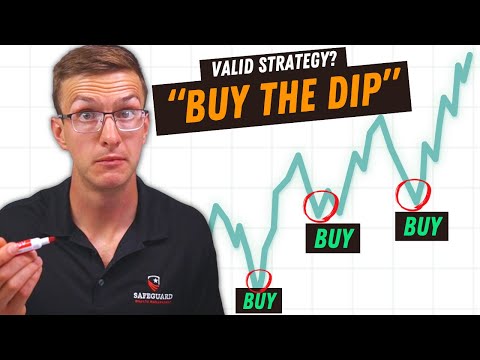

Stop Buying On Every Dip | The Right SIP Plus Lump Sum Strategy

Показать описание

A lot of smart investors use the SIP-plus-lump sum strategy for better returns. They maintain an ongoing SIP in mutual funds, and when markets fall, they invest a lump sum amount to benefit from market corrections. Recently, on 4th June, we saw markets fall close to 6% following unexpected election results. On that day, many investors seized the opportunity to invest lump sums, aiming to capitalize on the correction.

But does this strategy work? In this video, we dive deep into the data to find surprising answers. We'll explore three key aspects: the type of correction (whether to invest when markets fall or when valuations are low), the size of the correction (ideal investment points at 5%, 10%, or 15% drops), and the optimal investment horizon to maximize returns with this strategy. Watch the video to discover which combination of variables produces the highest returns and how you can optimize your investment strategy.

Chapters

00:00 Introduction

02:00 Key assumptions taken for the analysis

04:28 Buying on dips - easy way to earn more returns?

#ETMoney

👉 Subscribe to ET Money Hindi

👉 5 Minute Finance channel

👉 Follow us on:

But does this strategy work? In this video, we dive deep into the data to find surprising answers. We'll explore three key aspects: the type of correction (whether to invest when markets fall or when valuations are low), the size of the correction (ideal investment points at 5%, 10%, or 15% drops), and the optimal investment horizon to maximize returns with this strategy. Watch the video to discover which combination of variables produces the highest returns and how you can optimize your investment strategy.

Chapters

00:00 Introduction

02:00 Key assumptions taken for the analysis

04:28 Buying on dips - easy way to earn more returns?

#ETMoney

👉 Subscribe to ET Money Hindi

👉 5 Minute Finance channel

👉 Follow us on:

Комментарии

0:12:55

0:12:55

0:04:03

0:04:03

0:09:51

0:09:51

0:20:43

0:20:43

0:19:56

0:19:56

0:01:00

0:01:00

0:14:22

0:14:22

0:09:18

0:09:18

0:03:54

0:03:54

0:02:04

0:02:04

0:13:14

0:13:14

0:11:32

0:11:32

0:11:08

0:11:08

0:51:55

0:51:55

0:08:04

0:08:04

0:00:48

0:00:48

0:05:43

0:05:43

0:13:38

0:13:38

0:09:12

0:09:12

0:27:01

0:27:01

0:04:49

0:04:49

0:00:54

0:00:54

0:24:03

0:24:03

0:11:24

0:11:24