filmov

tv

CVA Calculation for Risky Bond (Solved Example) (FRM Part 2, Book 2, Credit Risk)

Показать описание

CVA Calculation for Risky Bond (Solved Example) (FRM Part 2, Book 2, Credit Risk)

CVA Calculation on a Bond.

CFA® Level II Fixed Income - Modelling Credit Risk and Credit Valuation Adjustment (CVA)

CFA Level 2 Exam Fixed Income: Credit Valuation Adjustment (CVA)

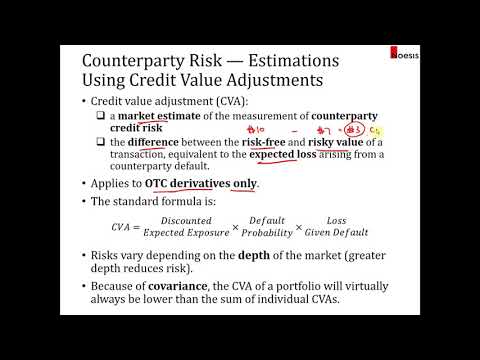

CPA FRM - Credit Value Adjustments

CFA Level 2 Exam Fixed Income: Credit Valuation Adjustment (CVA) Intro

CFA Level 2 Exam Fixed Income: Credit Valuation Adjustment (CVA)

The Credit Valuation Adjustment (CVA) and the Debt Valuation Adjustment (DVA) Calculator

Private Debt Profiles, Valuations, Risk & Return | CFA Level 3

CFA Level 2 | Fixed Income: Fair Value of Risky Bond (Zero Interest Rate Volatility)

Credit Value Adjustment (CVA) Introduction

4 New CVA Capital Charge Standardized and Advanced Formula

Credit Valuation Adjustment (CVA) for a European Option | FRM Part 2 (Credit Risk) | Solved Example

CVA and DVA

Credit Value Adjustment (CVA), Exposure Amount, Probability of Default, Probability of Survival-CFA2

Credit Valuation Adjustment | Basel 2.5

Bond valuation using spot rates

Credit Valuation Adjustment (CVA) Modelling

Basel III - Credit Valuation Adjustment (CVA)

Risk Management in Finance: 16. Credit Value Adjustment (CVA)

Webinar: IFRS 13 - Accounting for CVA & DVA, presented by Quantifi and Deloitte

Understanding xVA , CVA , FVA , KVA , MVA , COL-VA

Wrong-way Risk (FRM Part 2 – Book 2 – Chapter 13 – CVA Part B)

Credit Valuation Adjustment (CVA)

Комментарии

0:09:27

0:09:27

0:06:38

0:06:38

0:06:58

0:06:58

0:01:33

0:01:33

0:01:54

0:01:54

0:00:48

0:00:48

0:04:38

0:04:38

0:02:11

0:02:11

0:50:56

0:50:56

0:11:44

0:11:44

0:00:49

0:00:49

0:03:45

0:03:45

0:15:04

0:15:04

0:05:46

0:05:46

0:16:27

0:16:27

0:05:45

0:05:45

0:03:25

0:03:25

0:14:11

0:14:11

0:13:22

0:13:22

0:35:43

0:35:43

0:46:42

0:46:42

0:30:42

0:30:42

0:40:15

0:40:15

0:16:08

0:16:08