filmov

tv

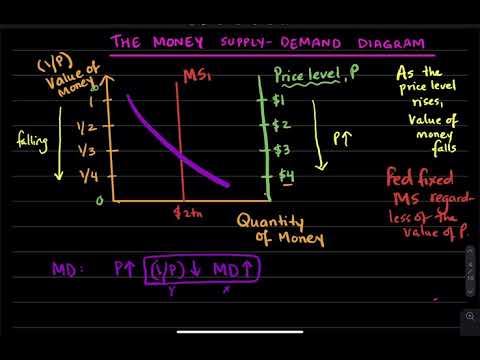

Money supply and demand impacting interest rates | Macroeconomics | Khan Academy

Показать описание

Examples showing how various factors can affect interest rates

Macroeconomics on Khan Academy: Topics covered in a traditional college level introductory macroeconomics course

About Khan Academy: Khan Academy offers practice exercises, instructional videos, and a personalized learning dashboard that empower learners to study at their own pace in and outside of the classroom. We tackle math, science, computer programming, history, art history, economics, and more. Our math missions guide learners from kindergarten to calculus using state-of-the-art, adaptive technology that identifies strengths and learning gaps. We've also partnered with institutions like NASA, The Museum of Modern Art, The California Academy of Sciences, and MIT to offer specialized content.

For free. For everyone. Forever. #YouCanLearnAnything

Money supply and demand impacting interest rates | Macroeconomics | Khan Academy

The Money Market (1 of 2)- Macro Topic 4.5

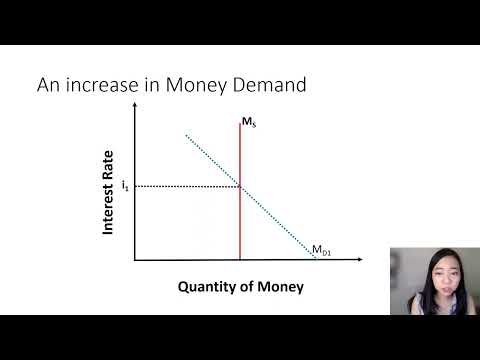

Money Demand, Money Supply, and Equilibrium Interest Rate

The Money Supply (Monetary Base, M1 and M2) Defined & Explained in One Minute

Supply and demand in 8 minutes

Money Supply & Aggregate Demand - Professor Ryan

What is The Money Supply and Interest Rates? | IB Macroeconomics | IB Economics Exam Review

Money supply: M0, M1, and M2 | The monetary system | Macroeconomics | Khan Academy

What is the Money Multiplier?

Y1 35) Monetary Policy - Interest Rates, Money Supply & Exchange Rate

Money and the Money Supply - M0 & M4

Draw Me The Economy: Money Supply

Supply and Demand Explained in One Minute

Money Supply Shifters (2 of 2)- Macro Topic 4.5

Milton Friedman on Inflation and Money Supply

Causes of shifts in currency supply and demand curves | AP Macroeconomics | Khan Academy

Supply and demand curves in foreign exchange | AP Macroeconomics | Khan Academy

Supply and Demand

Fiscal & Monetary Policy - Macro Topic 5.1

Supply and Demand Explained (in 40 seconds)

17.1b Money Supply, Money Demand and Monetary Equilibrium

Monetary and fiscal policy | Aggregate demand and aggregate supply | Macroeconomics | Khan Academy

REB | S5 | Economics | Unit 5: Money | Lesson: Money Supply

Macro: Unit 4.2 -- The Money Market

Комментарии

0:07:34

0:07:34

0:03:25

0:03:25

0:01:21

0:01:21

0:01:59

0:01:59

0:07:51

0:07:51

0:09:08

0:09:08

0:04:33

0:04:33

0:10:04

0:10:04

0:18:02

0:18:02

0:08:42

0:08:42

0:08:14

0:08:14

0:03:55

0:03:55

0:00:54

0:00:54

0:02:45

0:02:45

0:02:08

0:02:08

0:05:17

0:05:17

0:06:49

0:06:49

0:07:34

0:07:34

0:03:59

0:03:59

0:00:41

0:00:41

0:19:17

0:19:17

0:08:54

0:08:54

0:24:27

0:24:27

0:16:08

0:16:08