filmov

tv

Money supply: M0, M1, and M2 | The monetary system | Macroeconomics | Khan Academy

Показать описание

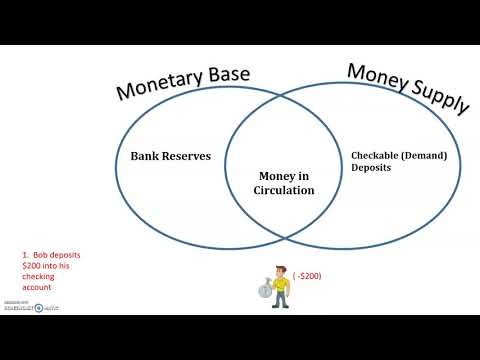

In this video, learn about the two measures of money that are part of the money supply - M1 and M2 - as well as the monetary base (which is sometimes called M0).

Macroeconomics on Khan Academy: Topics covered in a traditional college level introductory macroeconomics course

About Khan Academy: Khan Academy offers practice exercises, instructional videos, and a personalized learning dashboard that empower learners to study at their own pace in and outside of the classroom. We tackle math, science, computer programming, history, art history, economics, and more. Our math missions guide learners from kindergarten to calculus using state-of-the-art, adaptive technology that identifies strengths and learning gaps. We've also partnered with institutions like NASA, The Museum of Modern Art, The California Academy of Sciences, and MIT to offer specialized content.

For free. For everyone. Forever. #YouCanLearnAnything

Money supply: M0, M1, and M2 | The monetary system | Macroeconomics | Khan Academy

The Money Supply (Monetary Base, M1 and M2) Defined & Explained in One Minute

What is M0, M1, M2, & M3 Money Supply? (The Money Levels Show Macro Lesson)

Money and the Money Supply - M0 & M4

The Three Measures of Money Supply

Money Supply: M0, M1, M2, M3, M4

How Banks Create Money - Macro Topic 4.4

monetary base v money supply

M0 M1 M2 M3 M4 Money Supply - Money Aggregates - Stock of Money | Narrow Money & Broad Money - ...

Money supply M0, M1, and M2 The monetary system Macroeconomics

M1 & M2 Money Supply

⚡M0,M1,M2,M3 & M4, Money Multiplier | 💊Dose-3.3 |🔥UPSC Prelims-2024

Денежная масса - M0 M1 и M2

1. Monetary Base and Money Supply M0 M1 M2 M3

M0 - High Power Money & Money Multiplier | Indian Economy for UPSC

Money Supply | M0-M1-M2-M3-M4-Money | Broad and Narrow Money | ForumIAS

money supply measures

Money Supply | M0, M1, M2, M3 & M4 | Economy For Bankers | Money Multiplier

What Is Money?

Money Supply M0 M1 and M2

Broad Money and Narrow Money - M1,M2, M3 and M4

MONEY SUPPLY-M0,M1,M2 ,M3,M4 || Narrow & Broad Money

Narrow Money And Broad Money Concept- M0, M1, M2, M3, M4 | General Awareness.

Money Supply M0, M1, M2, M3 & M4 Economy For Bankers Money Multiplier

Комментарии

0:10:04

0:10:04

0:01:59

0:01:59

0:06:53

0:06:53

0:08:14

0:08:14

0:02:11

0:02:11

0:06:57

0:06:57

0:04:12

0:04:12

0:05:05

0:05:05

0:08:17

0:08:17

0:10:04

0:10:04

0:04:13

0:04:13

0:18:53

0:18:53

0:10:09

0:10:09

0:06:21

0:06:21

0:10:09

0:10:09

0:16:29

0:16:29

0:04:25

0:04:25

0:57:26

0:57:26

0:04:57

0:04:57

0:10:04

0:10:04

0:01:27

0:01:27

0:03:50

0:03:50

0:05:39

0:05:39

0:39:22

0:39:22