filmov

tv

What if the US Just Stopped Paying the Debt?

Показать описание

TIMECODES

0:00 Intro

0:17 U.S. National Budget Deficit

2:31 Should the Government Default

6:05 the Fed Would Step In

12:22 What Will Happen Next

Important Links:

Affiliates & Partners:

Socials @HeresyFinancial

My name is Joe Brown, and I'm a former stock broker who spent years advising the top 1% on how to manage their wealth. After making enough money to leave the corporate world behind, I turned my attention to teaching regular people financial strategies that exist outside the mainstream - things you'd never hear from your traditional fiancial advisor.

I am not a CPA, attorney, or licensed financial advisor and the information in these videos shall not be construed as tax, legal, or financial advice from a qualified perspective. Linked items may create a financial benefit for Heresy Financial.

What if the US Just Stopped Paying the Debt?

What if the US just doesn't pay its debt?

The U.S. Just Got Bigger

The U.S. just raised the debt ceiling — but what would happen if it didn't? | About That

What If America Just Said 'No'?

What if North America was just one country?

“What if I just turn around right now and see BAT-“

We Are Being Lied to About The US Economy!

US believes Iran is preparing to imminently launch attack against Israel

If 'Just The Two Of Us' had a guitar solo

Why 10 Million Men Have 'Given Up' on Work...

US Economy on Brink of Collapse: Japan ditch US Dollar!

If Just The Two Of Us was the HARDEST Song in the World

USA Prepares for War as Iran vs Israel Trade Blows

Imaginary friends, they’re just like us. 😂 See IF in cinemas now!

3 MINS AGO: China Just CUT All U.S. Corn Imports and DUMPED U.S. Debt… GOLD Next?

If you need help, just call Liam Neeson | Anjelah Johnson-Reyes

What if I Just Want to Live a Simple Life?

SCARY! If Disney Princesses Died *Just Let Us Adore You* | TIKTOK COMPILATION

What If Germany Just KEEPS Trying...

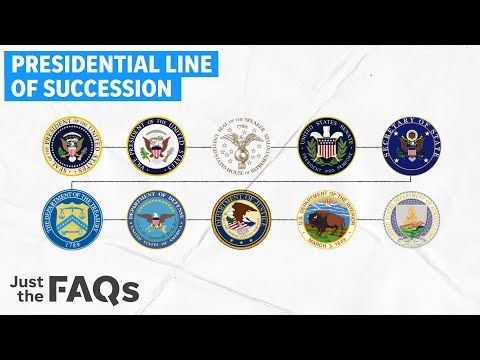

If the president becomes incapacitated, what happens next? | Just The FAQs

What if we just printed more money?

What if Aliens are JUST like Us?

Judge us if you want to but we will just be over here living our best life! #lifestyle #swing #swap

Комментарии

0:18:49

0:18:49

0:00:53

0:00:53

0:01:00

0:01:00

0:10:59

0:10:59

0:00:30

0:00:30

0:04:16

0:04:16

0:00:13

0:00:13

0:06:44

0:06:44

0:09:37

0:09:37

0:00:28

0:00:28

0:12:45

0:12:45

0:12:38

0:12:38

0:00:59

0:00:59

0:15:51

0:15:51

0:00:17

0:00:17

0:39:12

0:39:12

0:01:00

0:01:00

0:04:53

0:04:53

0:03:42

0:03:42

0:11:30

0:11:30

0:01:37

0:01:37

0:00:39

0:00:39

0:00:31

0:00:31

0:00:09

0:00:09