filmov

tv

Finance with Python! Portfolio Diversification and Risk

Показать описание

Tutorial reviewing how diversification impacts risk within a financial portfolio. Learn how to download financial data, create a price weighted portfolio, calculate correlations between asset class returns and analyze the volatility of asset classes.

**Disclaimer - The contents of this video are for informational and educational purposes only. They should not be considered investment, financial, legal or tax advice.**

The notebook can be found in the "Finance with Python" folder within the below repo.

CONNECT:

|-Video Chapters-|

0:00 - Intro

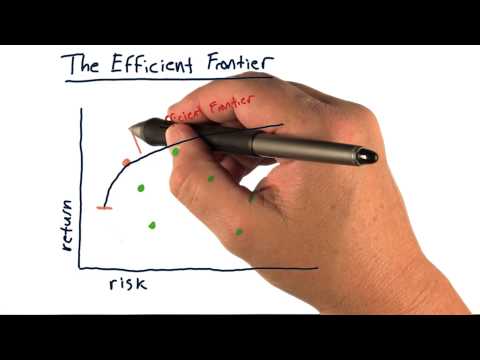

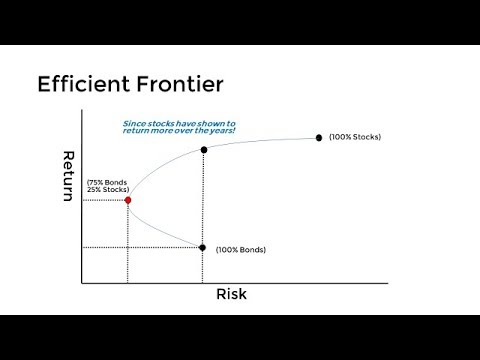

0:22 - Definition of diversification

1:42 - Creating a diversified price weighted portfolio

9:38 - Calculating the daily holding period return of an asset

10:59 - Calculating the historical volatility (standard deviation) of an asset

13:12 - Calculating historical volatility within Python

14:42 - Comparing volatility as we add assets into a portfolio

16:12 - Financial asset classes

20:00 - Correlation between different asset classes

22:16 - Asset class weightings within the portfolio

23:05 - Volatility across asset classes

26:32 - Calculating the annualized volatility for asset classes

28:45 - Falling risk as different asset classes are added into a portfolio

31:00 - References and additional learning

**Disclaimer - The contents of this video are for informational and educational purposes only. They should not be considered investment, financial, legal or tax advice.**

The notebook can be found in the "Finance with Python" folder within the below repo.

CONNECT:

|-Video Chapters-|

0:00 - Intro

0:22 - Definition of diversification

1:42 - Creating a diversified price weighted portfolio

9:38 - Calculating the daily holding period return of an asset

10:59 - Calculating the historical volatility (standard deviation) of an asset

13:12 - Calculating historical volatility within Python

14:42 - Comparing volatility as we add assets into a portfolio

16:12 - Financial asset classes

20:00 - Correlation between different asset classes

22:16 - Asset class weightings within the portfolio

23:05 - Volatility across asset classes

26:32 - Calculating the annualized volatility for asset classes

28:45 - Falling risk as different asset classes are added into a portfolio

31:00 - References and additional learning

Комментарии

0:31:41

0:31:41

0:33:04

0:33:04

0:08:05

0:08:05

0:30:44

0:30:44

0:16:31

0:16:31

0:18:23

0:18:23

0:09:12

0:09:12

0:04:38

0:04:38

1:28:38

1:28:38

0:08:46

0:08:46

0:06:02

0:06:02

1:02:07

1:02:07

0:00:06

0:00:06

1:11:27

1:11:27

0:02:54

0:02:54

0:03:05

0:03:05

0:00:06

0:00:06

0:07:42

0:07:42

0:57:51

0:57:51

0:42:23

0:42:23

0:10:29

0:10:29

0:00:20

0:00:20

0:03:51

0:03:51

0:03:29

0:03:29