filmov

tv

Understanding Mobile Wallets and Your Business

Показать описание

Featuring: Cori Sisson

Written by: Lauryn Johnson

Directed & Edited by: Brandon Paul Karlis

Did you know 54% of consumers have now used mobile wallets?

It’s not just millennials paying this way.

By 2020, in-store mobile payments are expected to overtake credit card purchases, at $503 billion.

With stats like those, it’s time your business considers accepting mobile wallet payments.

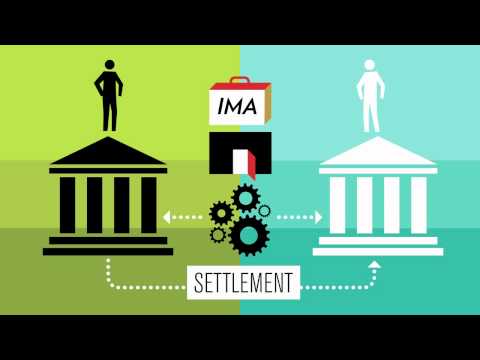

How They Work

Mobile wallets aren’t the same as mobile card swipers or credit card terminals.

They use near field communication technology to sense a smartphone’s digital wallet and complete a payment.

Picture waving a smartphone, and completing a payment. It’s that easy.

The Benefits

Mobile wallets improve the customer experience by speeding up checkout.

They’re secure, so you don’t have to worry about losing credit card info.

They give you insights into consumer behavior and data.

(cont. on next page)

The Costs

To get started, find a payment processor that accepts mobile wallet payments. Make sure it works with the top apps:

Apple Pay

Google Wallet

Android Pay

Samsung Pay

Don’t pay more than $500. Depending on your provider, it could even be free.

Want to learn more about payment processing?

manage your time, communicate with clients, and get paid.

Written by: Lauryn Johnson

Directed & Edited by: Brandon Paul Karlis

Did you know 54% of consumers have now used mobile wallets?

It’s not just millennials paying this way.

By 2020, in-store mobile payments are expected to overtake credit card purchases, at $503 billion.

With stats like those, it’s time your business considers accepting mobile wallet payments.

How They Work

Mobile wallets aren’t the same as mobile card swipers or credit card terminals.

They use near field communication technology to sense a smartphone’s digital wallet and complete a payment.

Picture waving a smartphone, and completing a payment. It’s that easy.

The Benefits

Mobile wallets improve the customer experience by speeding up checkout.

They’re secure, so you don’t have to worry about losing credit card info.

They give you insights into consumer behavior and data.

(cont. on next page)

The Costs

To get started, find a payment processor that accepts mobile wallet payments. Make sure it works with the top apps:

Apple Pay

Google Wallet

Android Pay

Samsung Pay

Don’t pay more than $500. Depending on your provider, it could even be free.

Want to learn more about payment processing?

manage your time, communicate with clients, and get paid.

0:01:18

0:01:18

0:03:55

0:03:55

0:06:34

0:06:34

0:24:42

0:24:42

0:03:31

0:03:31

0:18:57

0:18:57

0:05:31

0:05:31

0:02:00

0:02:00

0:00:39

0:00:39

0:06:13

0:06:13

0:12:32

0:12:32

0:10:20

0:10:20

0:08:13

0:08:13

0:26:02

0:26:02

0:04:02

0:04:02

0:05:04

0:05:04

0:01:22

0:01:22

0:06:03

0:06:03

0:06:26

0:06:26

0:10:19

0:10:19

0:00:58

0:00:58

0:02:55

0:02:55

0:00:17

0:00:17

0:03:35

0:03:35