filmov

tv

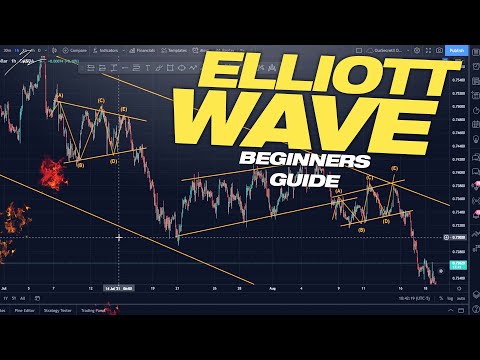

Practice on Elliott wave theory || How to identify waves Basics

Показать описание

The Elliott Wave Theory is a method of technical analysis that is used to predict the behavior of financial markets. It was developed by Ralph Nelson Elliott in the 1930s and is based on the idea that stock market prices move in predictable patterns, or waves. The theory states that these patterns repeat themselves and that by identifying and analyzing the current wave, one can predict the direction of future market movements.

The theory defines a complete market cycle as a sequence of five waves in the direction of the trend and three waves counter to the trend. The five waves in the direction of the trend are labeled as 1, 2, 3, 4 and 5, where wave 1 and 3 are impulsive waves and wave 2 and 4 are corrective waves. The three waves counter to the trend are labeled A, B, and C, where wave A and C are impulsive and wave B is corrective.

The Elliott wave theory is widely used by traders and investors to predict market trends and make trading decisions. However, it is important to note that the theory is not universally accepted and some critics argue that its predictions are often subjective and open to interpretation.

The theory defines a complete market cycle as a sequence of five waves in the direction of the trend and three waves counter to the trend. The five waves in the direction of the trend are labeled as 1, 2, 3, 4 and 5, where wave 1 and 3 are impulsive waves and wave 2 and 4 are corrective waves. The three waves counter to the trend are labeled A, B, and C, where wave A and C are impulsive and wave B is corrective.

The Elliott wave theory is widely used by traders and investors to predict market trends and make trading decisions. However, it is important to note that the theory is not universally accepted and some critics argue that its predictions are often subjective and open to interpretation.

Комментарии

0:16:49

0:16:49

0:16:48

0:16:48

0:05:14

0:05:14

0:24:28

0:24:28

0:13:22

0:13:22

0:27:02

0:27:02

0:14:19

0:14:19

0:04:02

0:04:02

0:13:37

0:13:37

0:10:22

0:10:22

0:15:46

0:15:46

0:05:01

0:05:01

0:15:31

0:15:31

0:44:26

0:44:26

0:08:04

0:08:04

0:05:30

0:05:30

0:19:29

0:19:29

0:03:43

0:03:43

0:03:51

0:03:51

0:04:23

0:04:23

0:08:35

0:08:35

0:13:25

0:13:25

0:30:40

0:30:40

0:16:23

0:16:23