filmov

tv

How everyday kiwis dodge income tax and why you should care - Whiteboard Friday

Показать описание

That's right Kiwi's are great a dodging paying income tax. The result is the PAYE tax payer pay too much and house prices are getting more expensive.

We thought we would explain in a video how people avoid paying income tax when they own property or a lifestyle business, and how our idea solves this.

This is the first video we have in our Whiteboard Friday series where will try to explain complex economic, social and environmental ideas as simply as possible. Please let us know what you think of this whiteboard Friday idea, if you have any questions on a CCIT, and give some ideas of other videos we could make.

We thought we would explain in a video how people avoid paying income tax when they own property or a lifestyle business, and how our idea solves this.

This is the first video we have in our Whiteboard Friday series where will try to explain complex economic, social and environmental ideas as simply as possible. Please let us know what you think of this whiteboard Friday idea, if you have any questions on a CCIT, and give some ideas of other videos we could make.

How everyday kiwis dodge income tax and why you should care - Whiteboard Friday

Must know KIWISAVER information | Beginner 101 friendly guide

Save Tax in New Zealand using PIE Funds (Part II)

Richest Kiwis effectively pay lower tax rate than ordinary NZers

Do not forget to change your socks

Save Tax in New Zealand using PIE Funds (PartI)

The Kiwi company offering unlimited annual leave | nzherald.co.nz

Kiwi's - Watch This To Pay No Tax In Australia

What a wealth tax could mean for Kiwis | nzherald.co.nz

How the rich get richer in their sleep

Living on $1,000,000 After Taxes in New Zealand #newzealand #democrat #republican #salary

How Much Tax Do You Pay Through KiwiSaver

Income Tax in New Zealand

3 Tax Secrets Every New Zealand Investor MUST Know!

Should you have KiwiSaver if you are Self Employed?

More support on the way for low-income Kiwis - but is it enough? | Newshub

Start Earning Money Without Labor

How does income tax work? | Everyday Money | ABC Australia

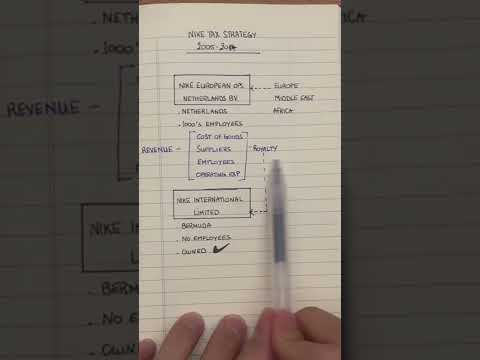

Nike Tax Avoidance Strategy Explained

NZ Tax System. #NZ #IncomeTax #Finance #BingosAndCo

NZ tax system is amazing

This is how the average Kiwi voter makes a decision

KiwiSaver – The good, the bad and the ugly

Expert's analysis of NZ Govt's moves for fairer tax system | AM

Комментарии

0:07:09

0:07:09

0:05:49

0:05:49

0:01:01

0:01:01

0:04:13

0:04:13

0:00:12

0:00:12

0:01:01

0:01:01

0:02:36

0:02:36

0:03:40

0:03:40

0:03:36

0:03:36

0:00:57

0:00:57

0:00:29

0:00:29

0:00:33

0:00:33

0:00:25

0:00:25

0:09:08

0:09:08

0:01:56

0:01:56

0:03:26

0:03:26

0:00:22

0:00:22

0:02:15

0:02:15

0:00:50

0:00:50

0:00:45

0:00:45

0:00:58

0:00:58

0:01:20

0:01:20

0:09:17

0:09:17

0:06:43

0:06:43