filmov

tv

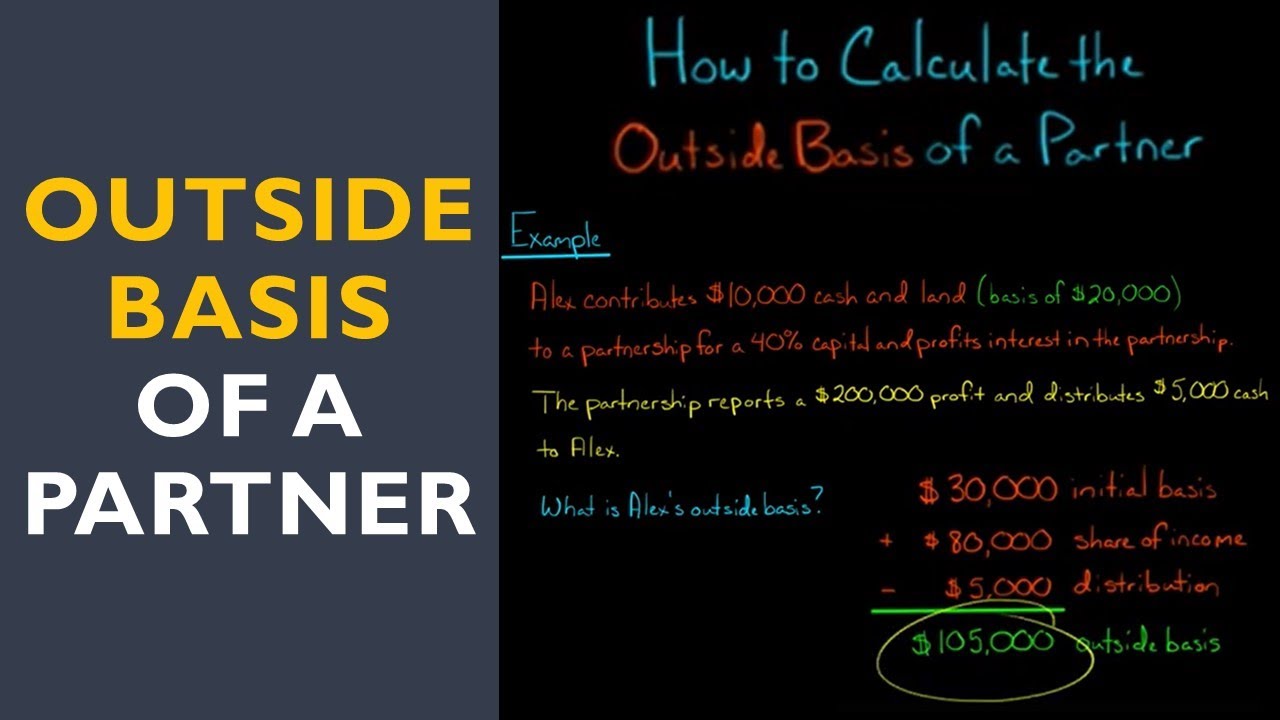

How to Calculate Outside Basis of a Partner

Показать описание

"Outside basis" refers to a partner's tax basis in their partnership interest. Outside basis is calculated as follows:

The partner's initial basis

Plus: additional contributions made by the partner to the partnership

Plus: increases in the partner's share of the partnership's liabilities

Plus: the partner's share of partnership income

Plus: the partner's share of tax-exempt income

Plus: the partner's share of depletion deductions in excess of the depletable property's basis

Minus: distributions of cash or property from the partnership to the partner

Minus: decreases in the partner's share of the partnership's liabilities

Minus: the partner's share of partnership losses

Minus: the partner's share of nondeductible expenses that aren't capital expenditures

Minus: the partner's depletion deduction for any partnership oil and gas property, to the extent the deduction doesn't exceed the proportionate share of the property's basis

Note that a partner's outside basis can never go below zero.

—

Edspira is the creation of Michael McLaughlin, an award-winning professor who went from teenage homelessness to a PhD. Edspira’s mission is to make a high-quality business education freely available to the world.

—

SUBSCRIBE FOR A FREE 53-PAGE GUIDE TO THE FINANCIAL STATEMENTS, PLUS:

• A 23-PAGE GUIDE TO MANAGERIAL ACCOUNTING

• A 44-PAGE GUIDE TO U.S. TAXATION

• A 75-PAGE GUIDE TO FINANCIAL STATEMENT ANALYSIS

• MANY MORE FREE PDF GUIDES AND SPREADSHEETS

—

SUPPORT EDSPIRA ON PATREON

—

GET CERTIFIED IN FINANCIAL STATEMENT ANALYSIS, IFRS 16, AND ASSET-LIABILITY MANAGEMENT

—

LISTEN TO THE SCHEME PODCAST

—

GET TAX TIPS ON TIKTOK

—

ACCESS INDEX OF VIDEOS

—

CONNECT WITH EDSPIRA

—

CONNECT WITH MICHAEL

—

ABOUT EDSPIRA AND ITS CREATOR

The partner's initial basis

Plus: additional contributions made by the partner to the partnership

Plus: increases in the partner's share of the partnership's liabilities

Plus: the partner's share of partnership income

Plus: the partner's share of tax-exempt income

Plus: the partner's share of depletion deductions in excess of the depletable property's basis

Minus: distributions of cash or property from the partnership to the partner

Minus: decreases in the partner's share of the partnership's liabilities

Minus: the partner's share of partnership losses

Minus: the partner's share of nondeductible expenses that aren't capital expenditures

Minus: the partner's depletion deduction for any partnership oil and gas property, to the extent the deduction doesn't exceed the proportionate share of the property's basis

Note that a partner's outside basis can never go below zero.

—

Edspira is the creation of Michael McLaughlin, an award-winning professor who went from teenage homelessness to a PhD. Edspira’s mission is to make a high-quality business education freely available to the world.

—

SUBSCRIBE FOR A FREE 53-PAGE GUIDE TO THE FINANCIAL STATEMENTS, PLUS:

• A 23-PAGE GUIDE TO MANAGERIAL ACCOUNTING

• A 44-PAGE GUIDE TO U.S. TAXATION

• A 75-PAGE GUIDE TO FINANCIAL STATEMENT ANALYSIS

• MANY MORE FREE PDF GUIDES AND SPREADSHEETS

—

SUPPORT EDSPIRA ON PATREON

—

GET CERTIFIED IN FINANCIAL STATEMENT ANALYSIS, IFRS 16, AND ASSET-LIABILITY MANAGEMENT

—

LISTEN TO THE SCHEME PODCAST

—

GET TAX TIPS ON TIKTOK

—

ACCESS INDEX OF VIDEOS

—

CONNECT WITH EDSPIRA

—

CONNECT WITH MICHAEL

—

ABOUT EDSPIRA AND ITS CREATOR

Комментарии

0:08:58

0:08:58

0:04:41

0:04:41

0:19:59

0:19:59

0:05:18

0:05:18

0:05:04

0:05:04

0:10:33

0:10:33

0:29:03

0:29:03

0:17:22

0:17:22

0:09:39

0:09:39

0:08:20

0:08:20

0:14:45

0:14:45

0:04:29

0:04:29

0:14:02

0:14:02

0:16:23

0:16:23

0:12:58

0:12:58

0:05:11

0:05:11

0:06:33

0:06:33

0:06:45

0:06:45

0:21:25

0:21:25

0:11:21

0:11:21

0:18:14

0:18:14

0:07:01

0:07:01

0:19:42

0:19:42

0:04:23

0:04:23