filmov

tv

Partnership Tax in the U.S.

Показать описание

This video provides an overview of how partnerships are taxed in the United States. It discusses:

-What a partnership is, how it is formed, and what tax return it must file

-Advantages of partnerships: why people would choose a partnership instead of an S corporation or a C corporation

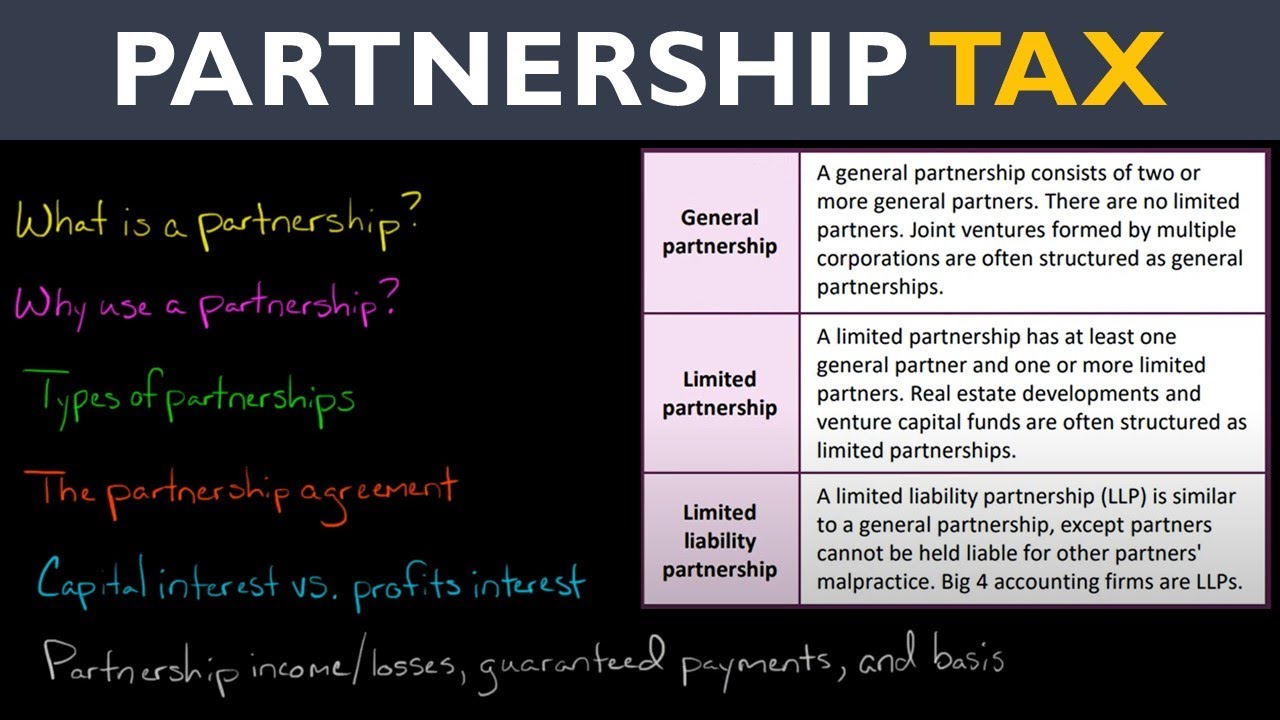

-The different types of partnerships, as well as the difference between general and limited partners

-The importance of the partnership agreement

-The difference between a partner's capital interest and their profits interest

-How a partnership's income flows through to the partners and is taxed at the partner level, with distinction made for separately stated items like capital gains

-The two types of guaranteed payments, and how they are taxed

-Outside basis, inside basis, and Section 704(b) capital accounts

0:00 Introduction

0:29 What is a partnership?

3:16 Why use a partnership?

6:23 Types of partnerships

8:34 The partnership agreement

9:45 Capital interest vs. profits interest

11:22 Partnership income/losses

13:12 Guaranteed payments

15:48 Outside basis

17:15 Inside basis

17:53 Section 721

18:49 Why outside basis and inside basis might differ

19:38 Special allocations and 704(b) capital accounts

—

Edspira is the creation of Michael McLaughlin, an award-winning professor who went from teenage homelessness to a PhD. Edspira’s mission is to make a high-quality business education freely available to the world.

—

SUBSCRIBE FOR A FREE 53-PAGE GUIDE TO THE FINANCIAL STATEMENTS, PLUS:

• A 23-PAGE GUIDE TO MANAGERIAL ACCOUNTING

• A 44-PAGE GUIDE TO U.S. TAXATION

• A 75-PAGE GUIDE TO FINANCIAL STATEMENT ANALYSIS

• MANY MORE FREE PDF GUIDES AND SPREADSHEETS

—

SUPPORT EDSPIRA ON PATREON

—

GET CERTIFIED IN FINANCIAL STATEMENT ANALYSIS, IFRS 16, AND ASSET-LIABILITY MANAGEMENT

—

LISTEN TO THE SCHEME PODCAST

—

GET TAX TIPS ON TIKTOK

—

ACCESS INDEX OF VIDEOS

—

CONNECT WITH EDSPIRA

—

CONNECT WITH MICHAEL

—

ABOUT EDSPIRA AND ITS CREATOR

-What a partnership is, how it is formed, and what tax return it must file

-Advantages of partnerships: why people would choose a partnership instead of an S corporation or a C corporation

-The different types of partnerships, as well as the difference between general and limited partners

-The importance of the partnership agreement

-The difference between a partner's capital interest and their profits interest

-How a partnership's income flows through to the partners and is taxed at the partner level, with distinction made for separately stated items like capital gains

-The two types of guaranteed payments, and how they are taxed

-Outside basis, inside basis, and Section 704(b) capital accounts

0:00 Introduction

0:29 What is a partnership?

3:16 Why use a partnership?

6:23 Types of partnerships

8:34 The partnership agreement

9:45 Capital interest vs. profits interest

11:22 Partnership income/losses

13:12 Guaranteed payments

15:48 Outside basis

17:15 Inside basis

17:53 Section 721

18:49 Why outside basis and inside basis might differ

19:38 Special allocations and 704(b) capital accounts

—

Edspira is the creation of Michael McLaughlin, an award-winning professor who went from teenage homelessness to a PhD. Edspira’s mission is to make a high-quality business education freely available to the world.

—

SUBSCRIBE FOR A FREE 53-PAGE GUIDE TO THE FINANCIAL STATEMENTS, PLUS:

• A 23-PAGE GUIDE TO MANAGERIAL ACCOUNTING

• A 44-PAGE GUIDE TO U.S. TAXATION

• A 75-PAGE GUIDE TO FINANCIAL STATEMENT ANALYSIS

• MANY MORE FREE PDF GUIDES AND SPREADSHEETS

—

SUPPORT EDSPIRA ON PATREON

—

GET CERTIFIED IN FINANCIAL STATEMENT ANALYSIS, IFRS 16, AND ASSET-LIABILITY MANAGEMENT

—

LISTEN TO THE SCHEME PODCAST

—

GET TAX TIPS ON TIKTOK

—

ACCESS INDEX OF VIDEOS

—

CONNECT WITH EDSPIRA

—

CONNECT WITH MICHAEL

—

ABOUT EDSPIRA AND ITS CREATOR

Комментарии

0:21:25

0:21:25

0:19:59

0:19:59

0:28:06

0:28:06

0:11:43

0:11:43

0:04:21

0:04:21

0:04:30

0:04:30

0:18:05

0:18:05

0:06:23

0:06:23

0:02:57

0:02:57

0:00:40

0:00:40

0:00:59

0:00:59

0:18:16

0:18:16

0:05:32

0:05:32

0:02:05

0:02:05

0:16:38

0:16:38

0:00:33

0:00:33

0:00:29

0:00:29

0:11:11

0:11:11

0:13:11

0:13:11

0:20:02

0:20:02

0:03:50

0:03:50

0:00:33

0:00:33

0:05:17

0:05:17

0:21:09

0:21:09