filmov

tv

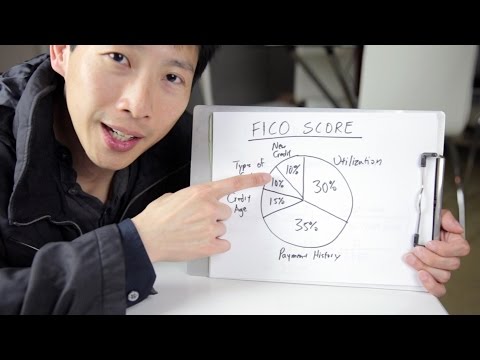

Is 0% Utilization Bad For Your Credit Score?

Показать описание

Welcome to my MissBeHelpful channel!

In this video I address 2 important things to consider when thinking about utilization, and specifically 0% utilization. Watch to find out if you're helping or hurting your score when you have a zero balance on your credit card!

More from MissBeHelpful:

Let’s connect:

’Til next time… PEACE!

In this video I address 2 important things to consider when thinking about utilization, and specifically 0% utilization. Watch to find out if you're helping or hurting your score when you have a zero balance on your credit card!

More from MissBeHelpful:

Let’s connect:

’Til next time… PEACE!

Is 0% Utilization Bad For Your Credit Score?

Is 0% Utilization BAD for Credit Score?

Is 0 Percent Credit Utilization Bad? Here's my answer..

Is 0% Utilization BAD for credit score and Why does Credit Card utilization Hack WORK

DON'T Use 0% Credit Card Utilization - Here's Why

Does Having a 0% Credit Utilization Hurt My Credit Score? - Credit Card Insider

Is It Bad for Your Credit Scores to Have 0% Utilization?

This Credit Myth Drives Me Insane (You Shouldn't Carry 0% Utilization) | @JustJWoodfin | #Short...

Difference Between Credit Card Inactivity and 0% Utilization

0% Utilization

CREDIT UTILIZATION IS IMPORTANT!

Credit Utilization Statement Date

Credit Utilization Is Extremely Important | Why The 30% Utilization Is Dumb

Is 0 GPU utilization bad?

0% Or Low Utilization Myth Busted!

Credit Utilization: What’s optimal?

Is It Worth It to Get a 1% Credit Card Utilization Ratio? - Credit Countdown With John Ulzheimer

Keeping Credit Utilization at 0% to Maximize Credit Score

How Credit Cards Affect Credit Score: Utilization

Credit Card Utilization Myths

How And Why I Keep My Credit Card Utilization Rate At 0% Every Month

What is the BEST Credit Utilization Ratio?

Does Having a 0% Credit Utilization Hurt My Credit Score

Does It Matter How Much Percentage My Credit Utilization Is At Within The Month?

Комментарии

0:08:23

0:08:23

0:09:58

0:09:58

0:06:51

0:06:51

0:10:58

0:10:58

0:09:02

0:09:02

0:04:13

0:04:13

0:07:02

0:07:02

0:00:46

0:00:46

0:03:36

0:03:36

0:00:40

0:00:40

0:00:41

0:00:41

0:00:48

0:00:48

0:07:13

0:07:13

0:00:42

0:00:42

0:06:10

0:06:10

0:01:01

0:01:01

0:07:28

0:07:28

0:03:08

0:03:08

0:11:16

0:11:16

0:06:19

0:06:19

0:15:10

0:15:10

0:11:34

0:11:34

0:08:55

0:08:55

0:00:24

0:00:24