filmov

tv

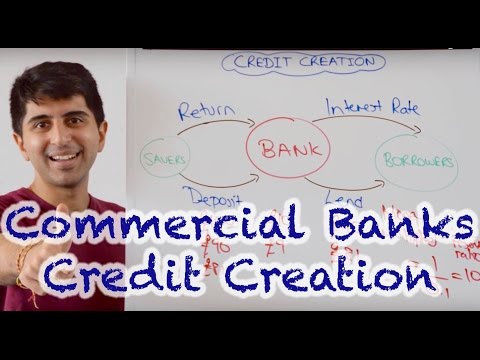

Understanding Bank Deposits, Money Creation and Economic Growth

Показать описание

Tune in to the latest episode of the Open Dialogue podcast. The episode talks about the intricacies of Bank Deposits and how they play a key role in fundamentals of the banking system.

This podcast further explores Loan Deposit Ratio and debunks the myth if deposits fund loans or vice versa? Our speakers will be seen discussing the process of money creation and how commercial banks are an engine of money supply for the country. We also discuss in detail why deposit growths are lagging & the liquidity management framework.

Chapters -

0:00 - Introduction

4:00 - Do Deposits Fund Loans?

11:16 - How the Central Bank Creates Money?

14:13 - Are Deposits Falling?

16:15 - Impact of FII

21:31 - How does Money go out of the System?

30:11 - Why is Deposit Growth so sluggish?

39:40 - Process of Money Creation

48:50 - The Growth of Economy

52:48 - What is Overnight Liquidity?

1:00:30 - Conclusion

Speakers:

Sameer Shetty - President & Head, Digital Business & Transformation, Axis Bank

Neelkanth Mishra - Chief Economist, Axis Bank & Head of Global Research, Axis Capital

Open Dialogue:

The aim of Open Dialogue by Axis Bank is to bring to the fore nuanced and insightful discussions on macroeconomics and market-oriented subjects.

Recommended Videos:

For more informative videos and discussion on important topics related to Banking, finance & economics:

#OpenDialogue #AxisBank #AxisBankOpenDialogue #RupeeInternationalisation #ReserveCurrency #GlobalCurrencyMarket #FinancialInsights #InvestmentStrategies #Forex #EconomicGrowth #SWIFT #IndiaEconomy #CurrencyExchange #InvestorEducation #InternationalTrade, #IndianRupee #FinancialLiteracy #Podcast #YouTubePodcast #AxisBankPodcast

Copyright:

©Axis Bank Limited [2024]. All rights reserved. This video and all other videos in this channel are protected by copyright law and may not be used or reproduced without the express written permission of the copyright owner.

STATUTORY DISCLAIMER:

By accessing this video podcast “Podcast”, I acknowledge that Axis Bank Limited and its subsidiaries ("AXIS BANK") makes no warranty, guarantee, or representation as to the accuracy or sufficiency of the information featured in this Podcast. The information, opinions, and recommendations presented in this Podcast are for general information only and any reliance on the information provided in this Podcast is done at your own risk. This Podcast should not be considered professional advice. Unless specifically stated otherwise, AXIS BANK does not endorse, approve, recommend, or certify any information, product, process, service, or organization presented or mentioned in this Podcast, and information from this Podcast should not be referenced in any way to imply such approval or endorsement. Moreover, AXIS BANK makes no warranty that this Podcast, or the server that makes it available, is free of viruses, worms, or other elements or codes that manifest contaminating or destructive properties.

AXIS BANK EXPRESSLY DISCLAIMS ANY AND ALL LIABILITY OR RESPONSIBILITY FOR ANY DIRECT, INDIRECT, INCIDENTAL, SPECIAL, CONSEQUENTIAL OR OTHER DAMAGES ARISING OUT OF ANY INDIVIDUAL'S USE OF, REFERENCE TO, RELIANCE ON, OR INABILITY TO USE, THIS PODCAST INFORMATION PRESENTED IN THIS PODCAST

This podcast further explores Loan Deposit Ratio and debunks the myth if deposits fund loans or vice versa? Our speakers will be seen discussing the process of money creation and how commercial banks are an engine of money supply for the country. We also discuss in detail why deposit growths are lagging & the liquidity management framework.

Chapters -

0:00 - Introduction

4:00 - Do Deposits Fund Loans?

11:16 - How the Central Bank Creates Money?

14:13 - Are Deposits Falling?

16:15 - Impact of FII

21:31 - How does Money go out of the System?

30:11 - Why is Deposit Growth so sluggish?

39:40 - Process of Money Creation

48:50 - The Growth of Economy

52:48 - What is Overnight Liquidity?

1:00:30 - Conclusion

Speakers:

Sameer Shetty - President & Head, Digital Business & Transformation, Axis Bank

Neelkanth Mishra - Chief Economist, Axis Bank & Head of Global Research, Axis Capital

Open Dialogue:

The aim of Open Dialogue by Axis Bank is to bring to the fore nuanced and insightful discussions on macroeconomics and market-oriented subjects.

Recommended Videos:

For more informative videos and discussion on important topics related to Banking, finance & economics:

#OpenDialogue #AxisBank #AxisBankOpenDialogue #RupeeInternationalisation #ReserveCurrency #GlobalCurrencyMarket #FinancialInsights #InvestmentStrategies #Forex #EconomicGrowth #SWIFT #IndiaEconomy #CurrencyExchange #InvestorEducation #InternationalTrade, #IndianRupee #FinancialLiteracy #Podcast #YouTubePodcast #AxisBankPodcast

Copyright:

©Axis Bank Limited [2024]. All rights reserved. This video and all other videos in this channel are protected by copyright law and may not be used or reproduced without the express written permission of the copyright owner.

STATUTORY DISCLAIMER:

By accessing this video podcast “Podcast”, I acknowledge that Axis Bank Limited and its subsidiaries ("AXIS BANK") makes no warranty, guarantee, or representation as to the accuracy or sufficiency of the information featured in this Podcast. The information, opinions, and recommendations presented in this Podcast are for general information only and any reliance on the information provided in this Podcast is done at your own risk. This Podcast should not be considered professional advice. Unless specifically stated otherwise, AXIS BANK does not endorse, approve, recommend, or certify any information, product, process, service, or organization presented or mentioned in this Podcast, and information from this Podcast should not be referenced in any way to imply such approval or endorsement. Moreover, AXIS BANK makes no warranty that this Podcast, or the server that makes it available, is free of viruses, worms, or other elements or codes that manifest contaminating or destructive properties.

AXIS BANK EXPRESSLY DISCLAIMS ANY AND ALL LIABILITY OR RESPONSIBILITY FOR ANY DIRECT, INDIRECT, INCIDENTAL, SPECIAL, CONSEQUENTIAL OR OTHER DAMAGES ARISING OUT OF ANY INDIVIDUAL'S USE OF, REFERENCE TO, RELIANCE ON, OR INABILITY TO USE, THIS PODCAST INFORMATION PRESENTED IN THIS PODCAST

Комментарии

1:04:26

1:04:26

0:04:12

0:04:12

0:03:53

0:03:53

0:05:08

0:05:08

0:13:18

0:13:18

0:08:09

0:08:09

0:01:00

0:01:00

0:06:10

0:06:10

0:00:37

0:00:37

0:06:58

0:06:58

0:33:31

0:33:31

0:05:21

0:05:21

0:05:35

0:05:35

0:04:22

0:04:22

0:06:56

0:06:56

0:04:31

0:04:31

0:15:46

0:15:46

0:01:32

0:01:32

0:20:18

0:20:18

0:09:57

0:09:57

0:00:55

0:00:55

0:04:45

0:04:45

0:00:59

0:00:59

0:05:34

0:05:34