filmov

tv

How Commercial Banks Really Create Money (the Money Multiplier is a MYTH).

Показать описание

△ Or for one-time donations:

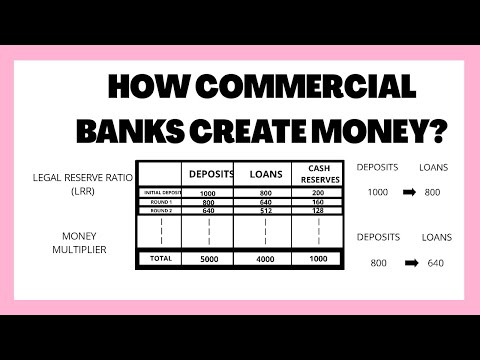

This video explains why fractional reserve banking and the money multiplier theory are myths and how banks do, in fact, create money.

Yes, banks create money (through credit creation) but they do not do so by getting cash from you and then lending over and over till they reach the reserve requirement limit, as the money multiplier theory suggests. The reserve requirement is not a hard limit on money creation because central banks create new reserves to support healthy but cash strained banks. This is evident since, even though banks can technically ‘create money’, they can still fail because they do have to pay back that money. There are three other important soft limits on bank money creation. These are the public’s demand for debt, capital requirements, and liquidity concerns.

Narrated and produced by Dr. Joeri Schasfoort (University of Cape Town)

If you would like to go even more in depth. I suggest these excellent books:

- Where Does Money Come From?, excellent introduction on where money comes from by some of the leading forces behind the positive money movement.

- The end of alchemy, excellent book written by the former governor of the Bank of England: Mervyn King;

- Debt: The First 5,000 Years, historical account of debt as money;

- The New Paradigm in Macroeconomics: Solving the Riddle of Japanese Macroeconomic Performance, interesting account on how bank money creation powered the Japanese economic miracle;

- Modern Money Theory: A Primer on Macroeconomics for Sovereign Monetary Systems, introduction to the popular Modern Money Theory (MMT), a macroeconomic school of thought with bank money creation at the heart of it.

For some of the footage used in this video, I make the following attributions:

- Wallstreet cc Vedevo

- NYC Times Square cc Vedevo

- City at night cc Vedevo

- Dollar printing cc Panning Vedevo

- Hong Kong street level cc Vedevo

- Banks in the clouds cc Pexels

- ECB construction video cc ECB

- Deutsche Bundesbank video cc Deutsche Bundesbank

Комментарии

0:13:18

0:13:18

0:01:32

0:01:32

0:04:12

0:04:12

0:09:17

0:09:17

0:05:49

0:05:49

0:09:57

0:09:57

0:03:53

0:03:53

0:05:21

0:05:21

0:36:12

0:36:12

0:29:56

0:29:56

0:06:10

0:06:10

0:01:22

0:01:22

0:01:00

0:01:00

0:09:56

0:09:56

0:03:03

0:03:03

0:02:49

0:02:49

0:03:46

0:03:46

0:19:02

0:19:02

0:03:54

0:03:54

0:16:45

0:16:45

0:05:34

0:05:34

0:15:54

0:15:54

0:05:58

0:05:58

0:00:50

0:00:50