filmov

tv

Calculate NPV and IRR in Microsoft Excel | Net Present Value and Internal Rate of Return Urdu Hindi

Показать описание

In this you will learn the following:

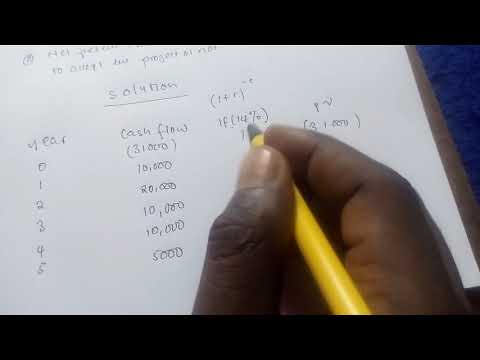

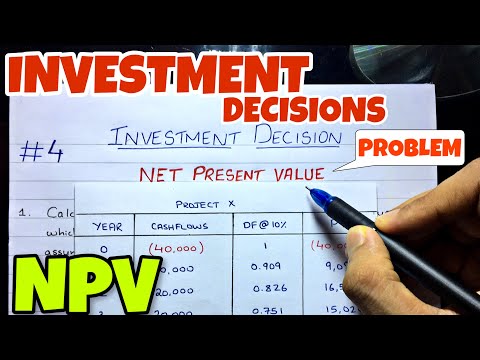

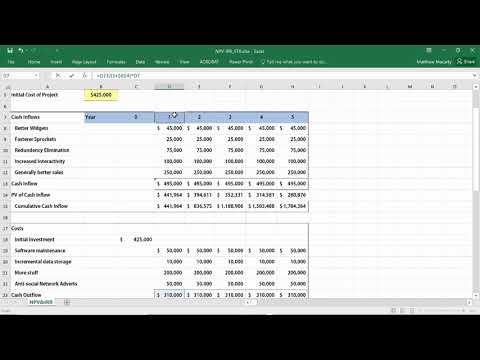

1) What is NPV and IRR?

2) What is net present value NPV

3) What is Internal Rate of Return IRR?

4) What is Future Value?

5) What is Present Value?

6) Which one is better - NPV vs IRR?

7) Which one is a better option for projects and investment calculation between NPV and IRR?

8) What to do when NPV and IRR give different results while evaluating projects or investments?

9) What is the difference between net present value and internal rate of return?

10) When should you opt for IRR and when for NPV for investment return calculation?

11) How NPV is different from IRR?

12) How to do NPV and IRR comparison for any project and investment?

13) Which is a better calculation method for investment matric NPV and IRR?

14) How to calculate net present value and internal rate of return in excel?

15) What is the calculation formula for NPV and IRR?

16) Why NPV is better calculation method for calculating investment returns?

17) What makes IRR a better option for investment return calculation method?

This Video is essential to watch for every person including students, officers and business person.

Only people with subscribe this channel will be able to request this file.. so make sure you subscribe to this channel

#npv #irr #excel #financialmodeling #npvandirr #netpresentvalue #internalrateofreturn

1) What is NPV and IRR?

2) What is net present value NPV

3) What is Internal Rate of Return IRR?

4) What is Future Value?

5) What is Present Value?

6) Which one is better - NPV vs IRR?

7) Which one is a better option for projects and investment calculation between NPV and IRR?

8) What to do when NPV and IRR give different results while evaluating projects or investments?

9) What is the difference between net present value and internal rate of return?

10) When should you opt for IRR and when for NPV for investment return calculation?

11) How NPV is different from IRR?

12) How to do NPV and IRR comparison for any project and investment?

13) Which is a better calculation method for investment matric NPV and IRR?

14) How to calculate net present value and internal rate of return in excel?

15) What is the calculation formula for NPV and IRR?

16) Why NPV is better calculation method for calculating investment returns?

17) What makes IRR a better option for investment return calculation method?

This Video is essential to watch for every person including students, officers and business person.

Only people with subscribe this channel will be able to request this file.. so make sure you subscribe to this channel

#npv #irr #excel #financialmodeling #npvandirr #netpresentvalue #internalrateofreturn

Комментарии

0:04:28

0:04:28

0:06:48

0:06:48

0:02:35

0:02:35

0:02:53

0:02:53

0:18:22

0:18:22

0:00:56

0:00:56

0:07:27

0:07:27

0:18:50

0:18:50

0:04:15

0:04:15

0:10:00

0:10:00

0:08:31

0:08:31

0:13:38

0:13:38

0:03:27

0:03:27

0:02:56

0:02:56

0:04:46

0:04:46

0:08:03

0:08:03

0:08:52

0:08:52

0:00:33

0:00:33

0:12:20

0:12:20

0:00:12

0:00:12

0:04:12

0:04:12

0:03:05

0:03:05

0:03:22

0:03:22

0:14:02

0:14:02