filmov

tv

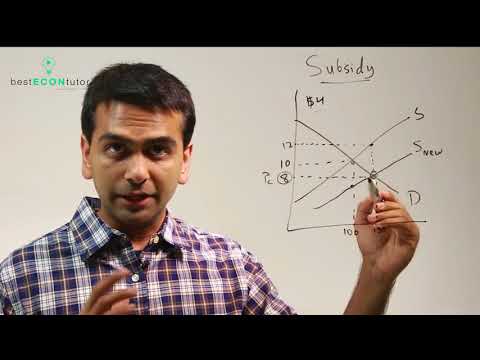

impact of per unit subsidy on the equilibrium price & the tax revenue used to pay for the subsidy

Показать описание

Suppose the supply of apples in S= (10+4p) and the demand for apples is D =(100-6p). Suppose government initates a Subsidy of t= $3 per unit of apples sold. Calculate Q, the equilibrium quantity of apples sold after the subsidy is imposed and R, the tax revenue needed to pay for

the subsidy

the subsidy

Microeconomics: Subsidy

The Effects of a Per Unit Subsidy

Y1 18) Subsidy - Full Market Impact

Who Get's the Benefits of a Per-Unit Subsidy (Part 1)

Welfare Analysis of a Per-Unit Subsidy

impact of per unit subsidy on the equilibrium price & the tax revenue used to pay for the subsi...

DSE Economics (Per-unit subsidy & Efficiency)_F.5_2nd form test_Q2

Micro: Unit 1.4 -- Government Intervention: Price Controls, Quotas, and Subsidies

2.7 (Micro) Subsidy (per unit subsidy): Role of government: Analysis & Evaluation: IB Econ

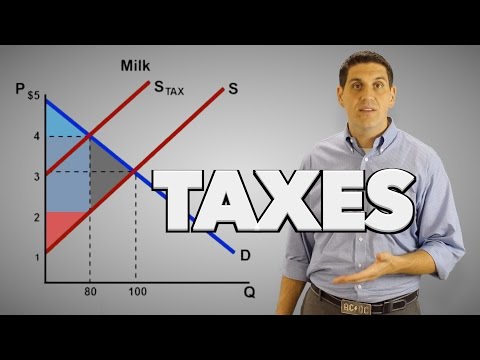

Taxes on Producers- Micro Topic 2.8

Government Intervention- Micro Topic 2.8

Subsidies

Subsidies on Buyers / Consumers in Perfect Competition - Market Outcomes and Welfare (PS, CS, DWL)

Monopoly and per unit Subsidy. impact of per unit subsidy on Monopoly equilibrium

Subsidy Effects on Community Surplus

2.7 (Micro) Calculating the effects of a per unit subsidy on stakeholders & welfare: IB Econ

impact of per unit tax on demand and supply

Calculating effects of subsidies (HL Only)

Economics: Subsidies and Consumer & Producer Surplus

Per Unit Subsidy (Calculation)

Economic Welfare Effects of a Government Subsidy

Subsidy Diagram | Per Unit Subsidy | Government Intervention | IB Microeconomics

per unit subsidy | microeconomics | Afsomali

Taxes

Комментарии

0:04:38

0:04:38

0:10:22

0:10:22

0:07:52

0:07:52

0:07:16

0:07:16

0:12:47

0:12:47

0:10:35

0:10:35

0:06:10

0:06:10

0:11:10

0:11:10

0:22:41

0:22:41

0:05:58

0:05:58

0:07:14

0:07:14

0:12:32

0:12:32

0:07:58

0:07:58

0:19:37

0:19:37

0:04:32

0:04:32

0:22:42

0:22:42

0:11:37

0:11:37

0:09:38

0:09:38

0:11:54

0:11:54

0:07:10

0:07:10

0:07:00

0:07:00

0:16:23

0:16:23

0:08:22

0:08:22

0:03:08

0:03:08