filmov

tv

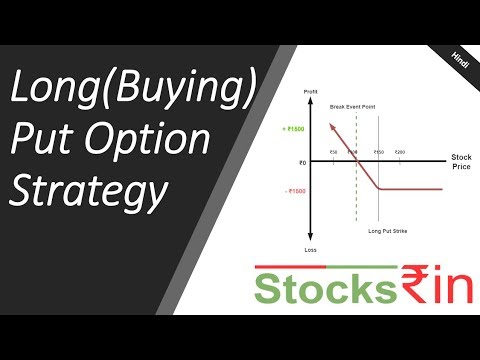

What Is a Long Put Option?

Показать описание

A Long a Put option is a position in which a trader/investor purchases or “Buys to Open” a Put Option Contract thereby securing the right to sell the underlying asset or security at the pre-determined “strike Price” on or before the pre-determined date “Expiration Date”

The term "going long" refers to buying a security (not selling one), and applies to any tradable instrument that a trader/investor ”buys to open” including put options

A trader/investor would buy “Long Puts” in anticipation of the price of the underlying asset falling in value.

Make sure to sign up for your free 15-day trial and take advantage of our powerful trading tool box, the Tackle Trading Trade Center, get our weekly Market Scoreboard and Scouting Reports as well as our daily stock market reports.

_________________________________________________________________________________________________

DISCLAIMER: Tackle Trading LLC is providing this live broadcast and any related materials (including newsletters, blog post, videos, social media and other communications) for educational purposes only. We are not providing legal, accounting, or financial advisory services, and this is not a solicitation or recommendation to buy or sell any stocks, options, or other financial instruments or investments.

The term "going long" refers to buying a security (not selling one), and applies to any tradable instrument that a trader/investor ”buys to open” including put options

A trader/investor would buy “Long Puts” in anticipation of the price of the underlying asset falling in value.

Make sure to sign up for your free 15-day trial and take advantage of our powerful trading tool box, the Tackle Trading Trade Center, get our weekly Market Scoreboard and Scouting Reports as well as our daily stock market reports.

_________________________________________________________________________________________________

DISCLAIMER: Tackle Trading LLC is providing this live broadcast and any related materials (including newsletters, blog post, videos, social media and other communications) for educational purposes only. We are not providing legal, accounting, or financial advisory services, and this is not a solicitation or recommendation to buy or sell any stocks, options, or other financial instruments or investments.

Комментарии

0:03:47

0:03:47

0:09:54

0:09:54

0:06:53

0:06:53

0:04:43

0:04:43

0:07:56

0:07:56

0:13:15

0:13:15

0:02:15

0:02:15

0:07:30

0:07:30

0:00:32

0:00:32

0:19:47

0:19:47

0:08:33

0:08:33

0:05:07

0:05:07

0:05:38

0:05:38

0:03:26

0:03:26

0:10:24

0:10:24

0:13:43

0:13:43

0:10:34

0:10:34

0:13:03

0:13:03

0:06:18

0:06:18

0:00:59

0:00:59

0:08:42

0:08:42

0:17:47

0:17:47

0:12:24

0:12:24

0:09:29

0:09:29